- South Korea

- /

- Personal Products

- /

- KOSE:A483650

Undiscovered Gems In Asia For June 2025

Reviewed by Simply Wall St

As the global market landscape continues to shift, with small-cap stocks showing resilience and leading gains in key indices like the Russell 2000, investors are increasingly looking toward Asia for potential opportunities. In this environment of cautious optimism amid trade tensions and economic indicators pointing towards selective growth, identifying promising small-cap stocks requires a keen eye for companies that demonstrate robust fundamentals and adaptability to changing market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yashima Denki | 2.40% | 0.14% | 21.00% | ★★★★★★ |

| Toukei Computer | NA | 5.68% | 13.35% | ★★★★★★ |

| Suzhou Highfine Biotech | NA | -1.11% | 7.27% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 25.44% | 15.19% | 13.48% | ★★★★★★ |

| Shanghai SK Automation TechnologyLtd | 37.27% | 33.22% | 12.18% | ★★★★★☆ |

| Daoming Optics&ChemicalLtd | 33.83% | 1.38% | 5.82% | ★★★★★☆ |

| iMarketKorea | 30.54% | 4.27% | 0.27% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.71% | 8.00% | 12.85% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

d'Alba Global (KOSE:A483650)

Simply Wall St Value Rating: ★★★★★★

Overview: d'Alba Global Co., Ltd. is involved in the manufacturing and sale of perfumes and cosmetic products both in South Korea and internationally, with a market capitalization of ₩1.99 trillion.

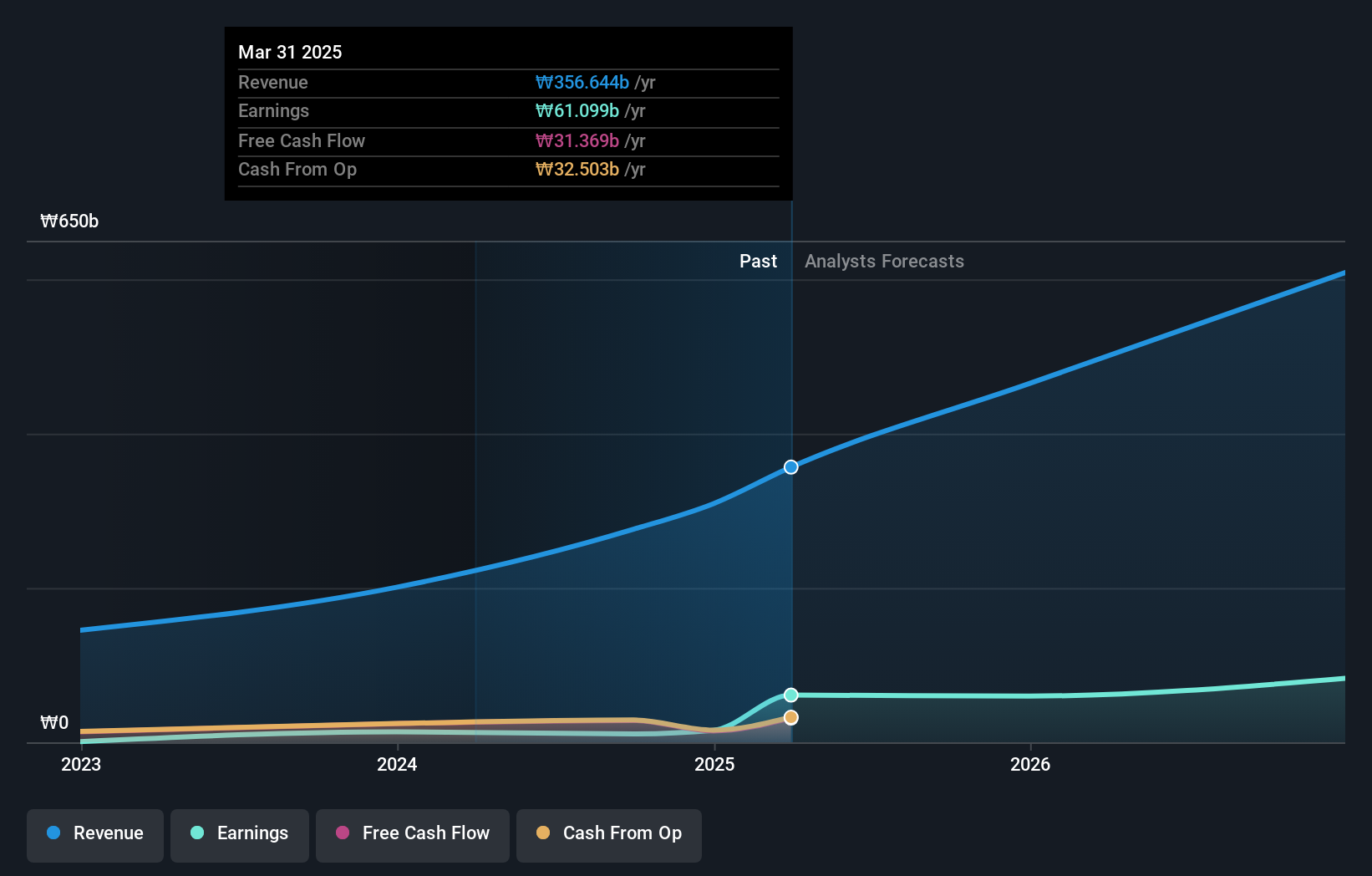

Operations: The primary revenue stream for d'Alba Global comes from the manufacturing and selling of cosmetics, generating ₩356.64 billion. The company's gross profit margin is a key financial metric to consider when evaluating its profitability in the competitive cosmetic industry.

d'Alba Global, a nimble player in the personal products sector, recently completed an IPO raising KRW 43.36 billion, showcasing its growth ambitions. This company has delivered impressive earnings growth of 382% over the past year, far outpacing the industry average of 9%. With no debt on its books for five years and high-quality earnings reported, d'Alba seems to be on solid financial ground. However, shares remain highly illiquid which may pose challenges for potential investors. Looking ahead, earnings are projected to grow at a steady pace of 19% annually.

- Navigate through the intricacies of d'Alba Global with our comprehensive health report here.

Assess d'Alba Global's past performance with our detailed historical performance reports.

Zhejiang Zhongjian TechnologyLtd (SZSE:002779)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Zhongjian Technology Co., Ltd focuses on the research, development, production, and sale of garden machinery products both in China and internationally, with a market capitalization of CN¥14.32 billion.

Operations: Zhejiang Zhongjian Technology generates revenue primarily from the sale of garden machinery products. The company's net profit margin is 8.5%, reflecting its efficiency in managing costs relative to its revenue.

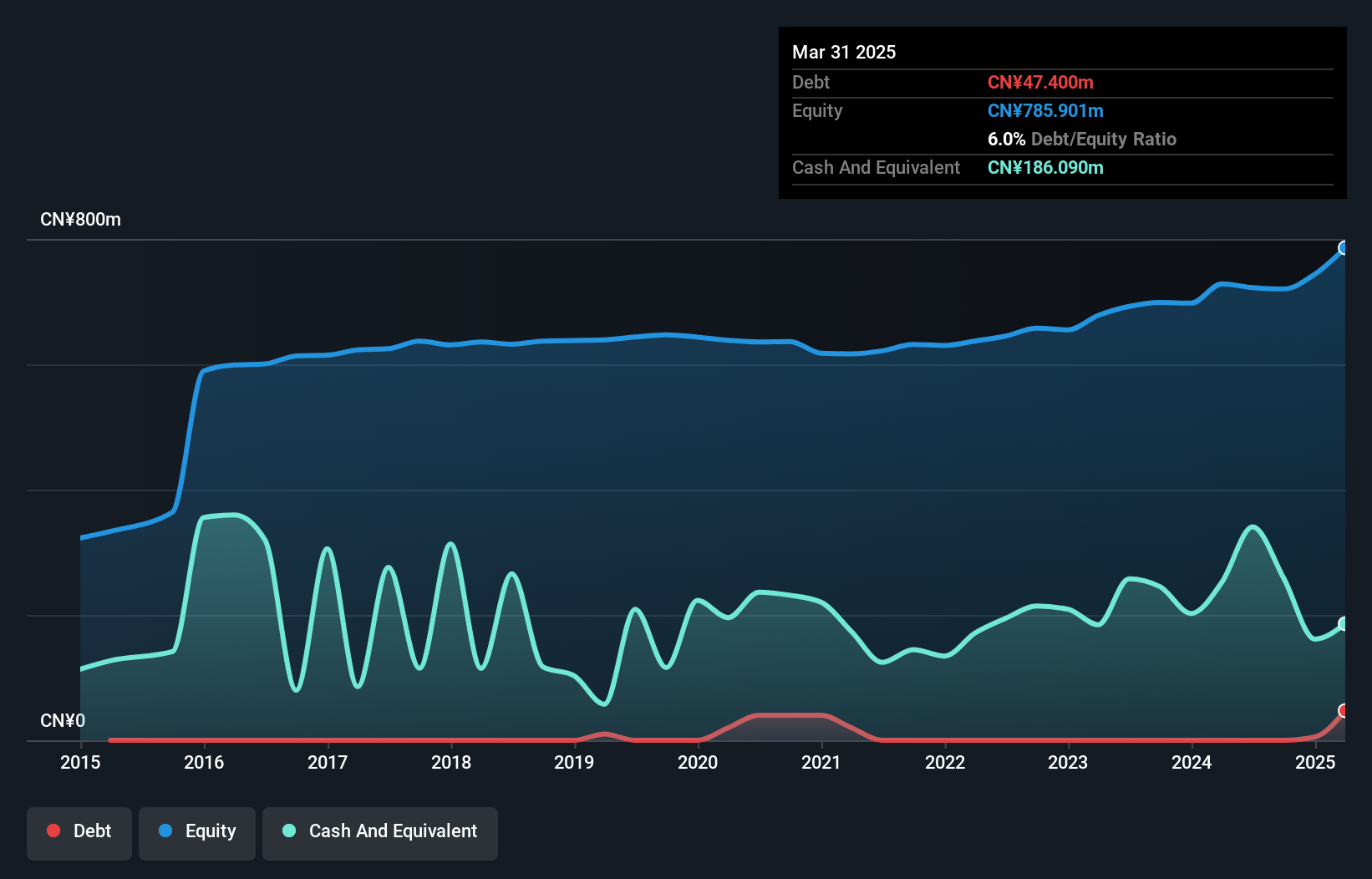

Zhejiang Zhongjian Technology, a company with promising growth prospects, has seen its earnings jump by 35% over the past year, outpacing the Consumer Durables industry. The debt to equity ratio increased from 3.1% to 6% in five years, but it holds more cash than total debt. Recent financials reveal Q1 2025 sales at CNY 285.93 million and net income of CNY 42.21 million, up from last year’s figures of CNY 272.42 million and CNY 31.01 million respectively. Despite high volatility in share price recently, the company approved a cash dividend of CNY 1.10 per ten shares for fiscal year-end distribution.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. specializes in offering brand integrated marketing solutions within China and has a market cap of CN¥13.06 billion.

Operations: Ruoyuchen derives its revenue primarily from the E-Commerce Service Industry, generating CN¥1.97 billion. The company's financial performance is influenced by its ability to manage costs effectively, impacting its net profit margin.

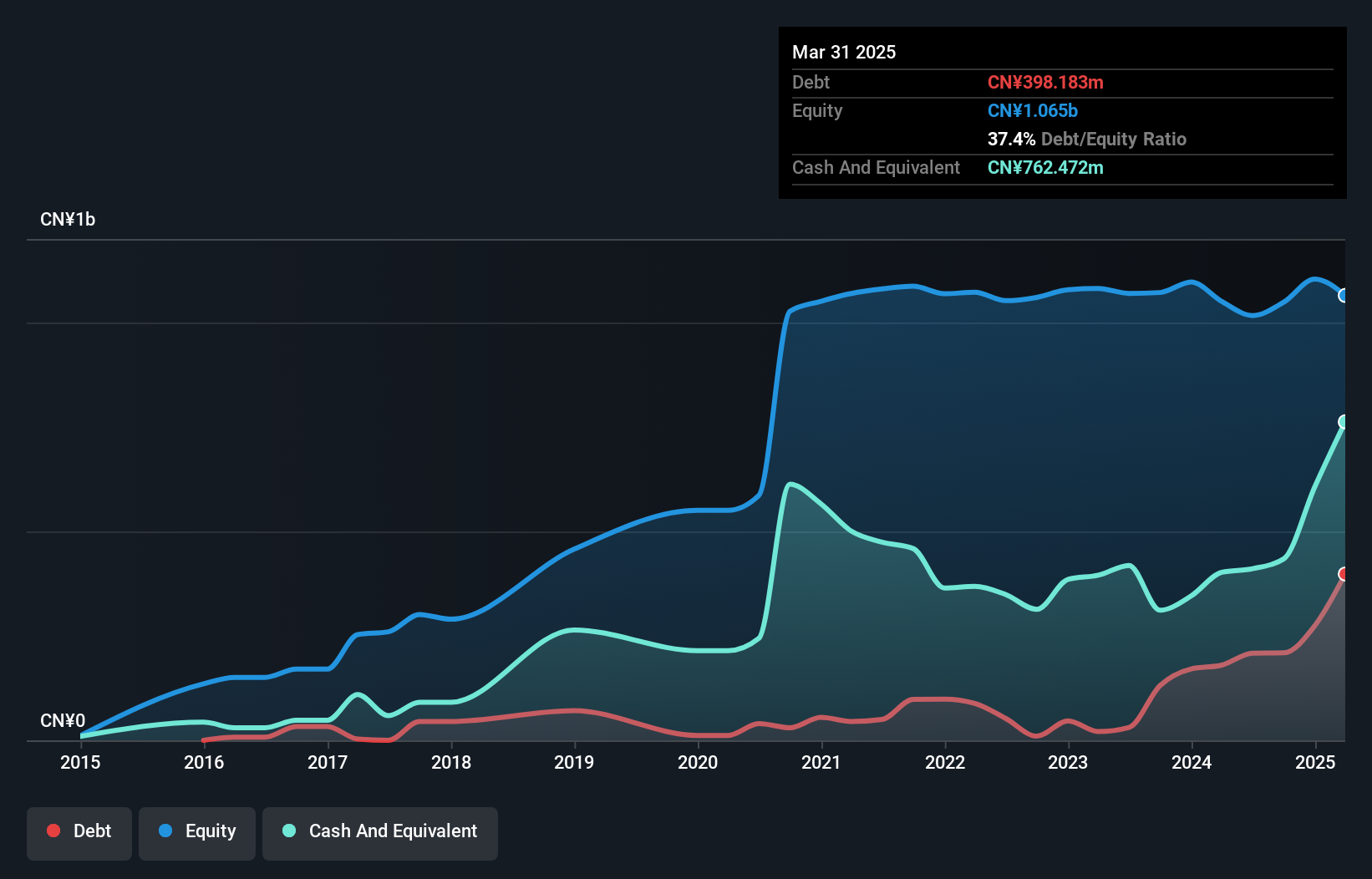

Guangzhou Ruoyuchen Technology, a smaller player in the tech scene, has shown impressive financial performance. Earnings surged by 99.6% last year, outpacing the consumer retailing sector's -8.6%. Despite a volatile share price recently, the company remains free cash flow positive and holds more cash than its total debt, ensuring financial stability. A recent dividend hike to CNY 5 per 10 shares reflects confidence in future growth. The firm also repurchased 292,100 shares for CNY 9.42 million earlier this year, indicating proactive capital management strategies amidst robust earnings growth projections of nearly 30% annually.

- Click here to discover the nuances of Guangzhou Ruoyuchen TechnologyLtd with our detailed analytical health report.

Understand Guangzhou Ruoyuchen TechnologyLtd's track record by examining our Past report.

Taking Advantage

- Unlock our comprehensive list of 2621 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A483650

d'Alba Global

Engages in the manufacturing and sale of perfumes and cosmetic products in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives