- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A290660

NeofectLtd's (KOSDAQ:290660) Stock Price Has Reduced 19% In The Past Year

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Neofect Co.,Ltd (KOSDAQ:290660) have tasted that bitter downside in the last year, as the share price dropped 19%. That's well below the market return of 90%. Because NeofectLtd hasn't been listed for many years, the market is still learning about how the business performs. In the last ninety days we've seen the share price slide 20%.

Check out our latest analysis for NeofectLtd

NeofectLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, NeofectLtd increased its revenue by 60%. That's a strong result which is better than most other loss making companies. The share price drop of 19% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

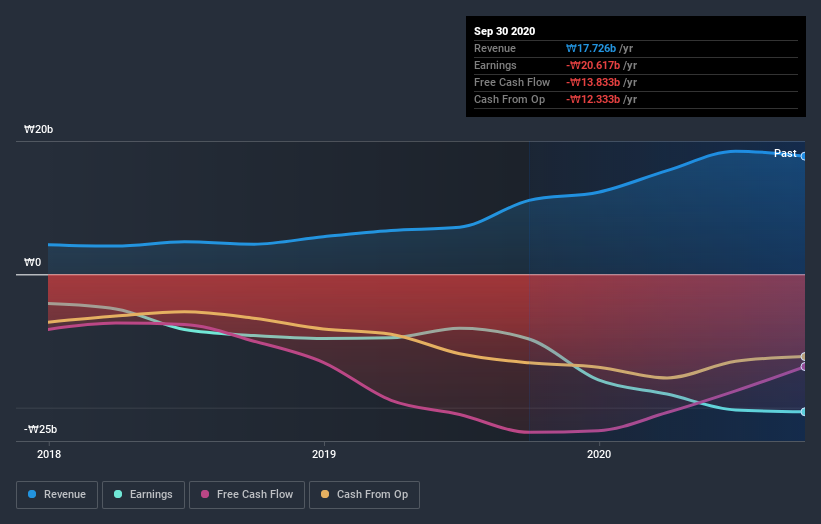

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We've already covered NeofectLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that NeofectLtd's TSR, at -8.3% is higher than its share price return of -19%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While NeofectLtd shareholders are down 8.3% for the year, the market itself is up 90%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 20% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for NeofectLtd you should be aware of, and 2 of them can't be ignored.

Of course NeofectLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading NeofectLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Neofect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A290660

Neofect

Researches, develops, manufactures, and sells rehabilitation medical devices and contents for stroke and spinal cord injuries.

Excellent balance sheet and good value.

Market Insights

Community Narratives