David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Okong Corporation (KOSDAQ:045060) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Okong

What Is Okong's Net Debt?

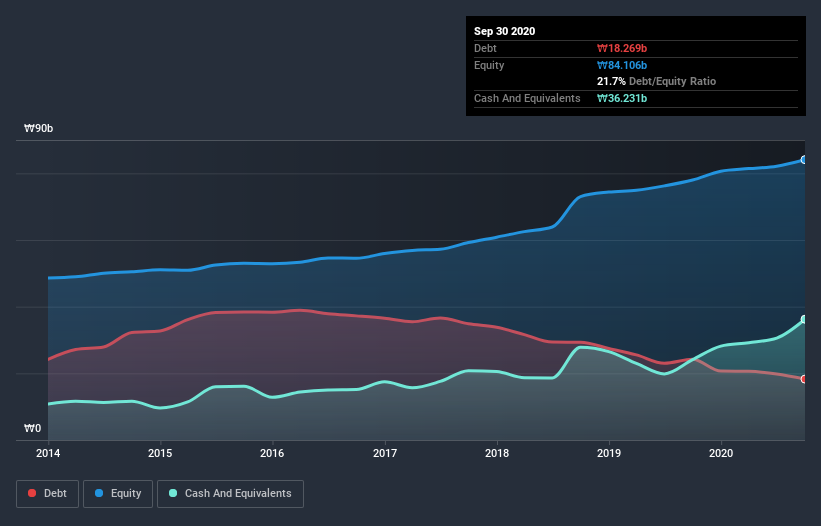

As you can see below, Okong had ₩18.3b of debt at September 2020, down from ₩24.2b a year prior. However, its balance sheet shows it holds ₩36.2b in cash, so it actually has ₩18.0b net cash.

How Strong Is Okong's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Okong had liabilities of ₩41.5b due within 12 months and liabilities of ₩6.09b due beyond that. On the other hand, it had cash of ₩36.2b and ₩21.7b worth of receivables due within a year. So it actually has ₩10.4b more liquid assets than total liabilities.

This surplus suggests that Okong has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Okong has more cash than debt is arguably a good indication that it can manage its debt safely.

And we also note warmly that Okong grew its EBIT by 12% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is Okong's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Okong may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Okong recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Okong has ₩18.0b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 99% of that EBIT to free cash flow, bringing in ₩15b. So we don't think Okong's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Okong you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Okong or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A045060

Okong

Engages in the manufacture and sale of various adhesives in South Korea and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives