- South Korea

- /

- Packaging

- /

- KOSDAQ:A037230

Shareholders of Hankukpackage (KOSDAQ:037230) Must Be Delighted With Their 338% Total Return

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. To wit, the Hankukpackage Co., Ltd. (KOSDAQ:037230) share price has soared 314% over five years. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 69% in about a quarter.

See our latest analysis for Hankukpackage

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

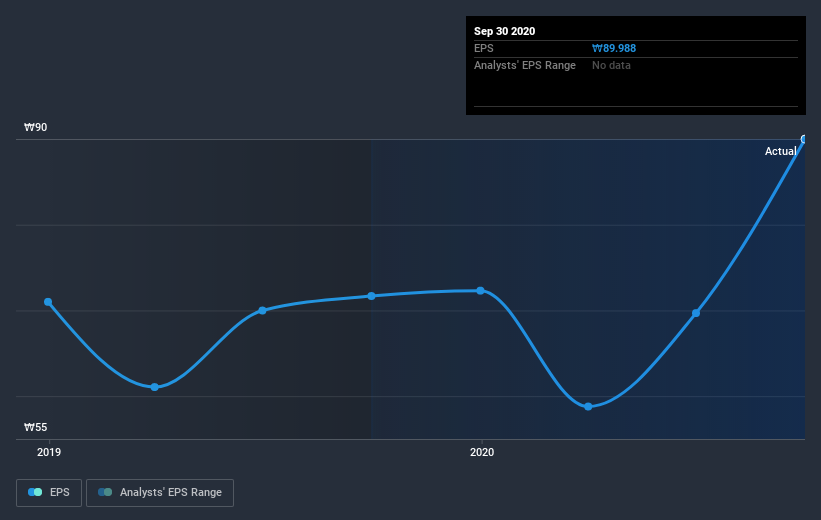

During the five years of share price growth, Hankukpackage moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Hankukpackage share price has gained 248% in three years. In the same period, EPS is up 4.5% per year. Notably, the EPS growth has been slower than the annualised share price gain of 51% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Hankukpackage's key metrics by checking this interactive graph of Hankukpackage's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hankukpackage's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Hankukpackage shareholders, and that cash payout contributed to why its TSR of 338%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Hankukpackage shareholders have received a total shareholder return of 255% over the last year. That gain is better than the annual TSR over five years, which is 34%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Hankukpackage better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Hankukpackage (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

But note: Hankukpackage may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Hankukpackage or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hankukpackage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A037230

Hankukpackage

Hankukpackage Co., Ltd. manufacture and sell liquid packaging container in South Korea.

Solid track record and fair value.

Market Insights

Community Narratives