- South Korea

- /

- Chemicals

- /

- KOSDAQ:A042040

Shareholders Will Be Pleased With The Quality of KPM TECH's (KOSDAQ:042040) Earnings

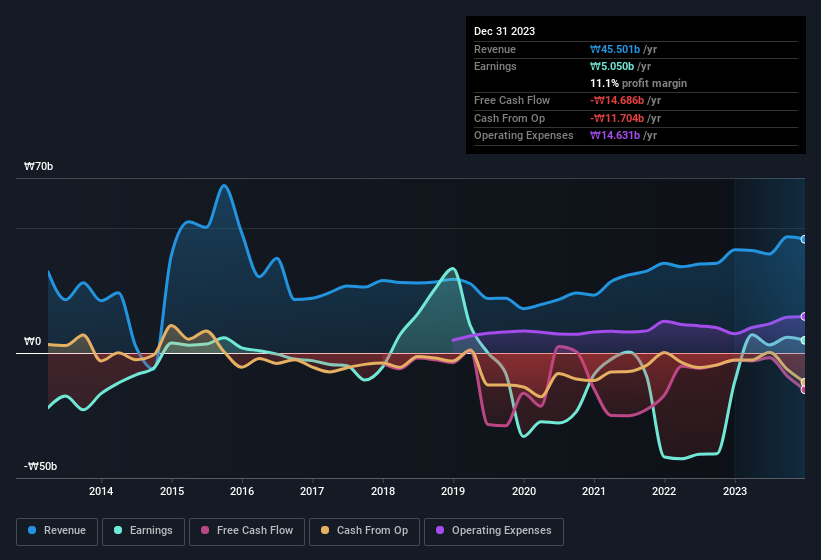

KPM TECH Co., Ltd. (KOSDAQ:042040) just reported healthy earnings but the stock price didn't move much. We think that investors have missed some encouraging factors underlying the profit figures.

View our latest analysis for KPM TECH

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, KPM TECH increased the number of shares on issue by 6.8% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of KPM TECH's EPS by clicking here.

How Is Dilution Impacting KPM TECH's Earnings Per Share (EPS)?

Three years ago, KPM TECH lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If KPM TECH's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of KPM TECH.

The Impact Of Unusual Items On Profit

On top of the dilution, we should also consider the ₩4.8b impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If KPM TECH doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On KPM TECH's Profit Performance

KPM TECH suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Considering all the aforementioned, we'd venture that KPM TECH's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - KPM TECH has 3 warning signs we think you should be aware of.

Our examination of KPM TECH has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if KPM TECH might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A042040

Low risk and overvalued.

Market Insights

Community Narratives