- South Korea

- /

- Insurance

- /

- KOSE:A000810

Global Dividend Stocks Featuring 3 Prominent Yield Generators

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating trade policies and easing inflation, global markets have shown resilience, with U.S. stocks closing higher despite some late-week volatility. As investors navigate these dynamic conditions, dividend stocks stand out as attractive options for those seeking income generation and potential stability in their portfolios.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Nissan Chemical (TSE:4021) | 4.24% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.71% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.36% | ★★★★★★ |

Click here to see the full list of 1560 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. operates as a provider of non-life insurance products and services across several countries including Korea, China, the United States, Indonesia, Vietnam, Singapore, and the United Kingdom with a market cap of approximately ₩17.18 trillion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates revenue primarily from its insurance business, amounting to approximately ₩17.42 billion.

Dividend Yield: 4.3%

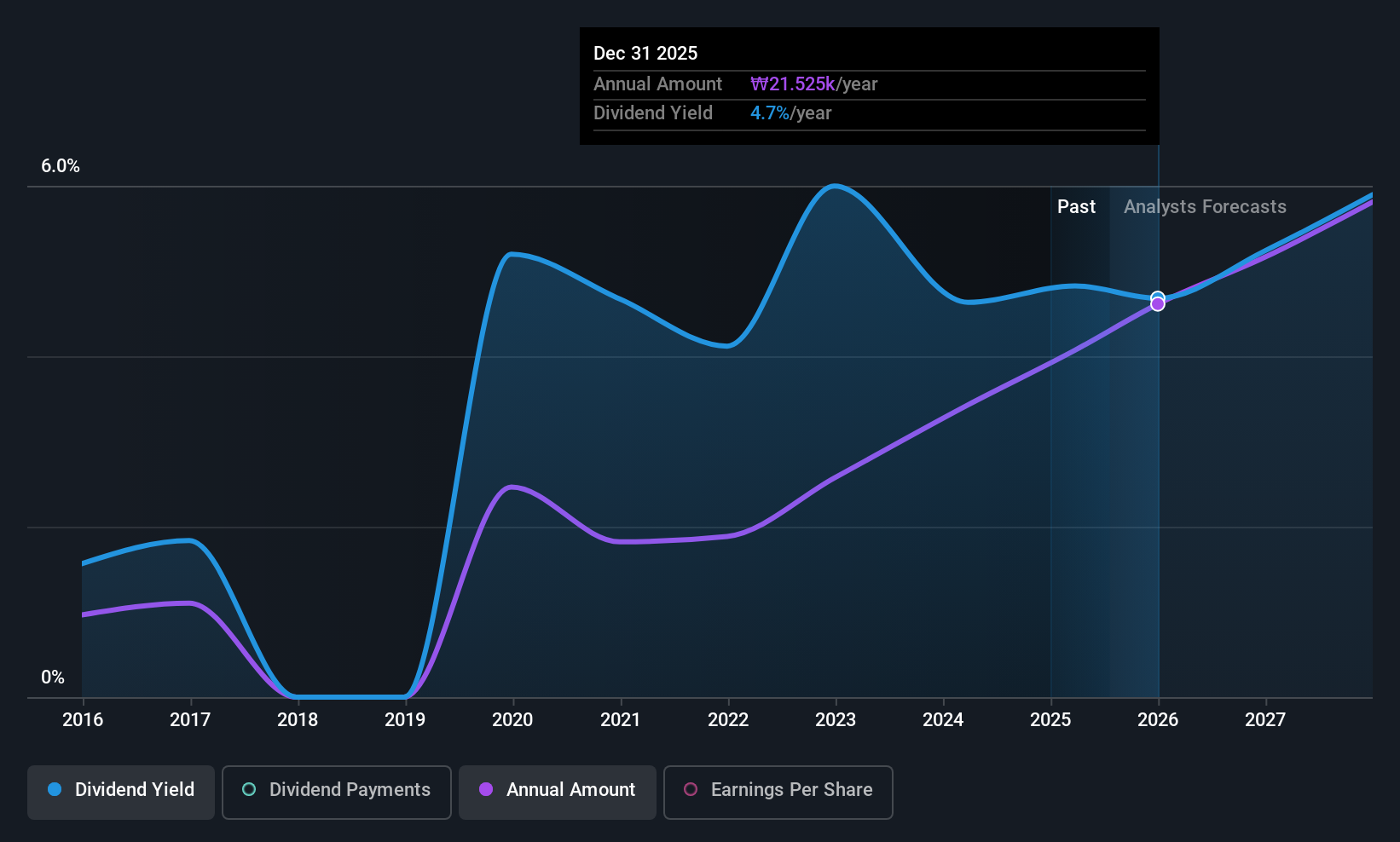

Samsung Fire & Marine Insurance's dividend payments, while covered by earnings and cash flows with payout ratios of 43.7% and 41.3% respectively, have been unreliable and volatile over the past decade. Despite this instability, dividends have increased during that period and yield is in the top 25% of the KR market at 4.33%. Trading significantly below estimated fair value suggests potential for price appreciation, but investors should consider its unstable dividend history when evaluating it as a dividend stock.

- Dive into the specifics of Samsung Fire & Marine Insurance here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Samsung Fire & Marine Insurance is priced lower than what may be justified by its financials.

JNBY Design (SEHK:3306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JNBY Design Limited, with a market cap of HK$8.58 billion, operates in the design, marketing, retail, and sale of fashion apparel, accessory products, and household goods in China and internationally.

Operations: JNBY Design Limited generates revenue through its segments, with Mature Brand contributing CN¥3 billion, Younger Brands adding CN¥2.16 billion, and Emerging Brands providing CN¥225.28 million.

Dividend Yield: 8.1%

JNBY Design's dividend payments are covered by earnings and cash flows, with payout ratios of 72.3% and 54.2%, respectively. Despite being in the top 25% of dividend payers in Hong Kong with an 8.08% yield, its dividends have been volatile over the past eight years, reflecting an unstable track record. While trading at a significant discount to estimated fair value, investors should weigh this against its inconsistent dividend history when considering it for income portfolios.

- Click here to discover the nuances of JNBY Design with our detailed analytical dividend report.

- Our valuation report here indicates JNBY Design may be undervalued.

Hokuriku Electric IndustryLtd (TSE:6989)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hokuriku Electric Industry Co., Ltd. develops, manufactures, and sells electronic components both in Japan and internationally, with a market cap of ¥18.21 billion.

Operations: Hokuriku Electric Industry Ltd. generates revenue primarily from its Electronic Components segment, amounting to ¥42.21 billion, and also from Mold-Mechanical Equipment, contributing ¥697 million.

Dividend Yield: 3.9%

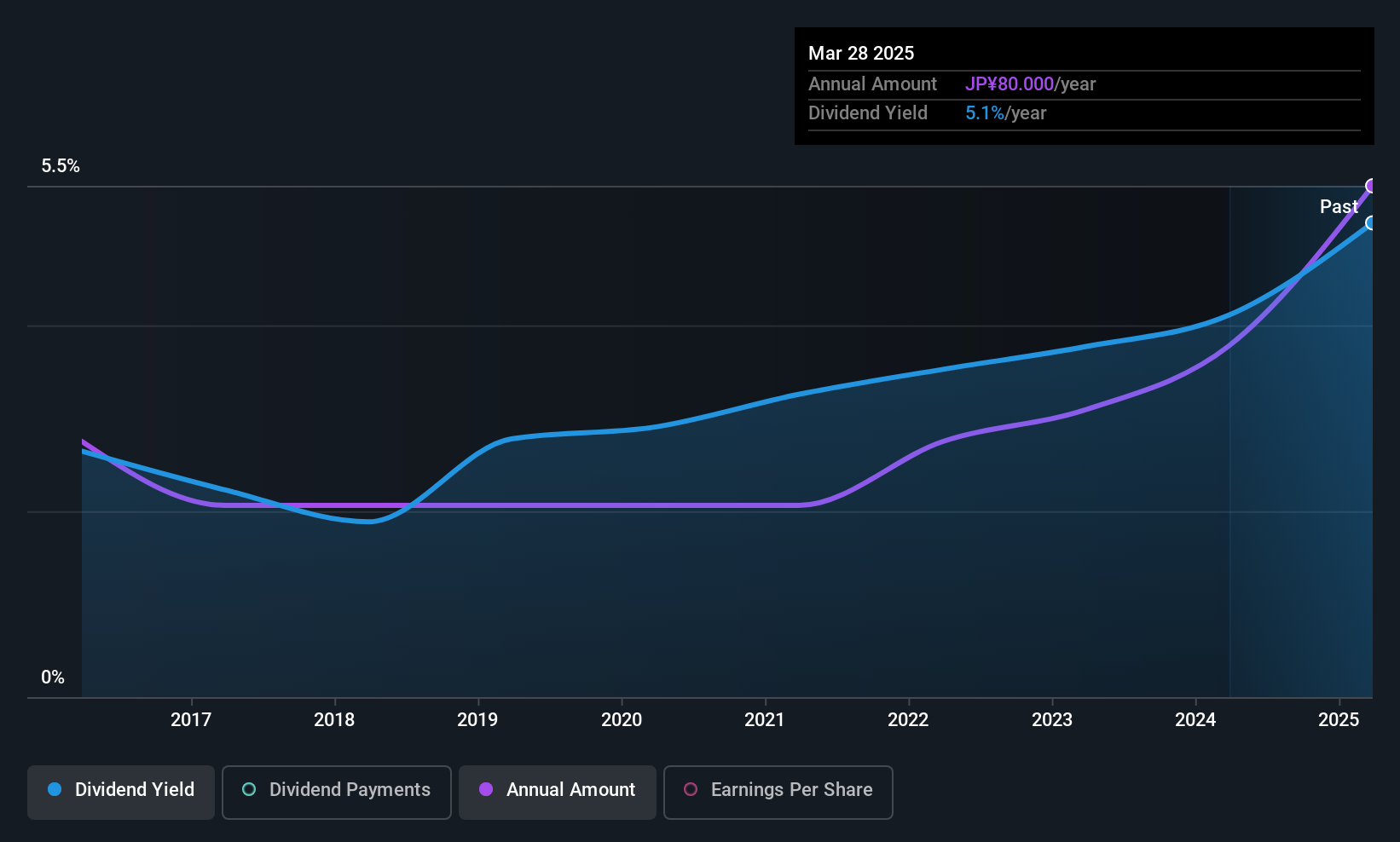

Hokuriku Electric Industry Ltd. offers a dividend yield of 3.87%, which is below the top quartile in Japan, yet its dividends are well-covered by earnings and cash flows, with payout ratios of 33.2% and 22.9%, respectively. Despite recent increases to JPY 90 per share, the dividend history has been volatile over the past decade. The company's recent buyback activity and trading at a discount to estimated fair value may interest potential investors seeking growth alongside income stability concerns.

- Unlock comprehensive insights into our analysis of Hokuriku Electric IndustryLtd stock in this dividend report.

- Our valuation report unveils the possibility Hokuriku Electric IndustryLtd's shares may be trading at a discount.

Summing It All Up

- Take a closer look at our Top Global Dividend Stocks list of 1560 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000810

Samsung Fire & Marine Insurance

Provides non-life insurance products and services in South Korea, China, Indonesia, Vietnam, Singapore, the United States, and the United Kingdom.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives