Stock Analysis

- South Korea

- /

- Industrials

- /

- KOSE:A000150

KRX Growth Companies With Insider Ownership Above 10%

Reviewed by Simply Wall St

The South Korean market has shown promising growth, rising 2.4% over the past week and achieving a 4.4% increase over the last year, with earnings expected to grow by 29% annually. In such a flourishing environment, stocks with high insider ownership can be particularly appealing as they often indicate that company leaders have a vested interest in the business's success.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's review some notable picks from our screened stocks.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology firm specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.26 trillion.

Operations: The company generates revenue through the development of enhanced biologics, targeted cancer therapies, and similar antibody products.

Insider Ownership: 26.6%

ALTEOGEN, a South Korean biotech firm, showcases robust growth prospects with expected annual revenue and earnings growth surpassing the market average at 48.3% and 73.1%, respectively. Despite recent share price volatility and shareholder dilution over the past year, its forecasted Return on Equity is very high at 45.2%. The company's valuation stands significantly below estimated fair value, suggesting potential upside. Recent activities include presenting at the Macquarie Asia Conference in May 2024.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- Our valuation report here indicates ALTEOGEN may be overvalued.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. specializes in providing medical aesthetics devices globally, with a market capitalization of approximately ₩3.48 billion.

Operations: The company specializes in the global provision of medical aesthetics devices, achieving a market capitalization of approximately ₩3.48 billion.

Insider Ownership: 10.1%

CLASSYS, a South Korean growth company with high insider ownership, has demonstrated solid performance with earnings and revenue growth forecasted at 22.18% and 21.3% per year respectively. Despite earnings growth trailing the broader Korean market, its Return on Equity is expected to be strong at 28%. The firm's active participation in numerous industry conferences highlights its commitment to visibility and expansion in the sector. However, it faces challenges with a highly volatile share price over recent months.

- Take a closer look at CLASSYS' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that CLASSYS is priced higher than what may be justified by its financials.

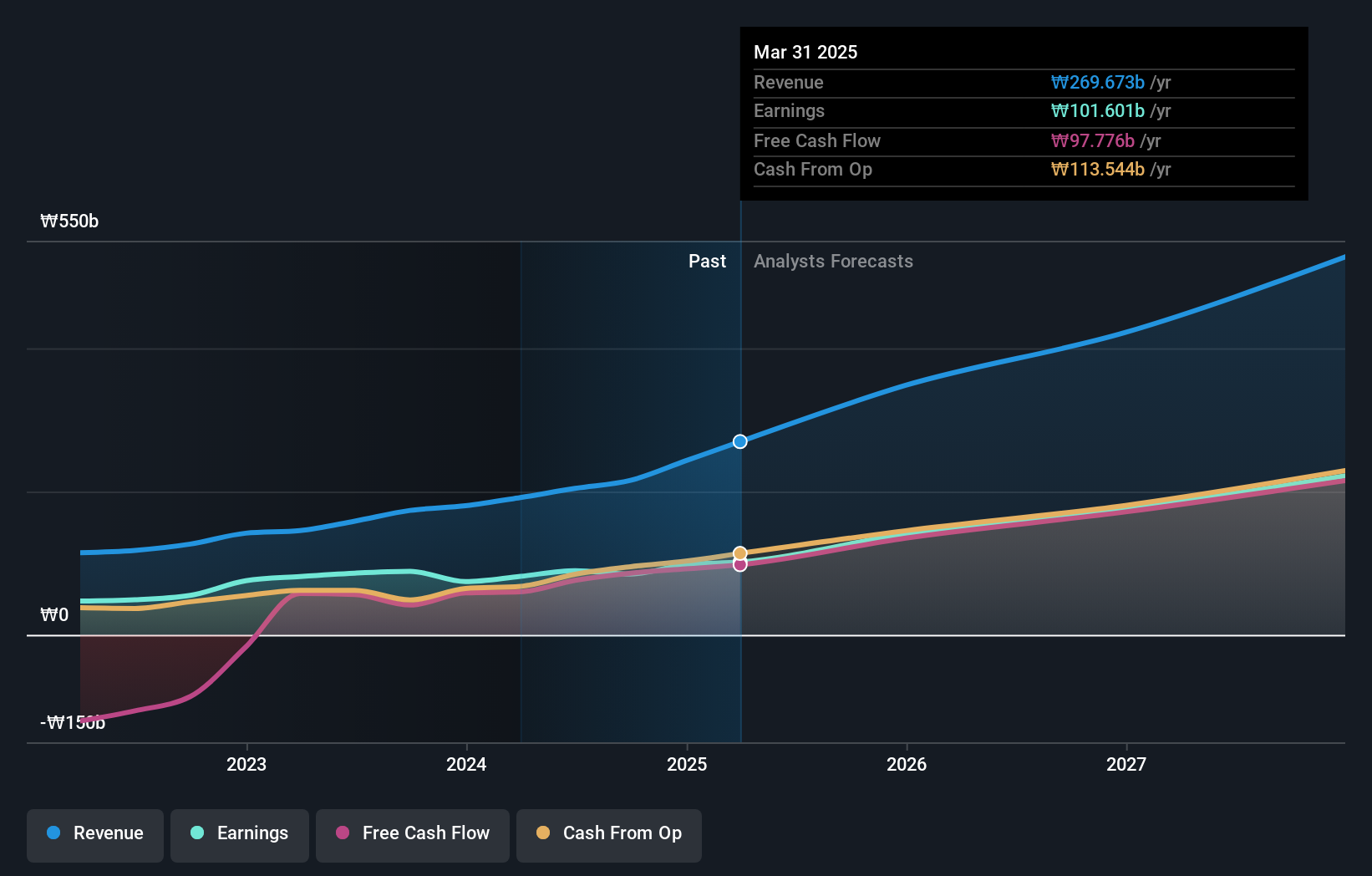

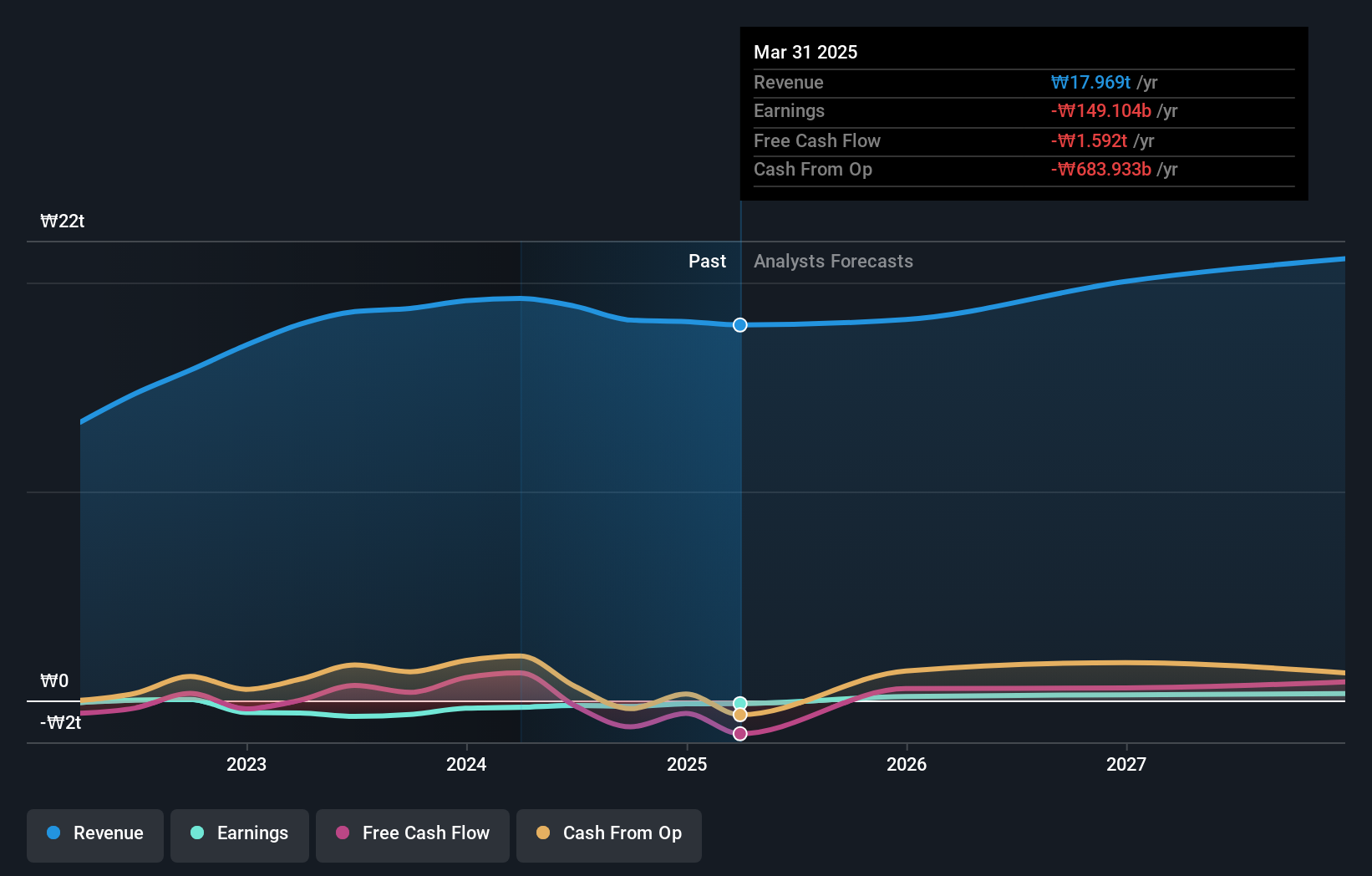

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.54 trillion.

Operations: The company's revenue is derived from heavy industry, machinery manufacturing, and apartment construction across various global regions.

Insider Ownership: 34.3%

Doosan Corporation, a South Korean company with high insider ownership, has shown significant recovery with its first-quarter sales reaching KRW 180.97 billion, up from KRW 169.05 billion year-over-year. The firm reversed a substantial net loss to a profit of KRW 4.98 billion in the same period. Despite this turnaround, revenue growth is expected to lag behind the broader market at 3.6% annually compared to the market's 10.4%. Additionally, while forecasted to become profitable within three years and expected earnings growth is strong at an annual rate of 72.89%, Doosan's share price remains highly volatile and it trades well below its estimated fair value by 55.8%.

- Click to explore a detailed breakdown of our findings in Doosan's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Doosan shares in the market.

Make It Happen

- Click through to start exploring the rest of the 79 Fast Growing KRX Companies With High Insider Ownership now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Doosan is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000150

Doosan

Engages in the heavy industry, machinery manufacturing, and apartment construction businesses in South Korea, the United States, rest of Asia, the Middle East, Europe, and internationally.

Flawless balance sheet and good value.