- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A248070

Top 3 High Insider Ownership Growth Stocks On KRX In August 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, though it is up 4.1% over the past year with earnings forecasted to grow by 29% annually. In such a promising environment, identifying growth companies with high insider ownership can be particularly advantageous as it often indicates confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 21.4% | 78.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 114.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 37.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 97.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

We'll examine a selection from our screener results.

Openedges Technology (KOSDAQ:A394280)

Simply Wall St Growth Rating: ★★★★★★

Overview: Openedges Technology, Inc. develops AI computing IP solutions and memory systems in South Korea and has a market cap of ₩339.02 billion.

Operations: The company's revenue segment primarily consists of Software & Programming, generating ₩21.02 billion.

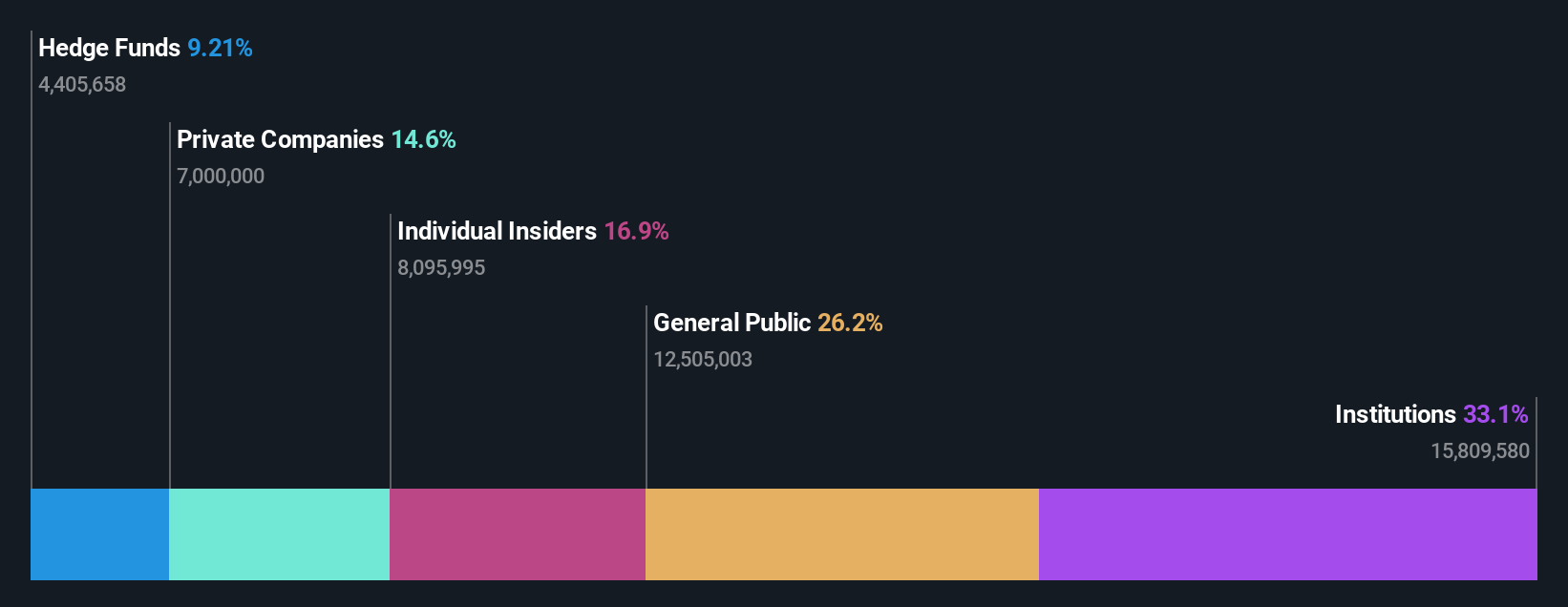

Insider Ownership: 30.8%

Earnings Growth Forecast: 109.0% p.a.

Openedges Technology is forecast to achieve substantial revenue growth of 53.6% per year, significantly outpacing the South Korean market's average of 10.7%. The company is expected to become profitable within three years, with a very high return on equity projected at 49.3%. Despite recent shareholder dilution and high share price volatility, Openedges recently completed a private placement raising KRW 59.99 billion, indicating strong investor interest and support for its growth trajectory.

- Navigate through the intricacies of Openedges Technology with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Openedges Technology is trading beyond its estimated value.

Jahwa Electronics (KOSE:A033240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jahwa Electronics Co., Ltd manufactures and sells precision electronic components in South Korea and internationally, with a market cap of ₩445.94 billion.

Operations: The company generates revenue primarily from the manufacturing and sales of mobile phone parts and other electronic components, totaling ₩592 billion.

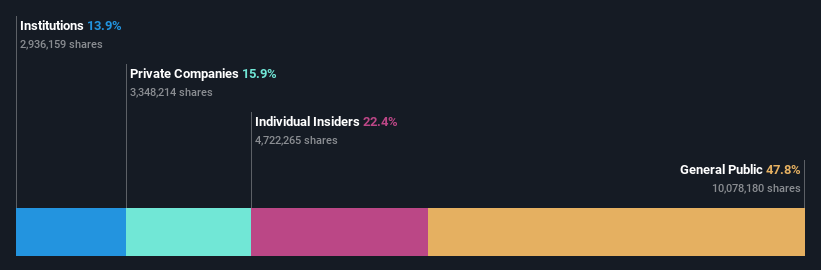

Insider Ownership: 22.4%

Earnings Growth Forecast: 49% p.a.

Jahwa Electronics is forecasted to achieve significant earnings growth of 49% per year, surpassing the South Korean market's average of 28.8%. While the company's revenue is expected to grow at a slower pace of 16.7% annually, it still outpaces the broader market's growth rate. Despite becoming profitable this year and trading at good value compared to peers, Jahwa faces challenges with interest payments not being well covered by earnings.

- Click to explore a detailed breakdown of our findings in Jahwa Electronics' earnings growth report.

- Our expertly prepared valuation report Jahwa Electronics implies its share price may be lower than expected.

Solum (KOSE:A248070)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solum Co., Ltd. manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally, with a market cap of ₩930.35 billion.

Operations: Solum's revenue segments include power modules, digital tuners, and electronic shelf labels.

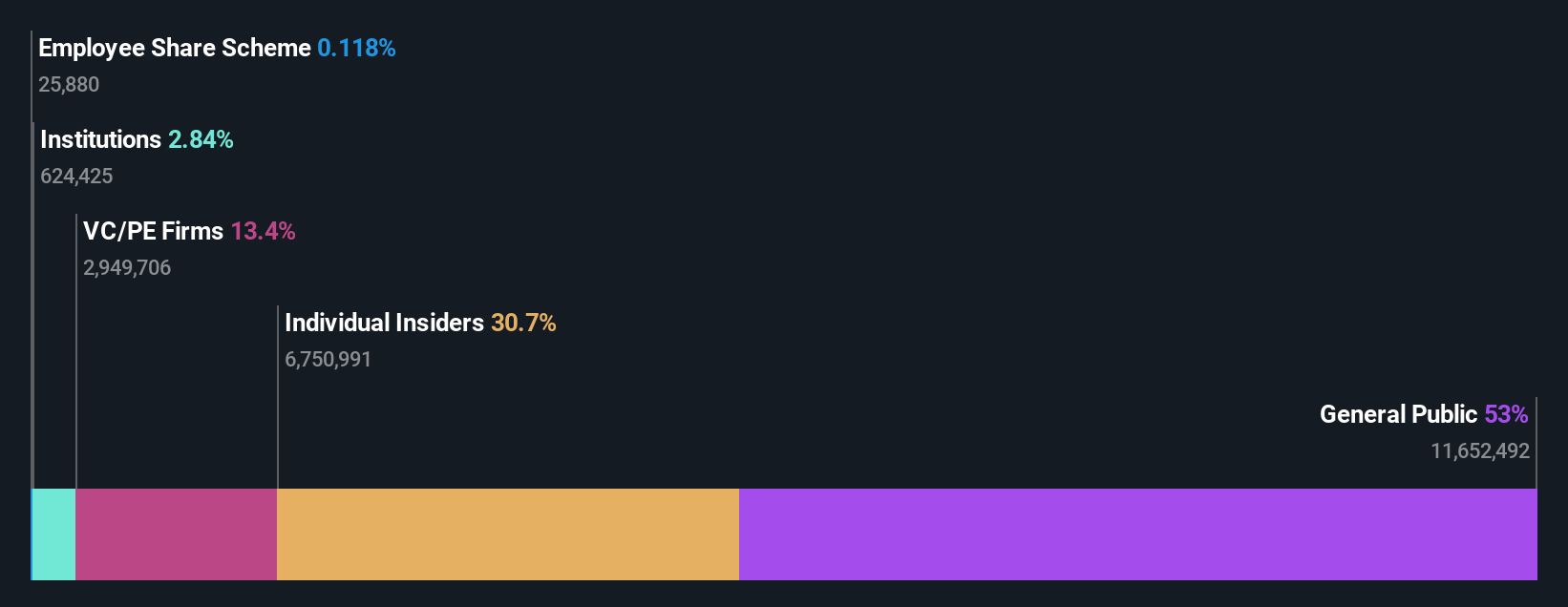

Insider Ownership: 16.3%

Earnings Growth Forecast: 36.2% p.a.

Solum Co., Ltd. is expected to see its revenue grow at 14.3% per year, outpacing the South Korean market's 10.7% growth rate, although it falls short of the 20% threshold for high growth. Earnings are forecasted to rise significantly at 36.2% annually, well above market averages. Despite trading at a substantial discount to fair value and having a high debt level, analysts predict a potential stock price increase of over 100%. Recent buyback plans aim to stabilize stock prices and enhance shareholder value through repurchasing up to KRW 20 billion in shares by August 2025.

- Unlock comprehensive insights into our analysis of Solum stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Solum shares in the market.

Where To Now?

- Discover the full array of 92 Fast Growing KRX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A248070

Solum

Manufactures and markets power modules, digital tuners, and electronic shelf labels to customers in South Korea and internationally.

Undervalued with high growth potential.