- South Korea

- /

- Insurance

- /

- KOSE:A244920

Aplus Asset Advisor Co. Ltd's (KRX:244920) Shares Leap 29% Yet They're Still Not Telling The Full Story

Aplus Asset Advisor Co. Ltd (KRX:244920) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

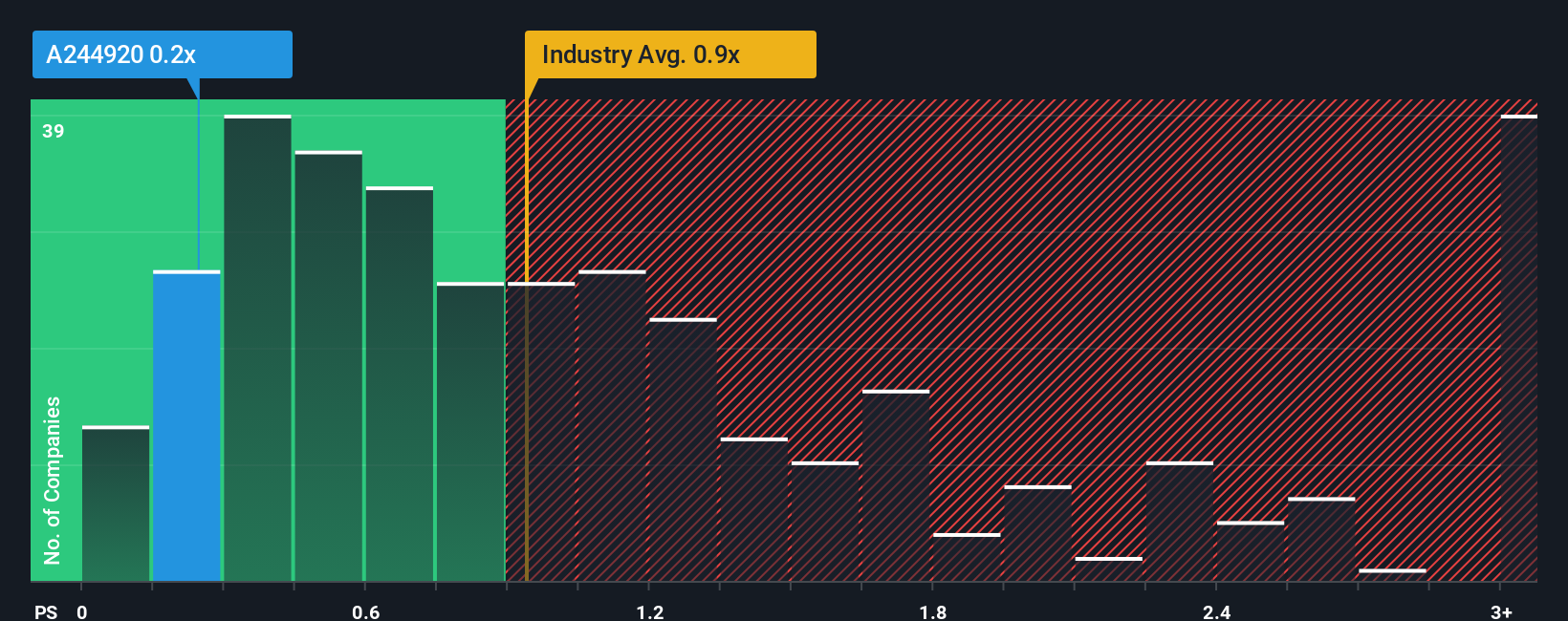

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Aplus Asset Advisor's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Korea is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Aplus Asset Advisor

How Has Aplus Asset Advisor Performed Recently?

Recent times have been pleasing for Aplus Asset Advisor as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Aplus Asset Advisor's future stacks up against the industry? In that case, our free report is a great place to start.How Is Aplus Asset Advisor's Revenue Growth Trending?

Aplus Asset Advisor's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. Pleasingly, revenue has also lifted 118% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 5.3% during the coming year according to the one analyst following the company. This is still shaping up to be materially better than the broader industry which is also set to decline 57%.

With this information, it's perhaps curious but not a major surprise that Aplus Asset Advisor is trading at a fairly similar P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Aplus Asset Advisor's P/S

Aplus Asset Advisor appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite Aplus Asset Advisor's analyst forecasts being a less shaky outlook than the rest of the industry, its P/S is a bit lower than we expected. Even though it's revenue prospects are better than the wider industry, we assume there are several risk factors might be placing downward pressure on the P/S, bringing it in line with the industry average. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. It appears some are indeed anticipating revenue instability, because outperforming the industry usually is a catalyst that provides a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Aplus Asset Advisor that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A244920

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026