- South Korea

- /

- Basic Materials

- /

- KOSDAQ:A006920

What Type Of Returns Would Mohenz.Co.Ltd's(KOSDAQ:006920) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Mohenz.Co.,Ltd. (KOSDAQ:006920) shareholders should be happy to see the share price up 19% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 13% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Mohenz.Co.Ltd

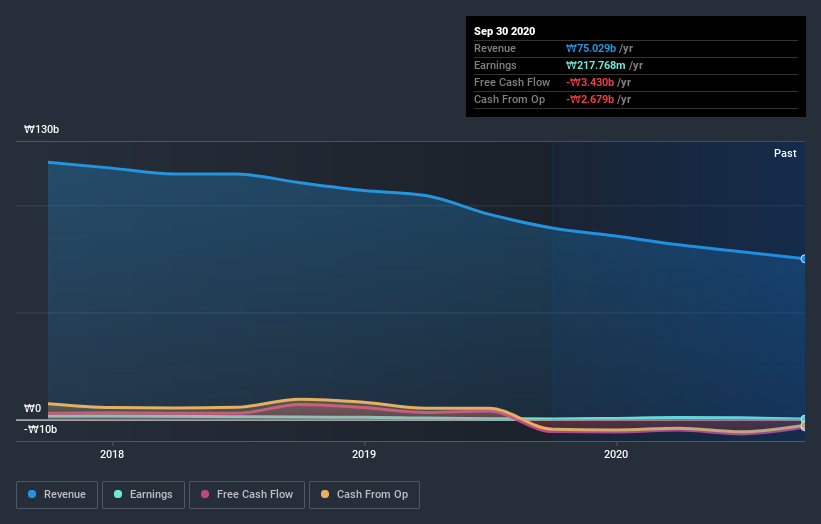

While Mohenz.Co.Ltd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last three years, Mohenz.Co.Ltd's revenue dropped 16% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 4% compound, over three years is well justified by the fundamental deterioration. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Mohenz.Co.Ltd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Mohenz.Co.Ltd had a tough year, with a total loss of 2.9%, against a market gain of about 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Mohenz.Co.Ltd you should be aware of, and 1 of them can't be ignored.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Mohenz.Co.Ltd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A006920

Mohenz.Co.Ltd

Produces and supplies ready-mixed concrete for the construction industry in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives