Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

KRX Growth Leaders With High Insider Ownership June 2024

Reviewed by Simply Wall St

Following a brief retreat from its four-day winning streak, the South Korean stock market remains a focal point for investors, with the KOSPI just below the 2,750-point mark. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| S&S Tech (KOSDAQ:A101490) | 22.1% | 44.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's explore several standout options from the results in the screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.21 billion.

Operations: The company specializes in three primary revenue segments: long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

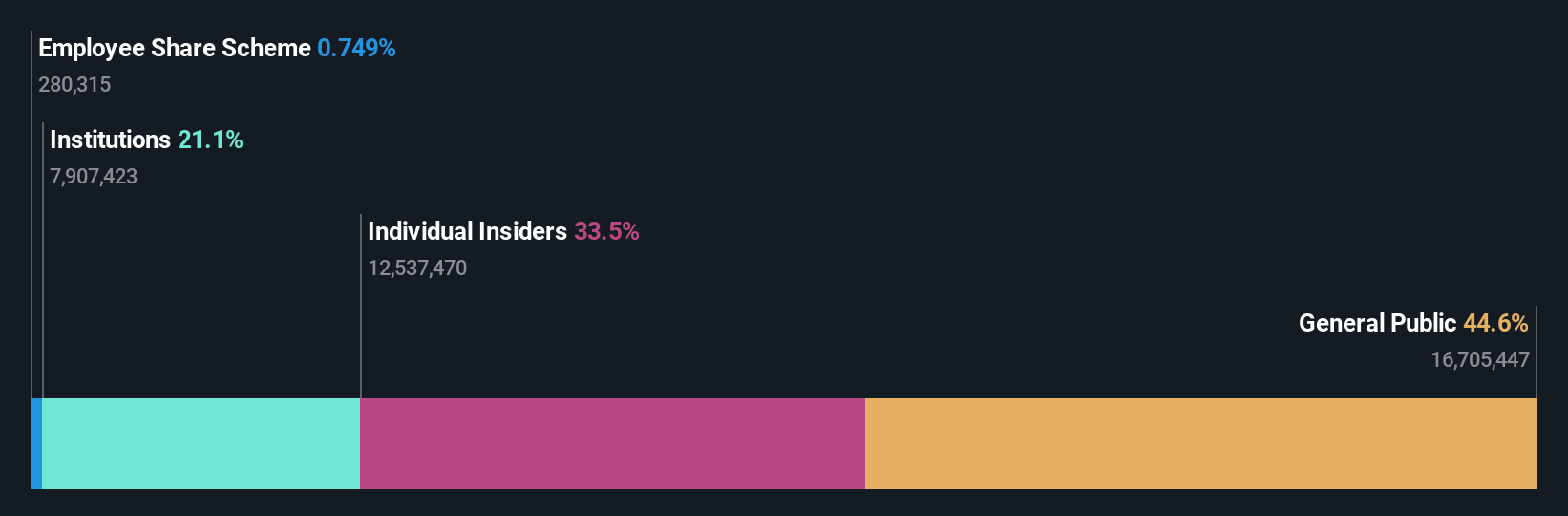

Insider Ownership: 26.6%

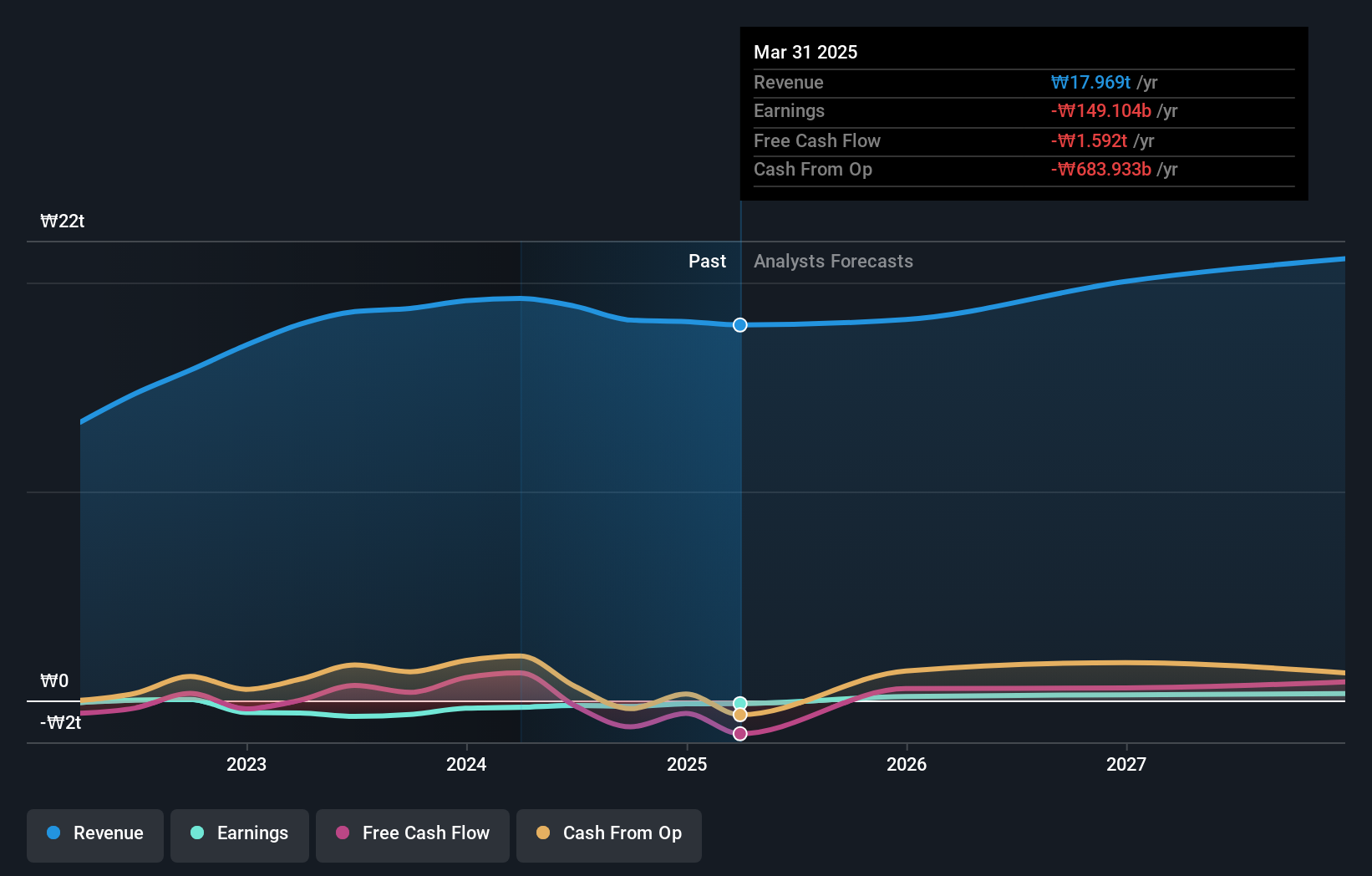

ALTEOGEN, a South Korean biotech firm, demonstrates robust growth prospects with expected annual earnings and revenue increases significantly outpacing the market average. Despite high volatility in its share price recently, ALTEOGEN's strategic presentations at significant industry conferences suggest strong future orientation. The company recently turned profitable and trades well below estimated fair value, though past shareholder dilution raises concerns. With no recent insider trading reported, investor alignment through high insider ownership remains speculative.

- Take a closer look at ALTEOGEN's potential here in our earnings growth report.

- According our valuation report, there's an indication that ALTEOGEN's share price might be on the expensive side.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in sectors including heavy industry, machinery manufacturing, and apartment construction across various regions such as South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.32 trillion.

Operations: The company's revenue is derived from heavy industry, machinery manufacturing, and apartment construction across multiple regions including South Korea, the United States, Asia, the Middle East, and Europe.

Insider Ownership: 34.3%

Doosan Corporation has shown a significant turnaround, reporting KRW 180.97 billion in Q1 2024 sales, up from KRW 169.05 billion the previous year, and shifting from a net loss to a profit of KRW 4.98 billion. This recovery is mirrored in its annual performance with reduced losses and increased sales. Despite this progress and high insider ownership indicating strong confidence, the company's revenue growth forecast of 3.6% per year lags behind the broader South Korean market expectation of 10.5%.

- Click to explore a detailed breakdown of our findings in Doosan's earnings growth report.

- In light of our recent valuation report, it seems possible that Doosan is trading behind its estimated value.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd. is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The company generates its revenue from the sale of cosmetic products targeted at both male and female consumers.

Insider Ownership: 34.2%

APR Co., Ltd. has demonstrated robust performance with its earnings growing by 70.2% over the past year, while trading at 15.3% below its estimated fair value. The company's revenue is expected to rise by 23.1% annually, outpacing the South Korean market forecast of 10.5%. Despite this strong growth trajectory, APR's projected annual earnings growth of 26.2% falls short of the broader market expectation of 29%. Additionally, APR maintains a high Return on Equity forecast at 34.8%, reflecting efficient management and potential profitability enhancements in the coming years.

- Dive into the specifics of APR here with our thorough growth forecast report.

- Our valuation report here indicates APR may be overvalued.

Where To Now?

- Dive into all 81 of the Fast Growing KRX Companies With High Insider Ownership we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether ALTEOGEN is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with flawless balance sheet.