- South Korea

- /

- Personal Products

- /

- KOSE:A090430

Some Confidence Is Lacking In Amorepacific Corporation's (KRX:090430) P/E

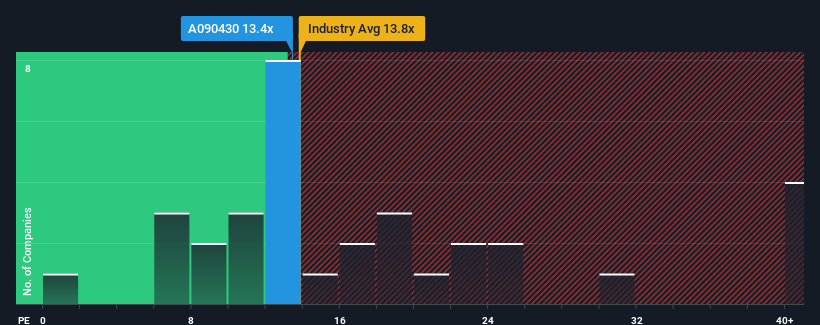

There wouldn't be many who think Amorepacific Corporation's (KRX:090430) price-to-earnings (or "P/E") ratio of 13.4x is worth a mention when the median P/E in Korea is similar at about 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Our free stock report includes 1 warning sign investors should be aware of before investing in Amorepacific. Read for free now.With earnings growth that's superior to most other companies of late, Amorepacific has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Amorepacific

How Is Amorepacific's Growth Trending?

In order to justify its P/E ratio, Amorepacific would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 230% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 205% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 5.8% per annum as estimated by the analysts watching the company. Meanwhile, the broader market is forecast to expand by 18% each year, which paints a poor picture.

In light of this, it's somewhat alarming that Amorepacific's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Amorepacific currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Amorepacific that we have uncovered.

If you're unsure about the strength of Amorepacific's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A090430

Amorepacific

Researches, develops, manufactures, markets, and sells cosmetics and beauty products worldwide.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives