- South Korea

- /

- Personal Products

- /

- KOSDAQ:A092730

NeoPharm CO., LTD. (KOSDAQ:092730) Stock Rockets 33% As Investors Are Less Pessimistic Than Expected

The NeoPharm CO., LTD. (KOSDAQ:092730) share price has done very well over the last month, posting an excellent gain of 33%. The last 30 days bring the annual gain to a very sharp 42%.

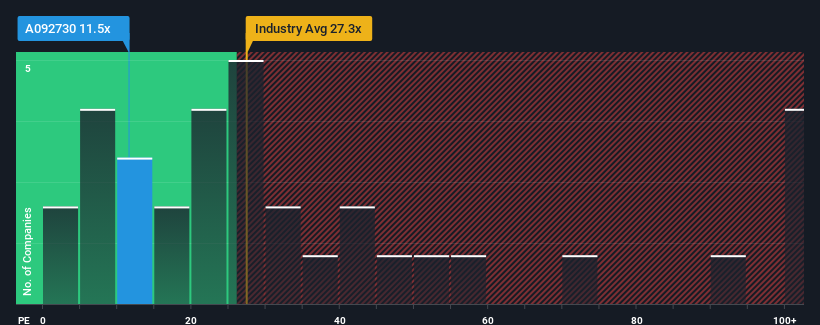

In spite of the firm bounce in price, there still wouldn't be many who think NeoPharm's price-to-earnings (or "P/E") ratio of 11.5x is worth a mention when the median P/E in Korea is similar at about 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

NeoPharm certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for NeoPharm

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like NeoPharm's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. The latest three year period has also seen a 22% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the sole analyst watching the company. With the market predicted to deliver 20% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it interesting that NeoPharm is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

NeoPharm appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of NeoPharm's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for NeoPharm you should be aware of, and 1 of them shouldn't be ignored.

You might be able to find a better investment than NeoPharm. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NeoPharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A092730

NeoPharm

Engages in the manufacturing and sale of skin care products in South Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives