- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A246960

InnoTherapy (KOSDAQ:246960) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, InnoTherapy, Inc. (KOSDAQ:246960) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for InnoTherapy

What Is InnoTherapy's Debt?

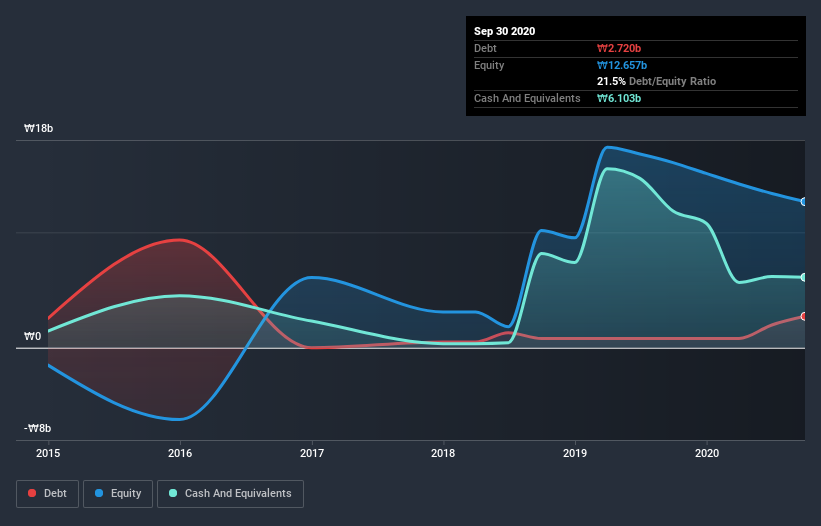

You can click the graphic below for the historical numbers, but it shows that as of September 2020 InnoTherapy had ₩2.72b of debt, an increase on ₩800.0m, over one year. However, its balance sheet shows it holds ₩6.10b in cash, so it actually has ₩3.38b net cash.

How Strong Is InnoTherapy's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that InnoTherapy had liabilities of ₩662.4m due within 12 months and liabilities of ₩3.49b due beyond that. Offsetting these obligations, it had cash of ₩6.10b as well as receivables valued at ₩261.7m due within 12 months. So it actually has ₩2.21b more liquid assets than total liabilities.

This short term liquidity is a sign that InnoTherapy could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that InnoTherapy has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is InnoTherapy's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year InnoTherapy had a loss before interest and tax, and actually shrunk its revenue by 7.6%, to ₩657m. We would much prefer see growth.

So How Risky Is InnoTherapy?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that InnoTherapy had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of ₩3.3b and booked a ₩3.8b accounting loss. But at least it has ₩3.38b on the balance sheet to spend on growth, near-term. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with InnoTherapy (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade InnoTherapy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A246960

SCL Science

Produces medical hemostatic agents using biomimetic technology.

Low risk with worrying balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026