Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current market climate, characterized by shifts in key indices and economic indicators, small-cap stocks have been experiencing varied impacts due to policy uncertainties and sector-specific developments. As investors navigate these changes, identifying promising small-cap companies requires a focus on strong fundamentals and growth potential that can withstand broader market fluctuations. In this article, we explore three lesser-known stocks that demonstrate such qualities amidst today's dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Value Rating: ★★★★☆☆

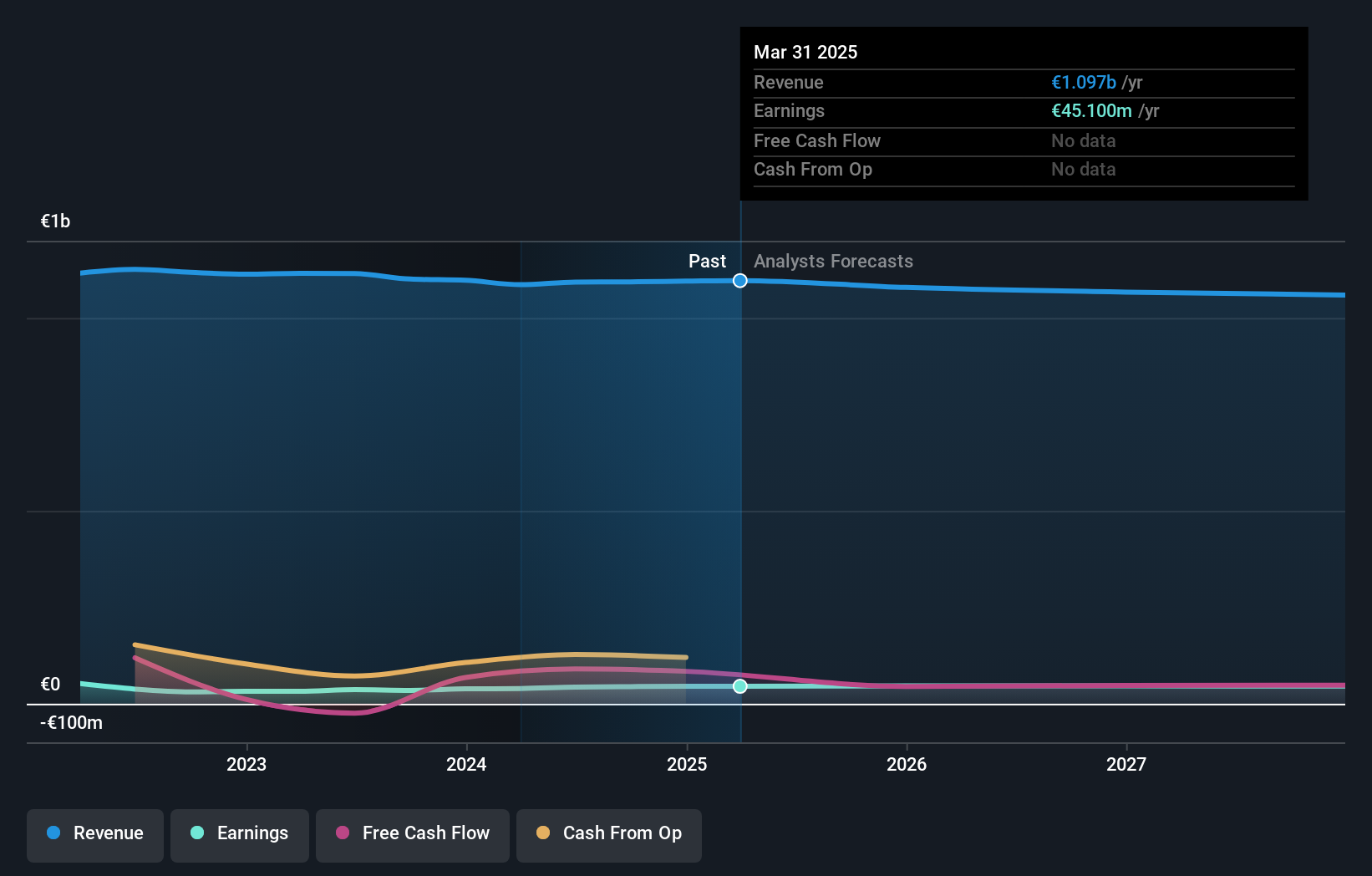

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain with a market capitalization of €297.73 million.

Operations: Cairo Communication generates revenue through its communication operations in Italy and Spain. The company has a market capitalization of €297.73 million.

Cairo Communication, a nimble player in the media sector, is making waves with its impressive financial metrics. The company recently reported net income of €16.7 million for the nine months ended September 2024, up from €10.8 million last year, showcasing solid earnings growth of 28%—outpacing the industry average of 13.1%. It trades at a compelling value, estimated to be 72% below fair value and boasts high-quality earnings without any debt burden; previously its debt-to-equity ratio was 28.5%. With positive free cash flow and inclusion in the S&P Global BMI Index, it seems poised for future opportunities.

- Click to explore a detailed breakdown of our findings in Cairo Communication's health report.

Assess Cairo Communication's past performance with our detailed historical performance reports.

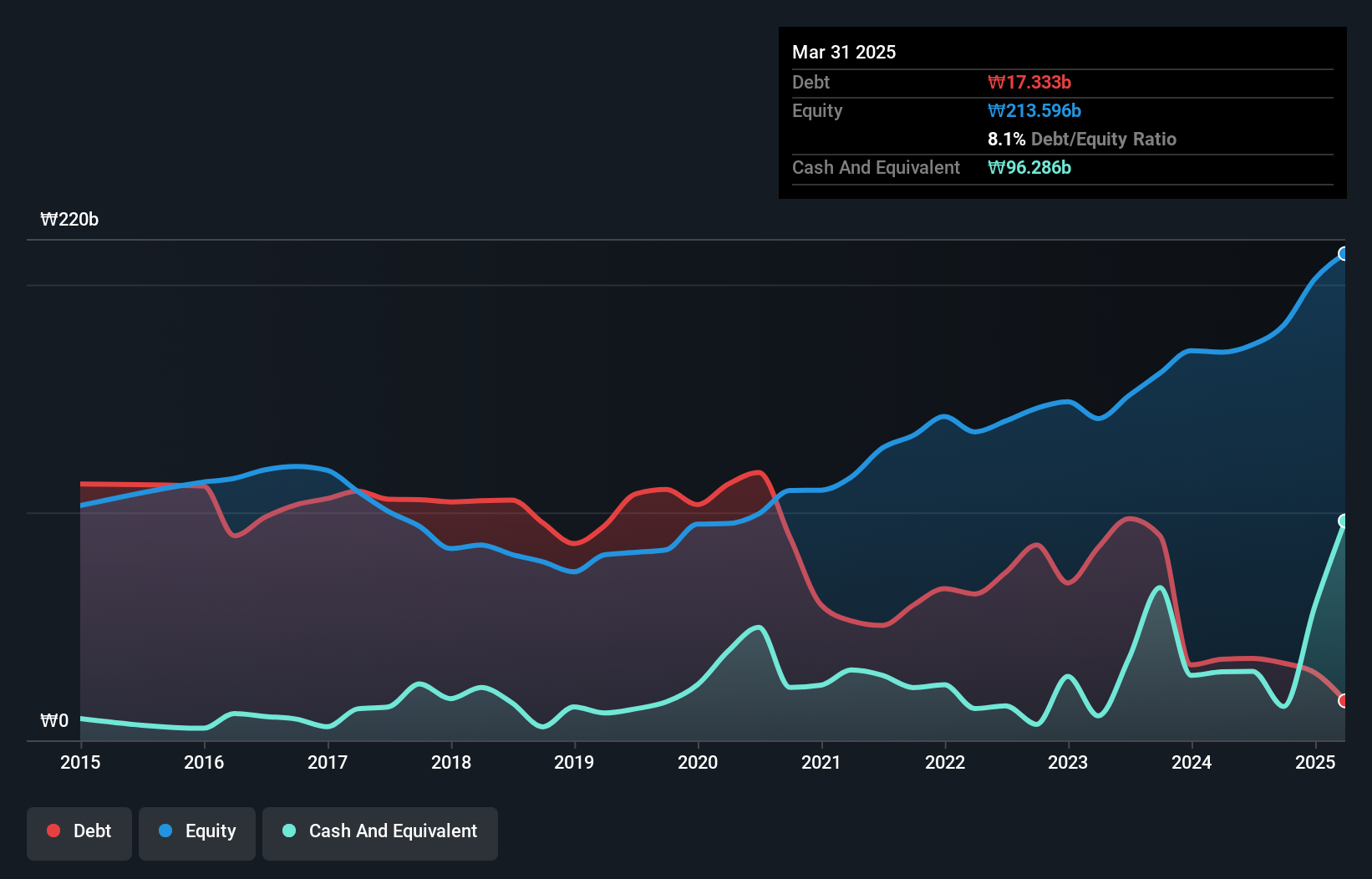

Dongsung FineTec (KOSDAQ:A033500)

Simply Wall St Value Rating: ★★★★★★

Overview: Dongsung FineTec Co., Ltd. specializes in the production and distribution of cryogenic insulation products in South Korea, with a market capitalization of approximately ₩369.88 billion.

Operations: The company's revenue primarily comes from its Cooling Material segment, generating ₩516.27 billion, while the Gas Business contributes ₩22.17 billion.

Dongsung FineTec is carving a niche in the chemicals sector, with its earnings surging 75.7% over the past year, outpacing the industry's -3.1%. Its net debt to equity ratio stands at a satisfactory 3.3%, indicating prudent financial management. Over five years, it has impressively reduced its debt to equity from 131.1% to 20.7%, reflecting strong fiscal discipline and strategic focus on sustainability. The company is trading at a significant discount of 37.4% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities in this dynamic industry space.

- Take a closer look at Dongsung FineTec's potential here in our health report.

Evaluate Dongsung FineTec's historical performance by accessing our past performance report.

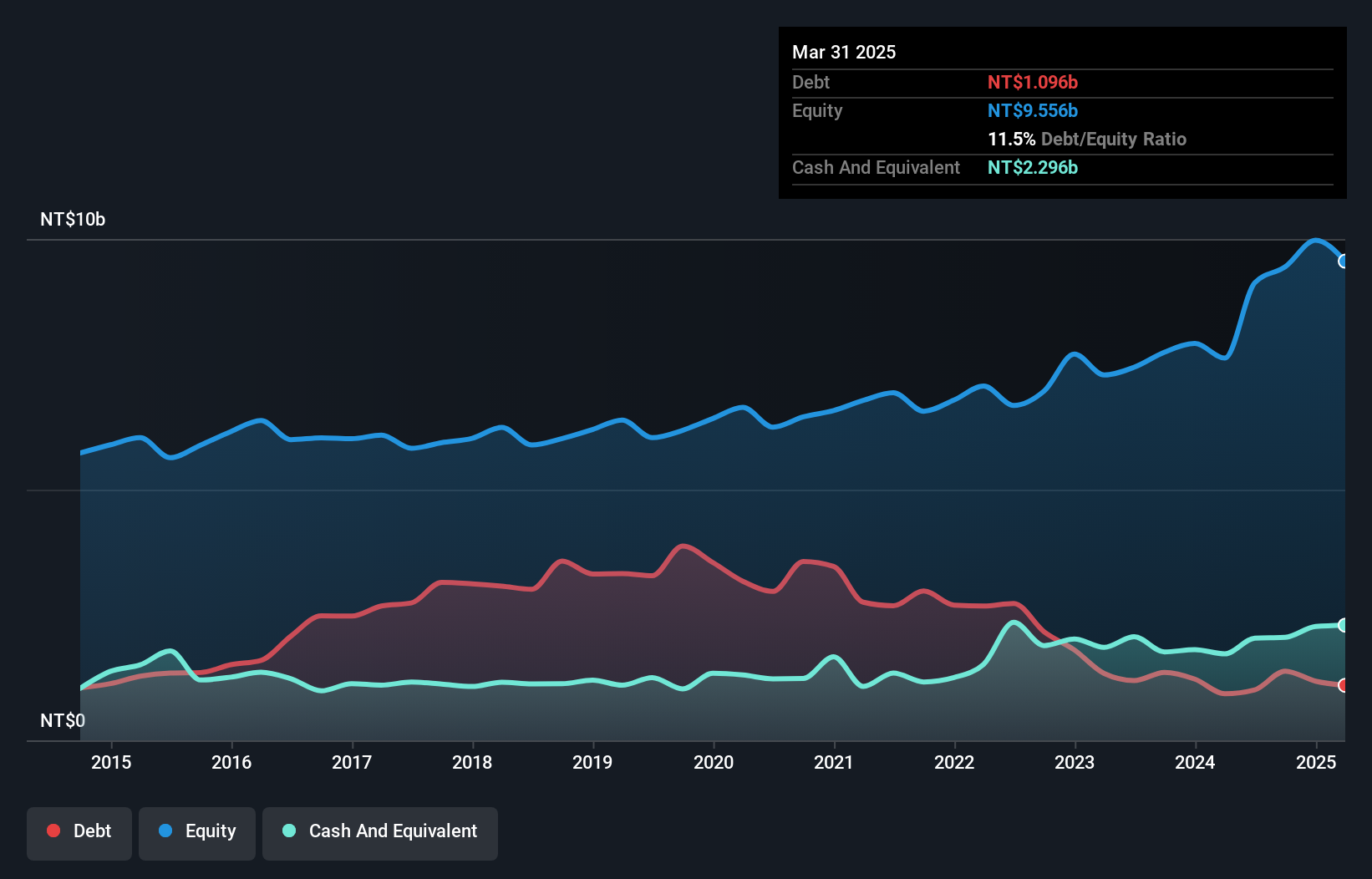

YungShin Global Holding (TWSE:3705)

Simply Wall St Value Rating: ★★★★★★

Overview: YungShin Global Holding Corporation operates through its subsidiaries to invest in, manufacture, and sell medicines, animal drugs, agricultural chemicals, industrial medicines, and cosmetics across Taiwan, Mainland China, Japan, and the United States with a market cap of NT$14.92 billion.

Operations: The company generates revenue primarily from the sale of medicines, animal drugs, agricultural chemicals, industrial medicines, and cosmetics. It operates in multiple regions including Taiwan, Mainland China, Japan, and the United States. The market capitalization is approximately NT$14.92 billion.

YungShin Global Holding, a smaller player in the pharmaceuticals sector, has demonstrated notable financial resilience. Over the past year, its earnings surged by 46%, outpacing the industry growth rate of 12%. The company is trading at a discount of 37% below its estimated fair value, suggesting potential upside. Its debt-to-equity ratio improved significantly from 63% to just under 15% over five years, reflecting stronger financial health. Recent reports show sales for Q3 at TWD 2.10 billion and net income at TWD 218 million, with basic earnings per share slightly down to TWD 0.82 from TWD 0.91 last year.

- Unlock comprehensive insights into our analysis of YungShin Global Holding stock in this health report.

Gain insights into YungShin Global Holding's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4651 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3705

YungShin Global Holding

Through its subsidiaries, invests in, manufactures, and sells medicines, animal drugs, agricultural chemicals, industrial medicines, and cosmetics.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives