Stock Analysis

- South Korea

- /

- Pharma

- /

- KOSDAQ:A237690

KRX Growth Leaders With High Insider Stakes June 2024

Reviewed by Simply Wall St

Over the past week, South Korea's stock market has seen a notable increase of 3.3%, contrasting with its flat performance over the last year. In this context, companies with high insider ownership can be particularly compelling as they often signal strong confidence in the company's future prospects, aligning well with expectations of significant earnings growth in the coming years.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| S&S Tech (KOSDAQ:A101490) | 21.6% | 44.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's explore several standout options from the results in the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company engaged in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.29 billion.

Operations: The company generates revenue from the development of enhanced biologics, targeted cancer therapies, and similar versions of existing antibody treatments.

Insider Ownership: 26.6%

Revenue Growth Forecast: 48.3% p.a.

ALTEOGEN, a South Korean biotech firm, recently became profitable and is trading at 69.7% below its estimated fair value, indicating potential undervaluation. Forecasts suggest significant growth with earnings expected to increase by 73.06% annually and revenue by 48.3% per year, outpacing the broader Korean market's growth rates. However, investor caution is advised due to high share price volatility in recent months and past shareholder dilution. The company's Return on Equity is also projected to be very high in three years.

- Click here and access our complete growth analysis report to understand the dynamics of ALTEOGEN.

- The valuation report we've compiled suggests that ALTEOGEN's current price could be inflated.

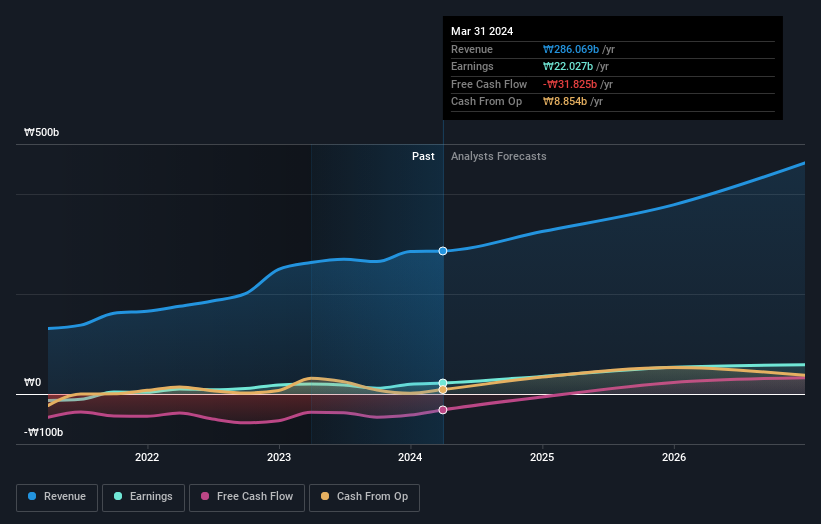

ST PharmLtd (KOSDAQ:A237690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both in South Korea and internationally, with a market capitalization of approximately ₩2.12 billion.

Operations: The company generates revenue through custom manufacturing services for active pharmaceutical ingredients and intermediates, serving clients both domestically and globally.

Insider Ownership: 13.2%

Revenue Growth Forecast: 14.9% p.a.

ST Pharm Co., Ltd. is poised for robust growth with earnings forecasted to rise by 37.88% annually, outstripping the broader Korean market's average. Despite trading at a 29.1% discount to its fair value, potential investors should note the company's high share price volatility and recent shareholder dilution. While insider buying data isn't available for the past three months, ST Pharm has demonstrated substantial earnings growth of 66.7% per year over the last five years, although its Return on Equity is expected to remain low at 14%.

- Click to explore a detailed breakdown of our findings in ST PharmLtd's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of ST PharmLtd shares in the market.

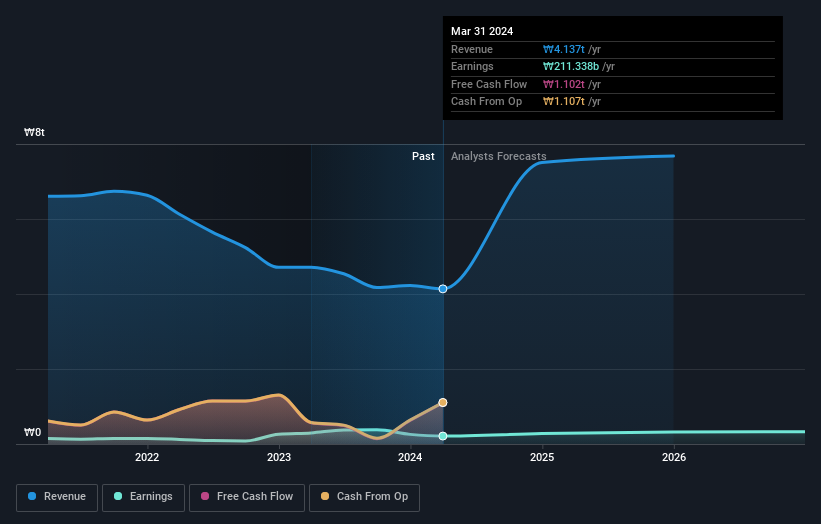

Korean Reinsurance (KOSE:A003690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Korean Reinsurance Company operates in Korea and internationally, offering life and non-life reinsurance products with a market capitalization of approximately ₩1.19 trillion.

Operations: The firm generates revenue from both life and non-life reinsurance products across domestic and international markets.

Insider Ownership: 23.5%

Revenue Growth Forecast: 29.8% p.a.

Korean Reinsurance is experiencing a phase of rapid revenue growth, projected at 29.9% annually, outpacing the South Korean market's average. However, its earnings growth forecast of 20.8% lags behind the broader market expectation of 28.9%. Recent financials reveal a significant drop in net income and EPS from the previous year, alongside unstable dividends and lower profit margins. Despite these challenges, analysts predict a potential price increase of 22.5%, though its Return on Equity is expected to remain modest at 9.7%.

- Get an in-depth perspective on Korean Reinsurance's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Korean Reinsurance's share price might be on the cheaper side.

Key Takeaways

- Delve into our full catalog of 80 Fast Growing KRX Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether ST PharmLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A237690

ST PharmLtd

Provides custom manufacturing services for active pharmaceutical ingredient and intermediates in South Korea and internationally.

Reasonable growth potential with adequate balance sheet.