- South Korea

- /

- Chemicals

- /

- KOSDAQ:A005290

These 4 Measures Indicate That Dongjin Semichem (KOSDAQ:005290) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Dongjin Semichem Co., Ltd. (KOSDAQ:005290) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Dongjin Semichem

What Is Dongjin Semichem's Net Debt?

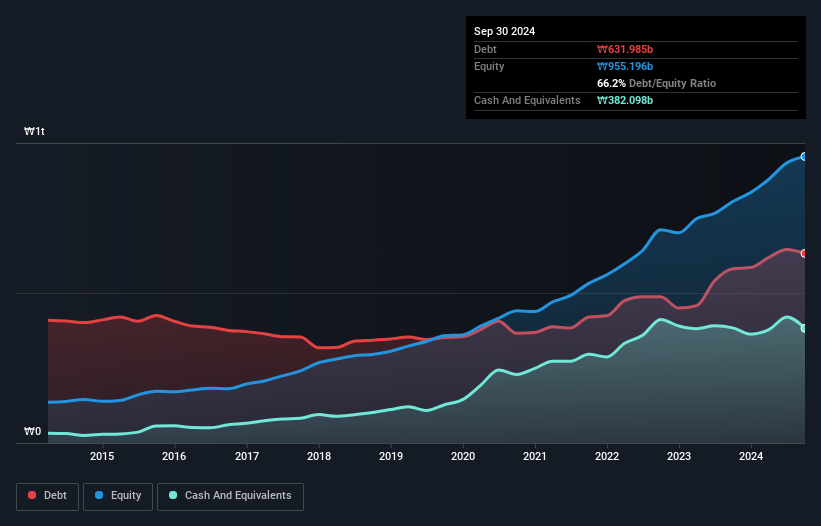

The image below, which you can click on for greater detail, shows that at September 2024 Dongjin Semichem had debt of ₩632.0b, up from ₩580.8b in one year. However, it also had ₩382.1b in cash, and so its net debt is ₩249.9b.

How Strong Is Dongjin Semichem's Balance Sheet?

We can see from the most recent balance sheet that Dongjin Semichem had liabilities of ₩611.0b falling due within a year, and liabilities of ₩226.0b due beyond that. On the other hand, it had cash of ₩382.1b and ₩254.8b worth of receivables due within a year. So it has liabilities totalling ₩200.1b more than its cash and near-term receivables, combined.

Since publicly traded Dongjin Semichem shares are worth a total of ₩1.50t, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Dongjin Semichem's net debt is only 0.97 times its EBITDA. And its EBIT easily covers its interest expense, being 11.6 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. While Dongjin Semichem doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Dongjin Semichem will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Dongjin Semichem actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

When it comes to the balance sheet, the standout positive for Dongjin Semichem was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Dongjin Semichem's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Dongjin Semichem's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A005290

Dongjin Semichem

Manufactures and supplies electronic materials and foaming agents.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026