- South Korea

- /

- Insurance

- /

- KOSE:A000810

Top Dividend Stocks On KRX You Should Know

Reviewed by Simply Wall St

The South Korean market has seen a 2.5% increase in the last 7 days, with all sectors gaining ground, although last year's performance remained flat. With earnings expected to grow by 29% per annum over the next few years, identifying strong dividend stocks can be a strategic move for investors looking to capitalize on this growth while securing steady income.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.41% | ★★★★★★ |

| Kangwon Land (KOSE:A035250) | 5.20% | ★★★★★☆ |

| Woori Financial Group (KOSE:A316140) | 4.56% | ★★★★★☆ |

| Hansae (KOSE:A105630) | 3.38% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.30% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.80% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.98% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.43% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.16% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.37% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. and its subsidiaries provide non-life insurance products and services across Korea, China, the United States, Indonesia, Vietnam, Singapore, and the United Kingdom with a market cap of ₩15.35 trillion.

Operations: Samsung Fire & Marine Insurance generates ₩18.88 billion in revenue from its insurance business.

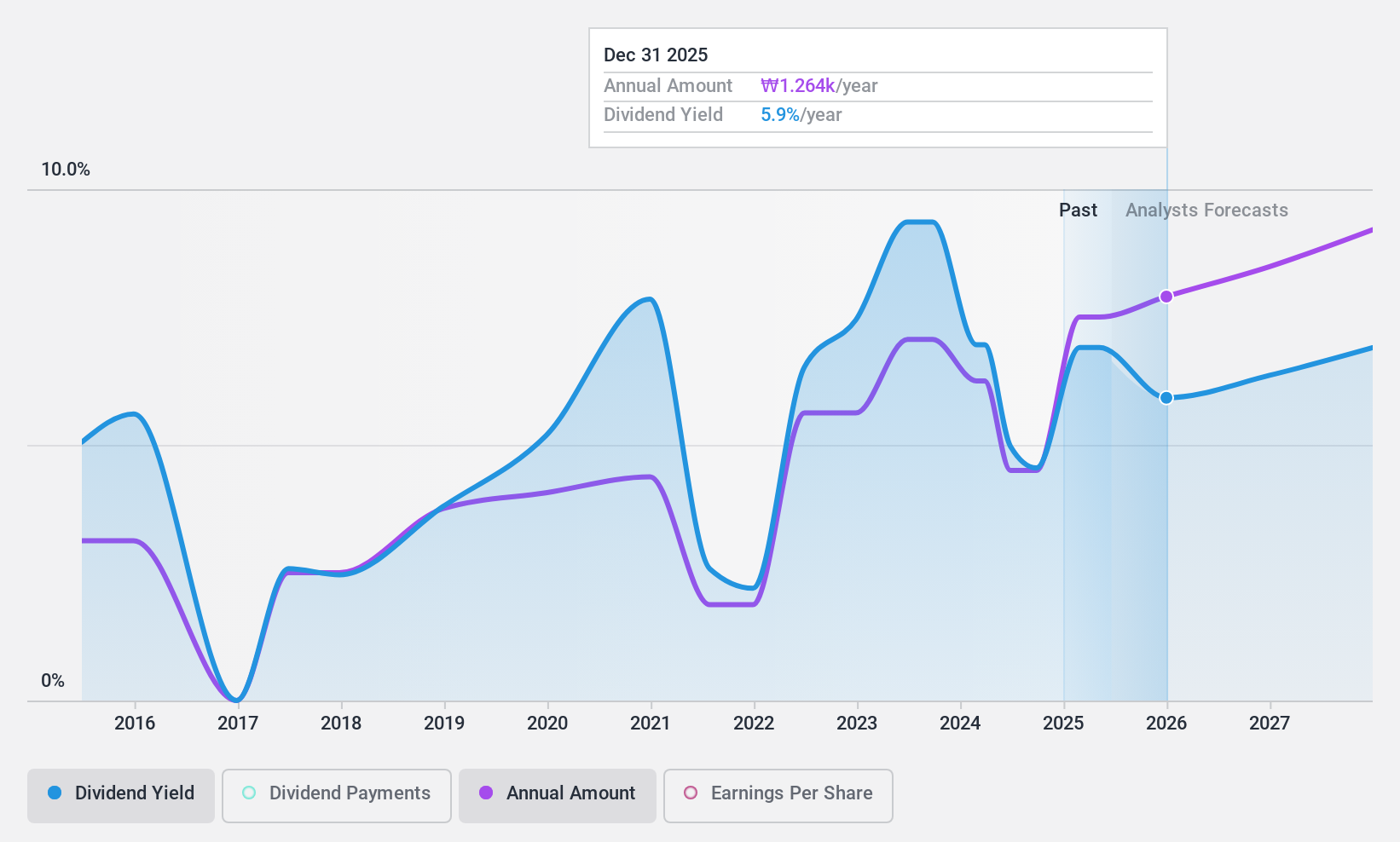

Dividend Yield: 4.4%

Samsung Fire & Marine Insurance reported strong earnings for the first half of 2024, with net income rising to ₩1.31 trillion from ₩1.21 trillion a year ago. Basic earnings per share also increased. The company’s dividend yield is in the top 25% of the KR market, and its payout ratios indicate dividends are well covered by both earnings and cash flows. However, its dividend history has been volatile over the past decade despite recent increases.

- Unlock comprehensive insights into our analysis of Samsung Fire & Marine Insurance stock in this dividend report.

- Upon reviewing our latest valuation report, Samsung Fire & Marine Insurance's share price might be too pessimistic.

HD Hyundai (KOSE:A267250)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd., with a market cap of ₩5.75 trillion, operates in the oil refining sector both domestically and internationally through its subsidiaries.

Operations: HD Hyundai Co., Ltd.'s revenue segments include Essential Oil (₩43.99 billion), Shipbuilding & Marine Engineering (₩25.77 billion), Construction Equipment (₩11.90 billion), Electrical/Electronic (₩4.15 billion), and Ship Service (₩1.99 billion).

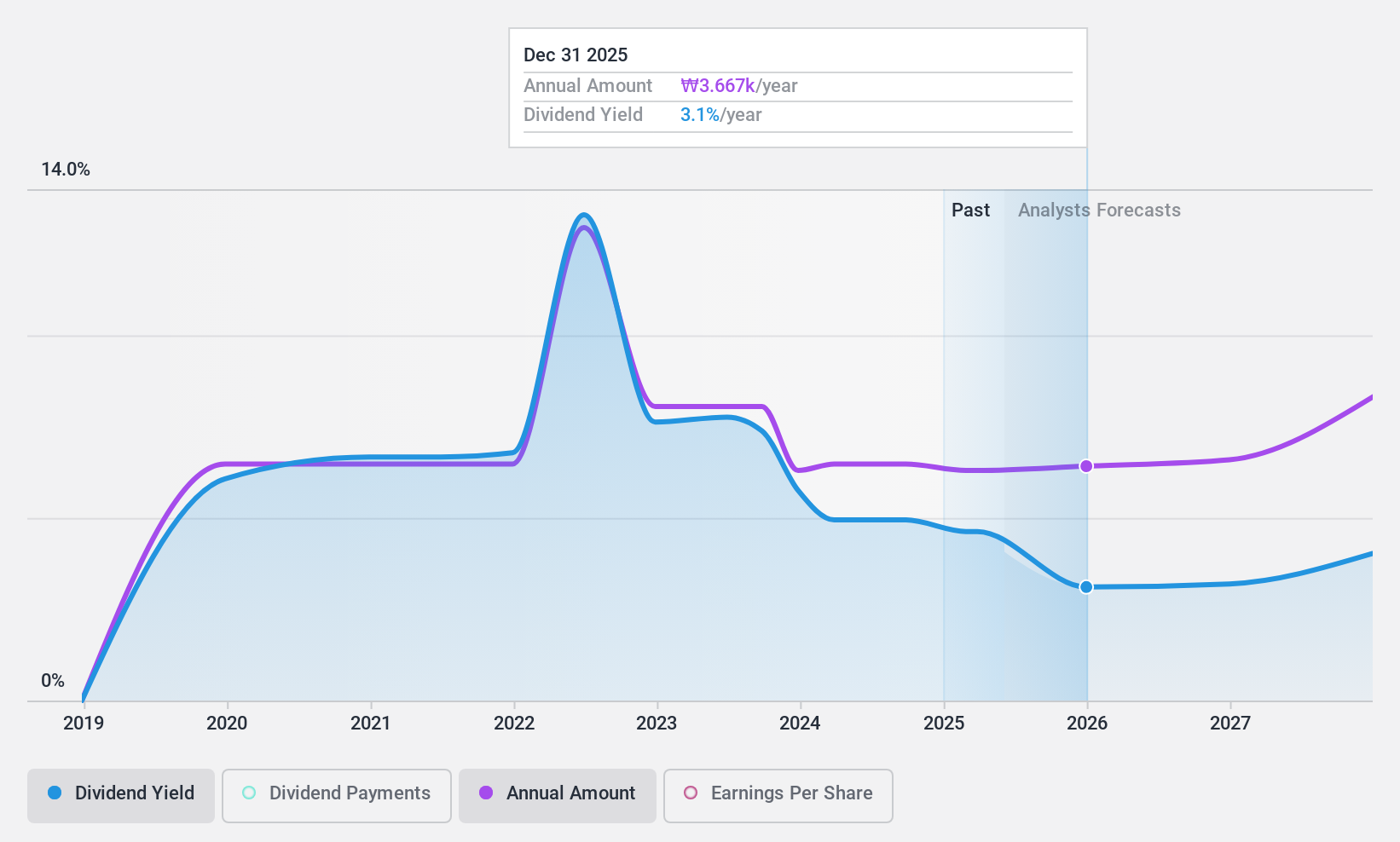

Dividend Yield: 4.5%

HD Hyundai's dividend yield is among the top 25% in South Korea, supported by a low cash payout ratio of 7.7%, indicating strong coverage by cash flows. Despite this, its five-year dividend history has been unstable and payments have not increased. Earnings grew significantly over the past year and are forecasted to continue rising. Recent Q2 2024 results showed substantial growth in sales and net income, further bolstering its financial position for potential future dividends.

- Delve into the full analysis dividend report here for a deeper understanding of HD Hyundai.

- Our valuation report unveils the possibility HD Hyundai's shares may be trading at a discount.

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., with a market cap of ₩11.73 billion, operates as a commercial bank offering various financial services to individual, business, and institutional customers in Korea.

Operations: Woori Financial Group Inc. generates revenue primarily from its Banking segment (₩7.41 billion), followed by Capital (₩281.91 million) and Credit Cards (₩440.47 million).

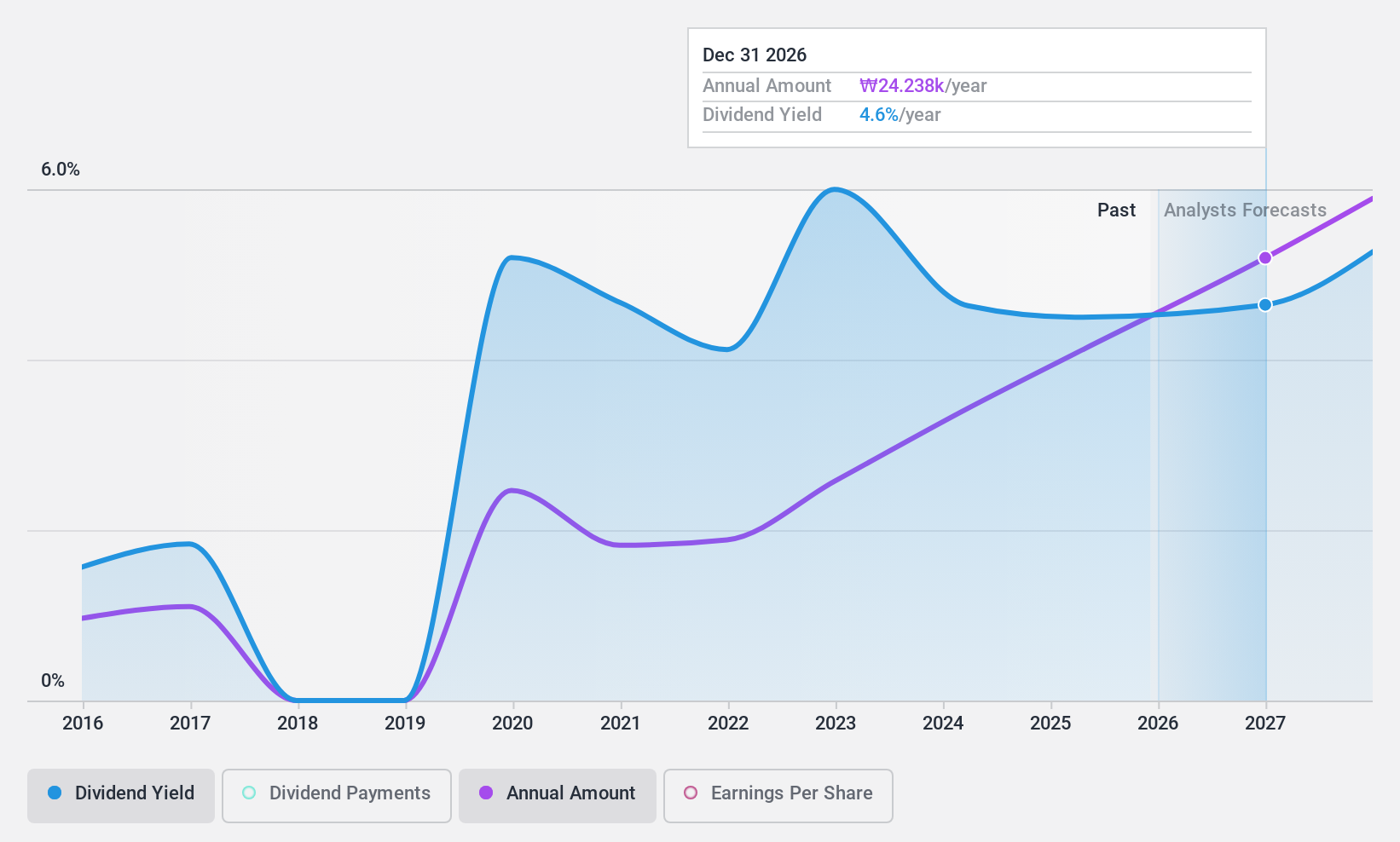

Dividend Yield: 4.6%

Woori Financial Group's recent earnings report showed notable growth, with Q2 net income rising to KRW 931.50 billion from KRW 625.19 billion a year ago. The company declared a quarterly cash dividend of KRW 180 per share, reflecting its commitment to shareholder returns. Despite a history of volatile and unreliable dividend payments, Woori's current payout ratio of 34% suggests dividends are well covered by earnings and forecasted to remain sustainable in the near term.

- Dive into the specifics of Woori Financial Group here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Woori Financial Group is trading behind its estimated value.

Taking Advantage

- Discover the full array of 73 Top KRX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000810

Samsung Fire & Marine Insurance

Engages in the provision of non-life insurance products and services in Korea, China, the United States, Indonesia, Vietnam, Singapore, and the United Kingdom.

Excellent balance sheet established dividend payer.