- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

KRX Stocks Estimated To Be Undervalued For August 2024

Reviewed by Simply Wall St

The South Korean market has shown resilience, with the Financials sector gaining 5.6% while the overall market remained flat last week and up 4.1% over the past year. With earnings forecasted to grow by 29% annually, identifying undervalued stocks can offer significant opportunities for investors seeking to capitalize on this growth potential in August 2024.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Samwha ElectricLtd (KOSE:A009470) | ₩47500.00 | ₩92470.64 | 48.6% |

| APR (KOSE:A278470) | ₩264500.00 | ₩506642.40 | 47.8% |

| Neosem (KOSDAQ:A253590) | ₩10050.00 | ₩17868.38 | 43.8% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩28100.00 | ₩50146.08 | 44% |

| Global Tax Free (KOSDAQ:A204620) | ₩3695.00 | ₩6982.04 | 47.1% |

| TOVISLtd (KOSDAQ:A051360) | ₩19420.00 | ₩38635.94 | 49.7% |

| Wonik Ips (KOSDAQ:A240810) | ₩34450.00 | ₩64882.24 | 46.9% |

| Jeisys Medical (KOSDAQ:A287410) | ₩12840.00 | ₩23765.52 | 46% |

| Hanall Biopharma (KOSE:A009420) | ₩36600.00 | ₩70271.91 | 47.9% |

| ABCO Electronics (KOSDAQ:A036010) | ₩6010.00 | ₩11474.05 | 47.6% |

Let's review some notable picks from our screened stocks.

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.35 billion.

Operations: The company generates revenue of ₩204.37 million from its Surgical & Medical Equipment segment.

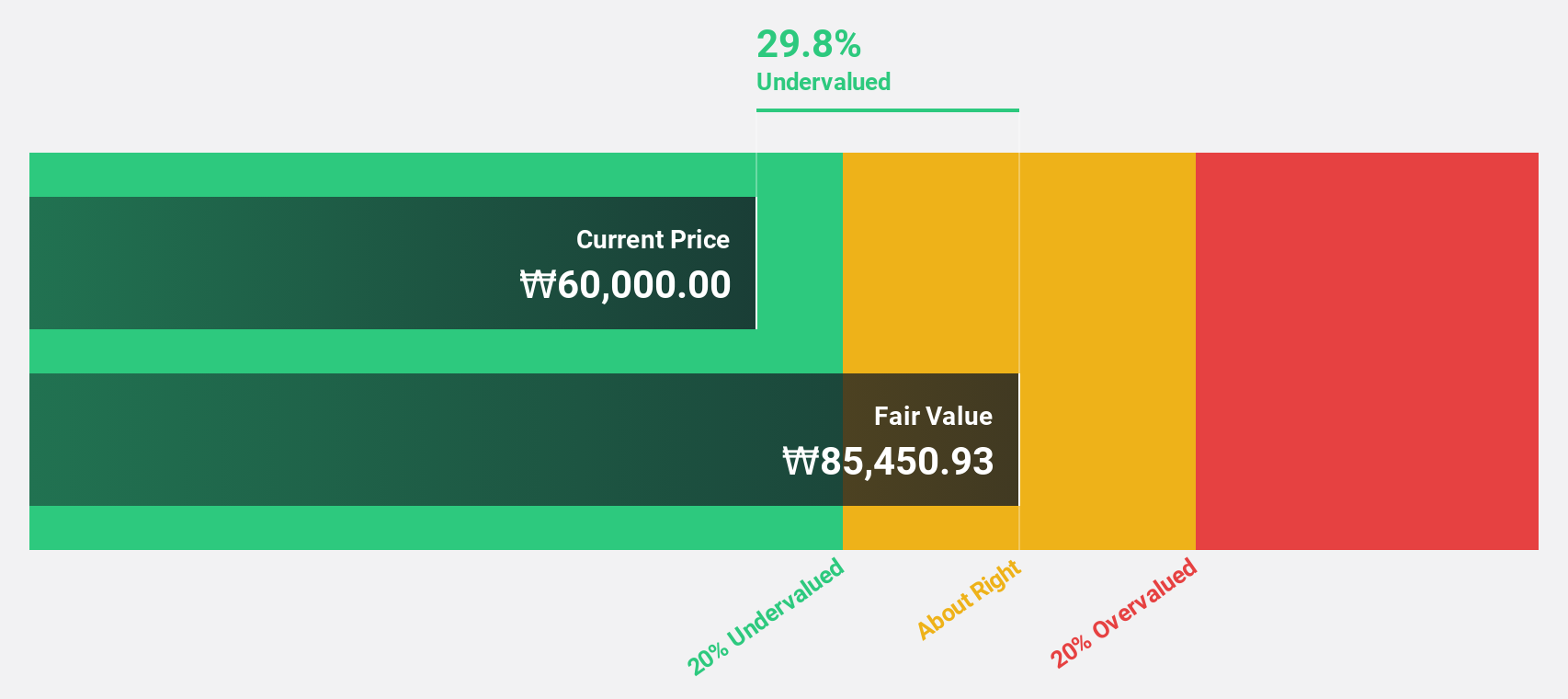

Estimated Discount To Fair Value: 18.9%

CLASSYS is trading at ₩52,400, which is 18.9% below its estimated fair value of ₩64,578.02. Despite a modest earnings growth of 4% over the past year, its revenue is forecast to grow at 19.3% per year, outpacing the South Korean market's average of 10.7%. Earnings are expected to grow significantly by 22.5% annually over the next three years, with a high return on equity projected at 28.1%.

- Our earnings growth report unveils the potential for significant increases in CLASSYS' future results.

- Click here to discover the nuances of CLASSYS with our detailed financial health report.

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products in South Korea and internationally, with a market cap of ₩1.86 trillion.

Operations: Hanall Biopharma generates revenue from the manufacturing and sale of pharmaceutical products both domestically and internationally.

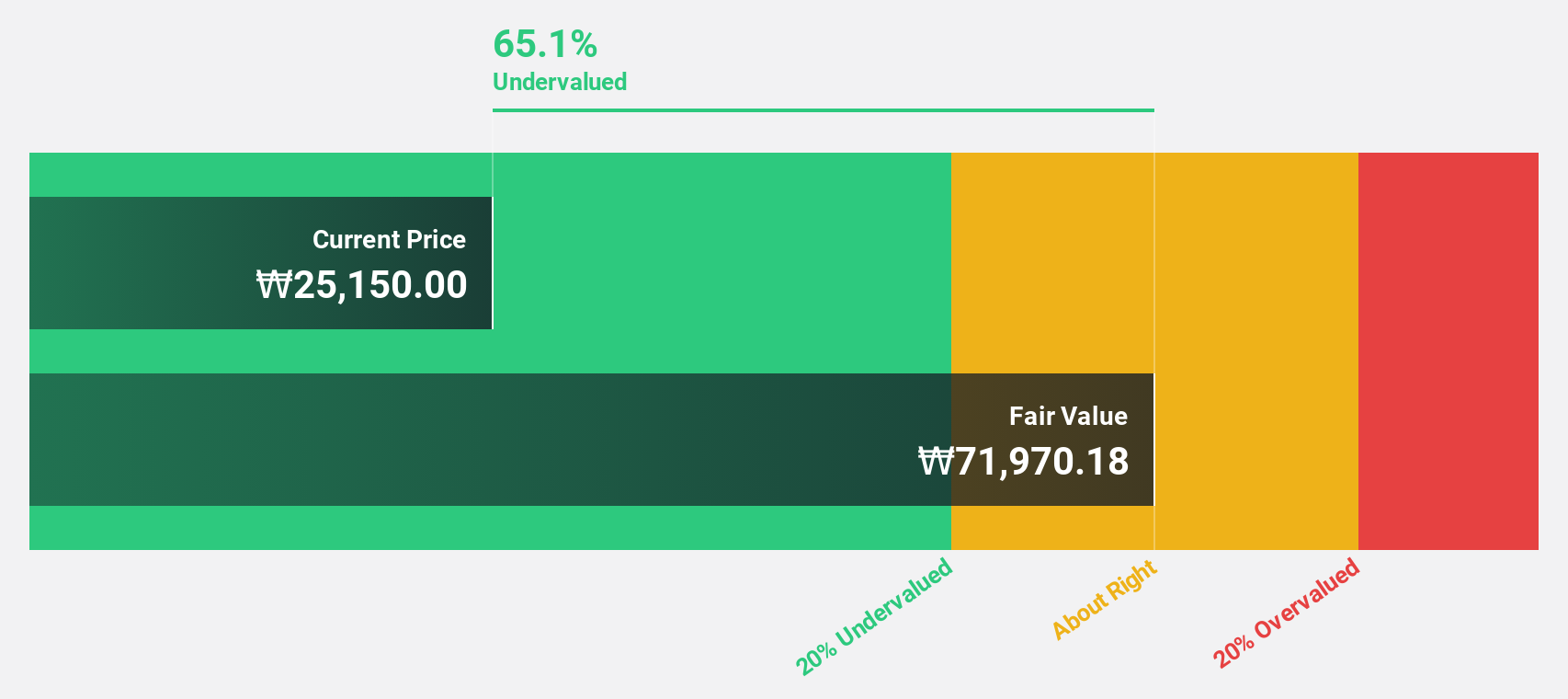

Estimated Discount To Fair Value: 47.9%

Hanall Biopharma is trading at ₩36,600, significantly below its estimated fair value of ₩70,271.91. Despite recent financial setbacks with a net loss of KRW 3.65 billion for the first half of 2024 and declining sales, the company is forecast to become profitable within three years with an annual earnings growth rate of 109.74%. Revenue is expected to grow by 16.4% per year, outpacing the South Korean market average and indicating potential undervaluation based on cash flows.

- According our earnings growth report, there's an indication that Hanall Biopharma might be ready to expand.

- Take a closer look at Hanall Biopharma's balance sheet health here in our report.

HYBE (KOSE:A352820)

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.36 trillion.

Operations: The company's revenue segments include Label (₩1.28 billion), Platform (₩361.12 million), and Solution (₩1.24 billion).

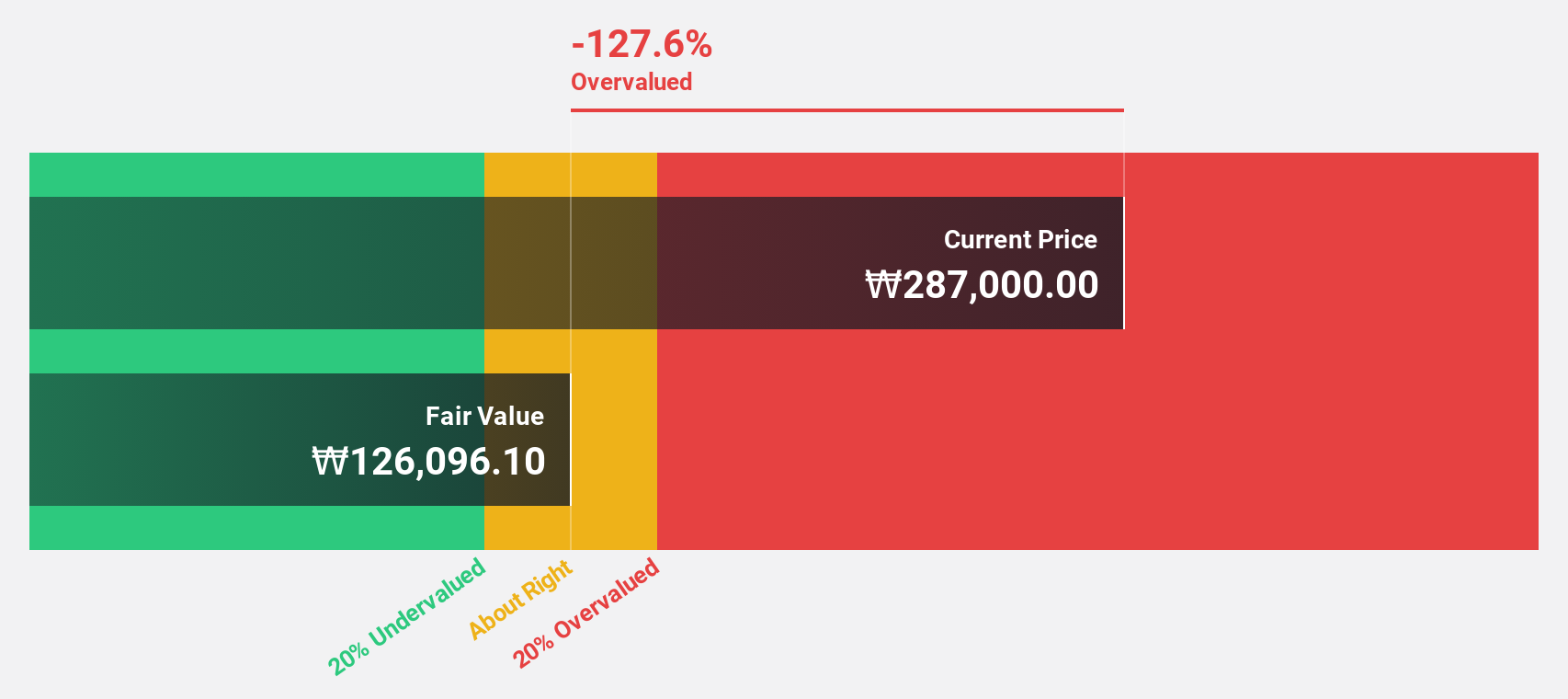

Estimated Discount To Fair Value: 22.5%

HYBE, trading at ₩176,600, is undervalued with an estimated fair value of ₩227,812.47. Despite recent earnings showing a significant drop in net income to KRW 14.59 billion for Q2 2024 from KRW 117.34 billion a year ago due to large one-off items, the company's earnings are forecast to grow significantly at 42.5% annually over the next three years, outpacing the South Korean market average and suggesting strong future cash flows.

- Insights from our recent growth report point to a promising forecast for HYBE's business outlook.

- Get an in-depth perspective on HYBE's balance sheet by reading our health report here.

Where To Now?

- Click through to start exploring the rest of the 28 Undervalued KRX Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Excellent balance sheet with reasonable growth potential.