- Taiwan

- /

- Commercial Services

- /

- TWSE:9917

3 Dividend Stocks Yielding Over 4.1% For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, buoyed by optimism over trade negotiations and robust earnings reports. In this environment, dividend stocks yielding over 4.1% offer a compelling option for investors seeking both income and potential growth, as they provide regular payouts that can help offset market volatility while contributing to long-term portfolio stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.92% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

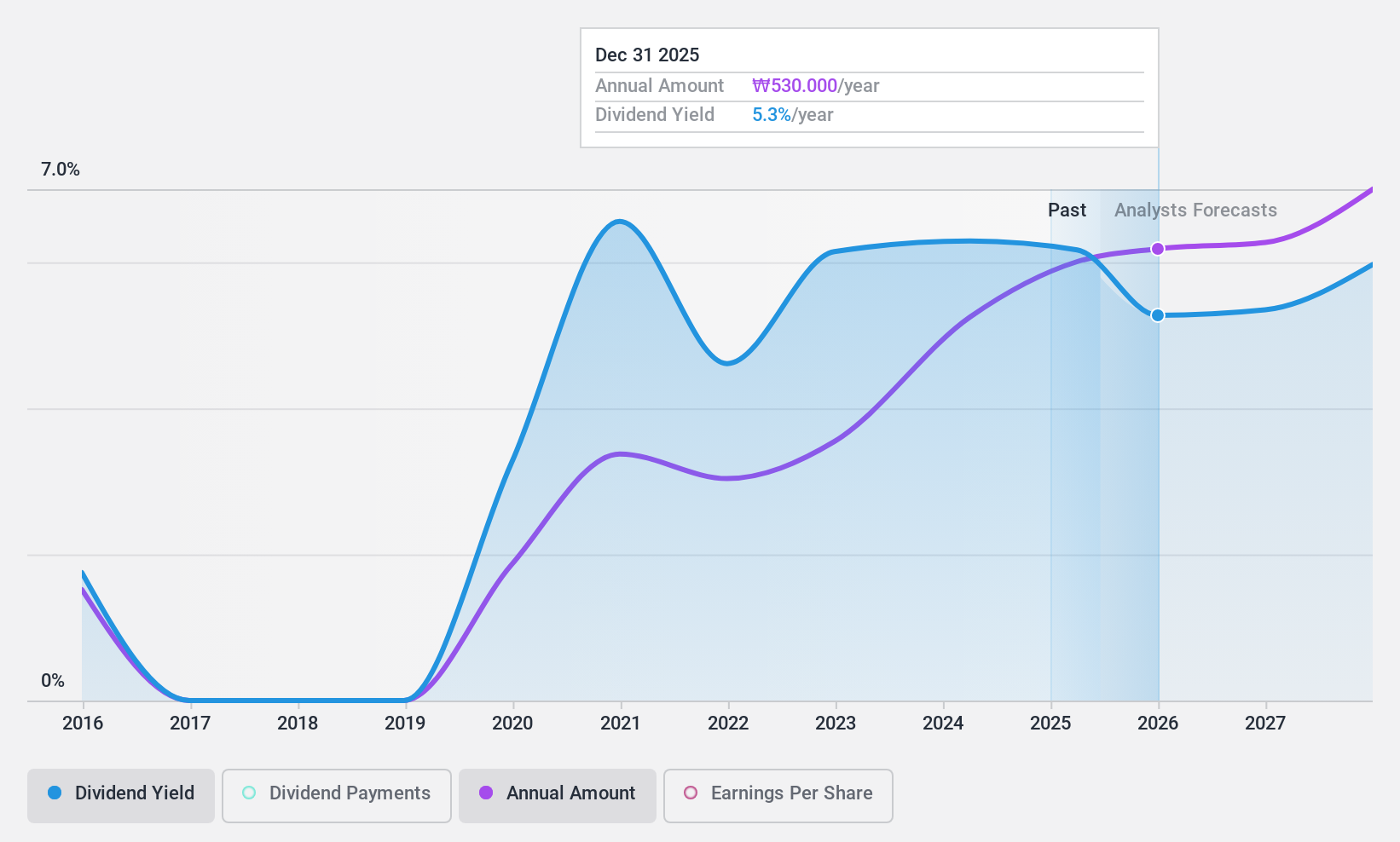

Korean Reinsurance (KOSE:A003690)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Korean Reinsurance Company is a reinsurance firm offering life and non-life reinsurance products both in Korea and internationally, with a market cap of ₩1.44 trillion.

Operations: Korean Reinsurance Company's revenue segment consists entirely of reinsurance, generating ₩4.37 trillion.

Dividend Yield: 5.4%

Korean Reinsurance offers an attractive dividend yield of 5.4%, ranking in the top 25% of KR market payers. Its dividends are well-covered, with a cash payout ratio of 5.3% and earnings payout at 28.1%, ensuring sustainability. Over the past decade, dividends have been stable and growing, indicating reliability despite large one-off items affecting earnings quality. The stock trades significantly below its estimated fair value, enhancing its appeal to dividend investors.

- Dive into the specifics of Korean Reinsurance here with our thorough dividend report.

- Our valuation report unveils the possibility Korean Reinsurance's shares may be trading at a discount.

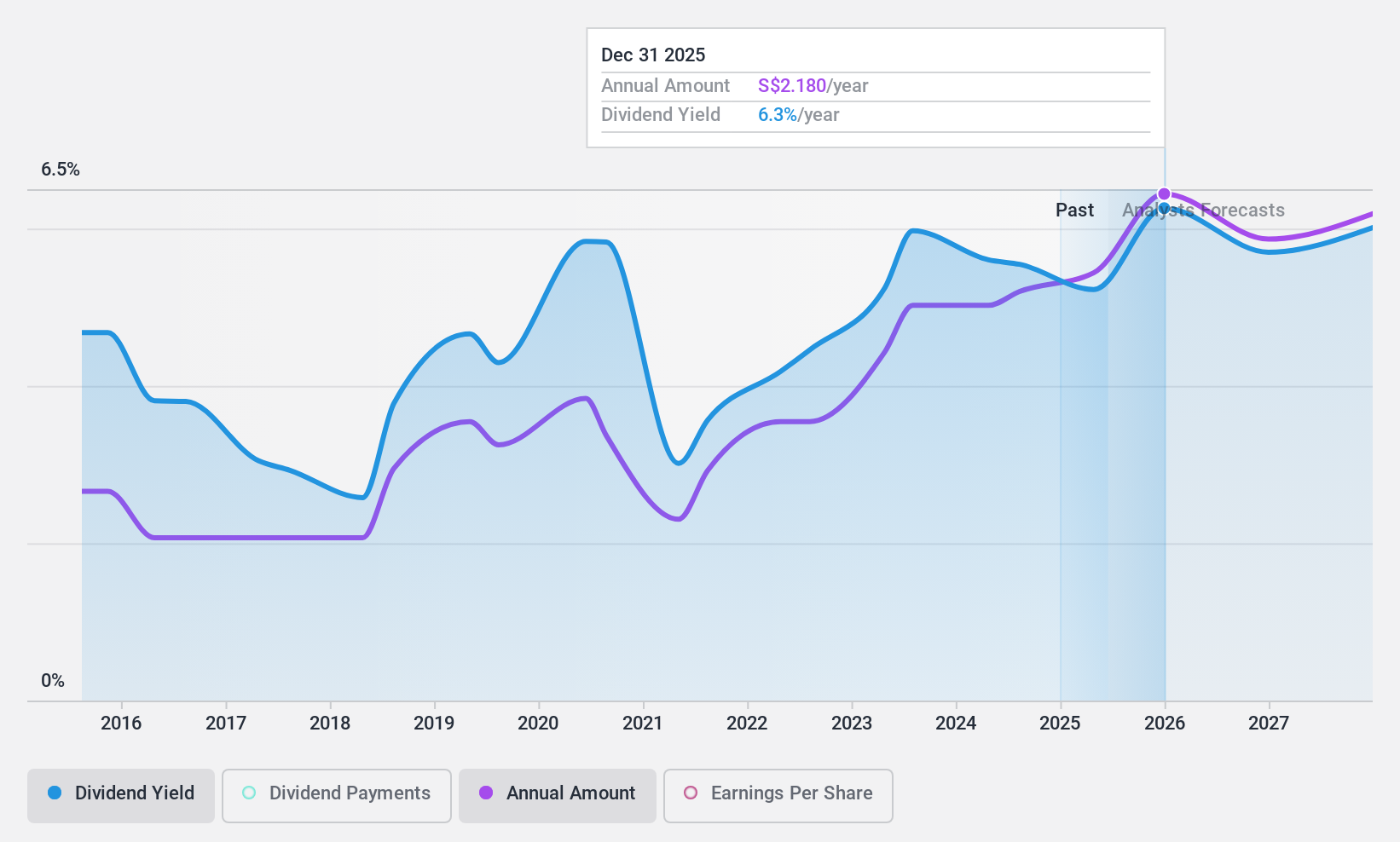

United Overseas Bank (SGX:U11)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, with a market cap of SGD64.54 billion, operates globally by offering a range of banking products and services through its subsidiaries.

Operations: United Overseas Bank Limited generates revenue through various segments, including Group Retail at SGD4.56 billion, Group Wholesale Banking at SGD5.12 billion, and Global Markets at SGD1.34 billion.

Dividend Yield: 4.6%

United Overseas Bank's dividend yield of 4.56% is below the top tier in Singapore, but its dividends are well-covered by earnings with a payout ratio of 49.8%. Despite past volatility in dividend payments, the bank's earnings have grown steadily at 11.4% annually over five years and are forecasted to continue growing. The bank trades at a significant discount to its estimated fair value, which may interest investors seeking potential value alongside dividend income.

- Get an in-depth perspective on United Overseas Bank's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that United Overseas Bank is trading behind its estimated value.

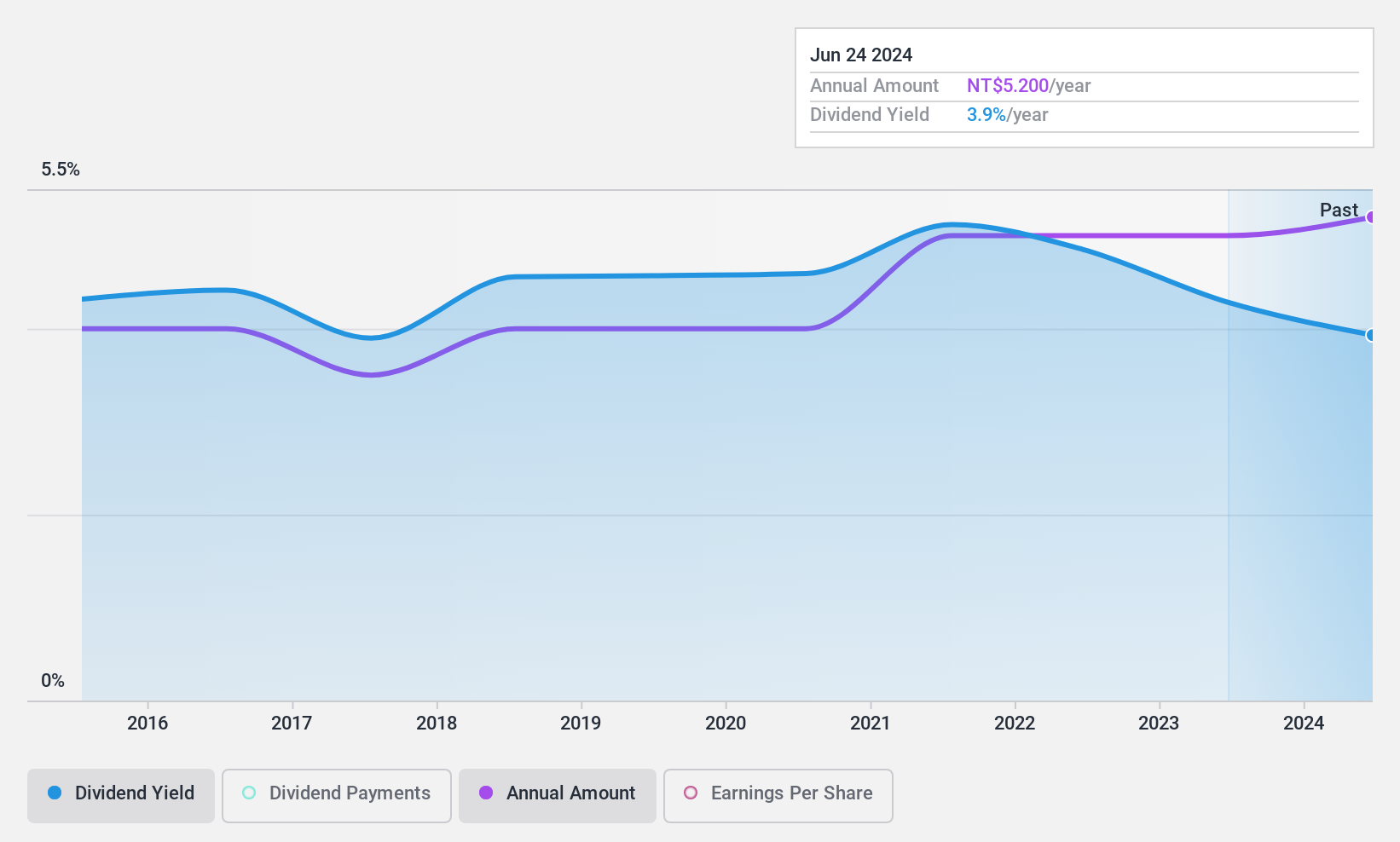

Taiwan Secom (TWSE:9917)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Secom Co., Ltd. offers security services in Taiwan and has a market cap of NT$55.21 billion.

Operations: Taiwan Secom Co., Ltd.'s revenue segments include NT$1.79 billion from Restaurant Services, NT$1.09 billion from the Logistics Department, NT$1.62 billion from the Banknote Service Department, NT$2.62 billion from the Stay in Security Department, and NT$7.61 billion from the Electronic Systems Department.

Dividend Yield: 4.2%

Taiwan Secom's dividend yield of 4.18% is slightly below the top tier in Taiwan, and its dividends are not well covered by free cash flows with a high cash payout ratio of 141.8%. The company's earnings have grown by 8.9% over the past year, supporting its current payout ratio of 81.8%. Dividends have been stable and reliable over the last decade, though they remain low compared to top payers in the market.

- Click to explore a detailed breakdown of our findings in Taiwan Secom's dividend report.

- The analysis detailed in our Taiwan Secom valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Embark on your investment journey to our 1970 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Secom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9917

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives