- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A338220

July 2024 Guide To KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the past week, South Korea's market has experienced a 2.4% decline, though it maintains a positive trajectory with a 5.4% increase over the last year and an anticipated annual earnings growth of 30%. In this context, companies with high insider ownership can be particularly compelling as they often indicate strong confidence from those most familiar with the business.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.8% | 58.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Park Systems (KOSDAQ:A140860) | 33% | 36.3% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's uncover some gems from our specialized screener.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc., a global manufacturer and seller of molecular diagnostics products, has a market capitalization of approximately ₩998.17 billion.

Operations: The company generates its revenue primarily from the sale of diagnostic kits and equipment, totaling approximately ₩367.27 billion.

Insider Ownership: 35.7%

Seegene, a South Korean biotech firm, has shown fluctuating financial performance with a recent shift from profit to a net loss of KRW 2.08 billion in Q1 2024. Despite this setback, the company is anticipated to return to profitability within three years, outpacing average market growth expectations. Insider ownership remains static without significant buying or selling in recent months. The firm's revenue growth forecast at 13.1% annually exceeds the national average of 10.6%, positioning Seegene favorably among peers for potential growth, though it trails the high-growth benchmark of 20% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Seegene.

- Our valuation report here indicates Seegene may be undervalued.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp., a global company, develops, manufactures, and sells atomic force microscopy (AFM) systems with a market capitalization of approximately ₩1.12 trillion.

Operations: The company primarily generates revenue from its scientific and technical instruments segment, totaling approximately ₩142.98 billion.

Insider Ownership: 33%

Park Systems, a leader in atomic force microscopy, recently unveiled the Park FX200, enhancing large-sample AFM technology. Trading 11.6% below its fair value, the company's revenue is expected to grow at 22.2% annually—double the Korean market rate. With earnings projected to increase by 36.32% per year and a forecasted Return on Equity of 26.2%, Park Systems is poised for significant growth despite lacking recent insider buying activity.

- Unlock comprehensive insights into our analysis of Park Systems stock in this growth report.

- Upon reviewing our latest valuation report, Park Systems' share price might be too optimistic.

Vuno (KOSDAQ:A338220)

Simply Wall St Growth Rating: ★★★★★★

Overview: Vuno Inc. is a South Korean company specializing in the development of medical artificial intelligence (AI) solutions, with a market capitalization of approximately ₩424.98 billion.

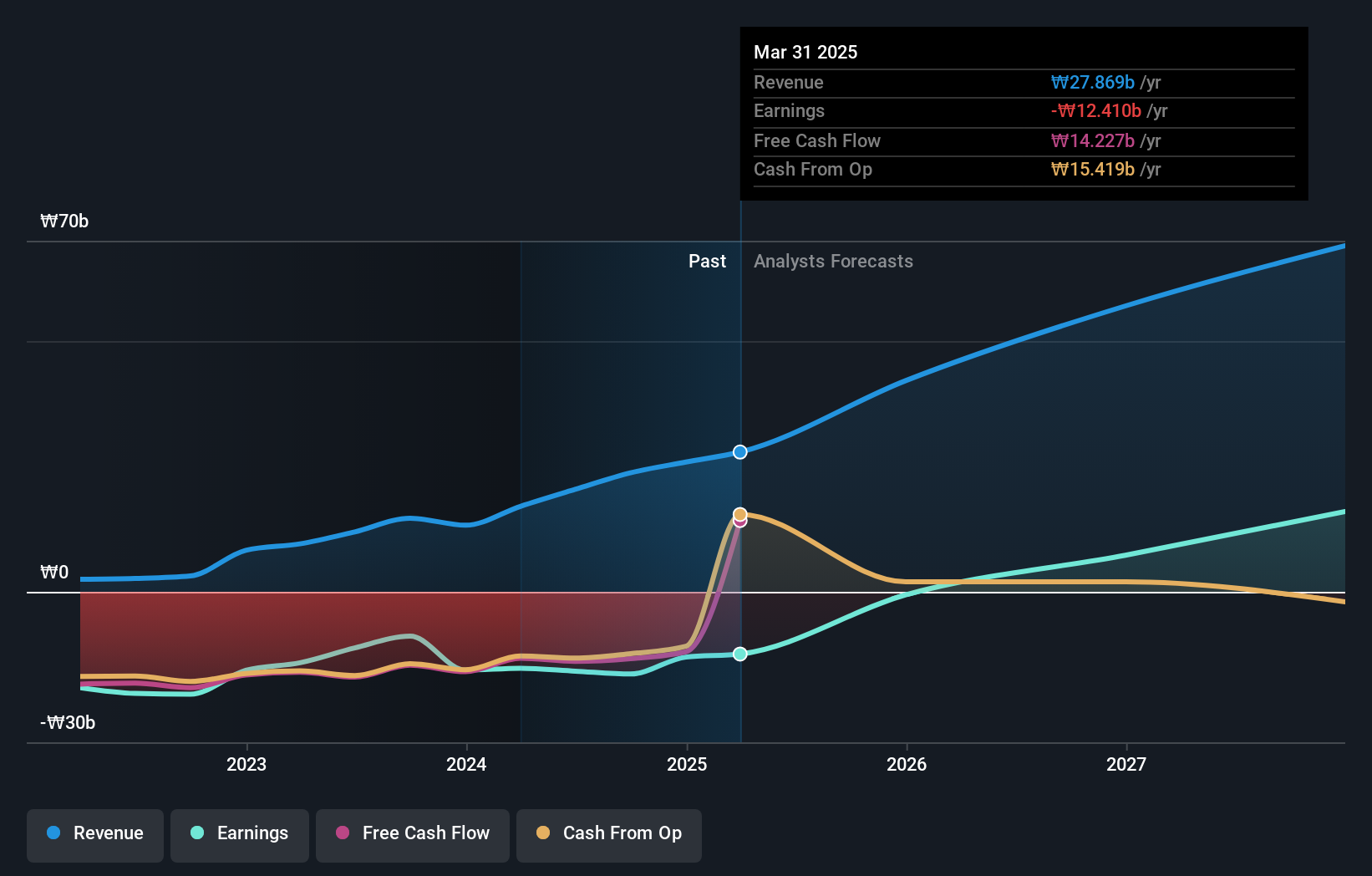

Operations: The company generates revenue primarily from its artificial intelligence medical software production, totaling approximately ₩17.04 billion.

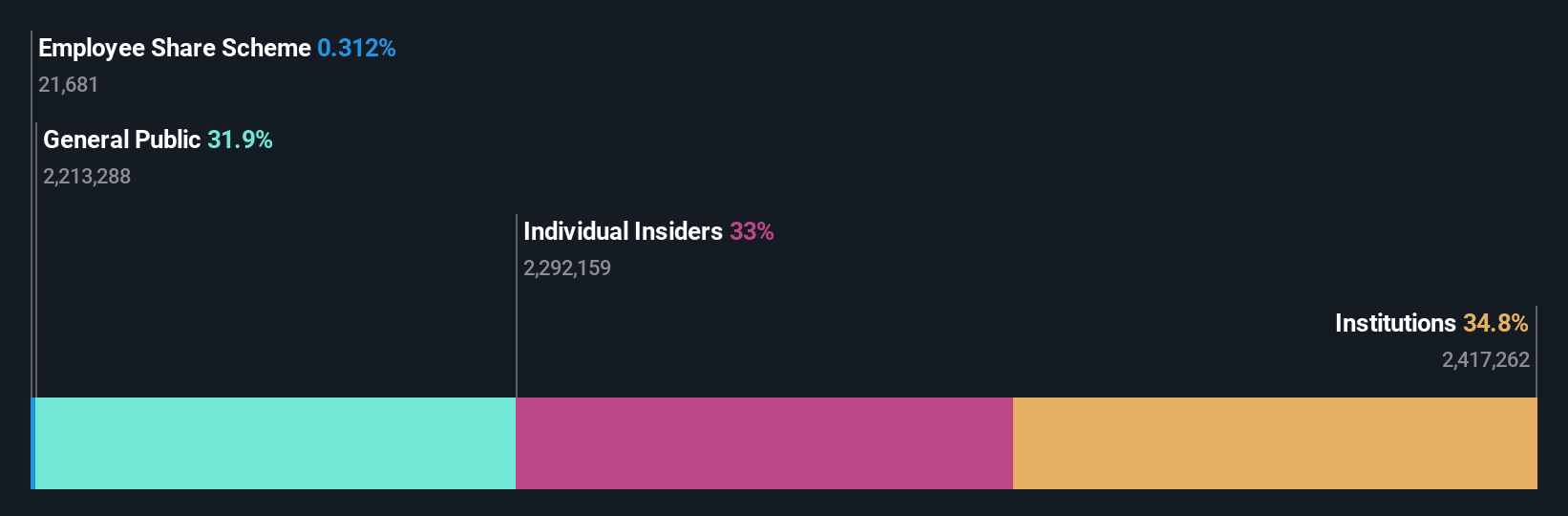

Insider Ownership: 19.5%

Vuno Inc., despite its highly volatile share price over the past three months, is on a trajectory for substantial growth, with revenue expected to increase by 41.4% annually, significantly outpacing the South Korean market's 10.6%. Forecasted to turn profitable within three years, the company's earnings could surge by approximately 105% per year. However, shareholder dilution has occurred in the past year, and there has been no recent insider buying to reinforce confidence in these projections.

- Click to explore a detailed breakdown of our findings in Vuno's earnings growth report.

- Our valuation report unveils the possibility Vuno's shares may be trading at a premium.

Where To Now?

- Delve into our full catalog of 81 Fast Growing KRX Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A338220

Vuno

Operates as a medical artificial intelligence (AI) solution development company.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives