- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A305090

Introducing Micro Digital (KOSDAQ:305090), The Stock That Zoomed 196% In The Last Year

It hasn't been the best quarter for Micro Digital Co., Ltd. (KOSDAQ:305090) shareholders, since the share price has fallen 13% in that time. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 196% in that time. So it may be that the share price is simply cooling off after a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

Check out our latest analysis for Micro Digital

Micro Digital wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Micro Digital saw its revenue shrink by 52%. We're a little surprised to see the share price pop 196% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

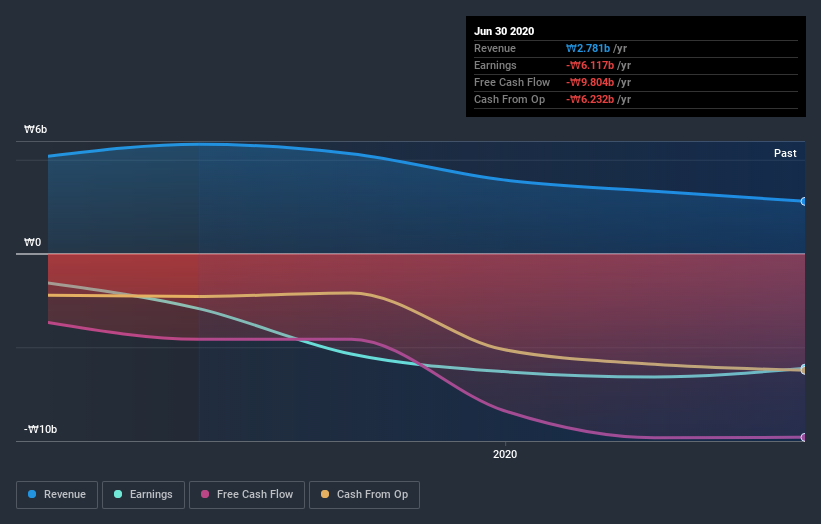

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Micro Digital stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Micro Digital boasts a total shareholder return of 196% for the last year. Unfortunately the share price is down 13% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Micro Digital better, we need to consider many other factors. Even so, be aware that Micro Digital is showing 4 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

We will like Micro Digital better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Micro Digital, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A305090

Micro Digital

Develops biomedicals based on ultra-precision optical technology.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives