- South Korea

- /

- Chemicals

- /

- KOSDAQ:A102710

ENF Technology Co., Ltd.'s (KOSDAQ:102710) 36% Price Boost Is Out Of Tune With Revenues

ENF Technology Co., Ltd. (KOSDAQ:102710) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

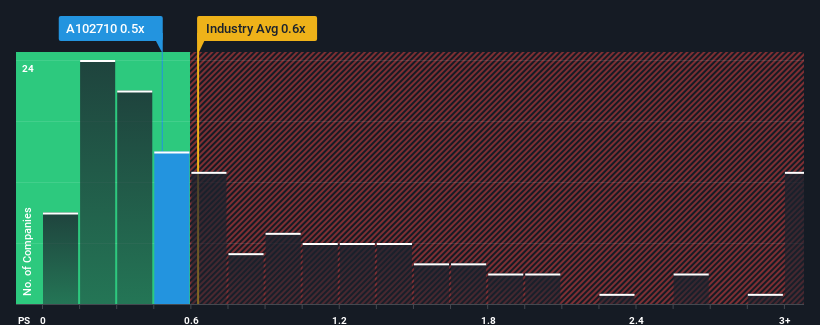

Even after such a large jump in price, there still wouldn't be many who think ENF Technology's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Korea's Chemicals industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for ENF Technology

How Has ENF Technology Performed Recently?

Revenue has risen at a steady rate over the last year for ENF Technology, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on ENF Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on ENF Technology's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

ENF Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. Revenue has also lifted 25% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that ENF Technology's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does ENF Technology's P/S Mean For Investors?

ENF Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of ENF Technology revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You need to take note of risks, for example - ENF Technology has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of ENF Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ENF Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A102710

ENF Technology

Produces and sells process chemicals, fine chemicals, and color pastes for use in semiconductor and display manufacturing processes in South Korea and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives