Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

KRX Growth Companies With High Insider Ownership And Up To 118% Earnings Growth

Reviewed by Simply Wall St

The South Korean market has shown promising growth, climbing 2.0% in the past week and 6.7% over the last year, with earnings expected to grow by 29% annually. In such a flourishing environment, companies with high insider ownership can be particularly compelling as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25.1% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We'll examine a selection from our screener results.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. operates in the semiconductor industry, focusing on the development, manufacturing, sale, and servicing of inspection equipment both domestically and internationally, with a market capitalization of approximately ₩1.84 trillion.

Operations: The company's revenue is primarily derived from the development, manufacture, sale, and servicing of semiconductor inspection equipment across domestic and international markets.

Insider Ownership: 18.7%

Earnings Growth Forecast: 118.2% p.a.

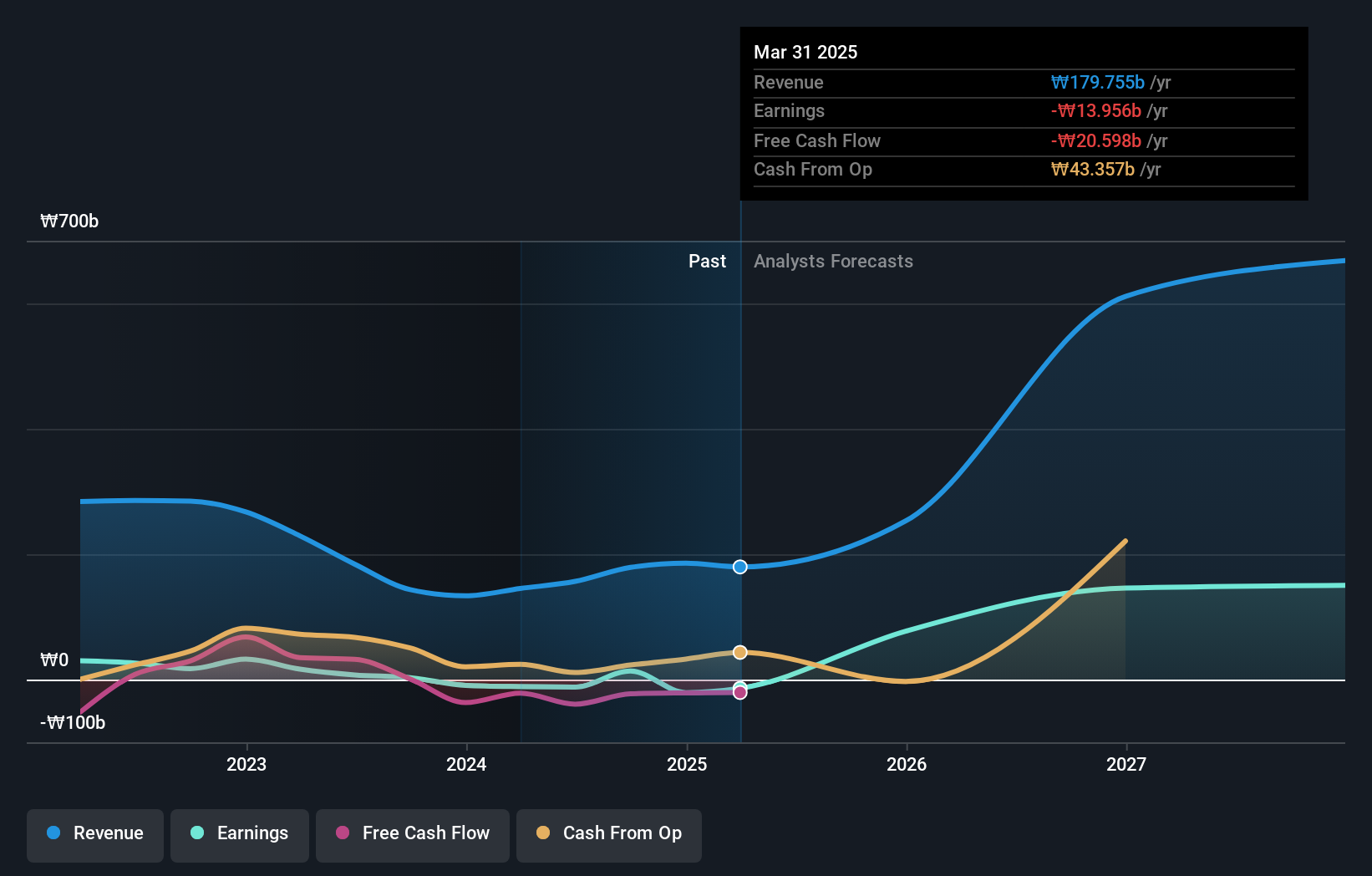

Techwing, poised for significant growth, is expected to become profitable within three years, with earnings projected to increase by 118.23% annually. This growth rate surpasses average market expectations significantly. Additionally, its revenue is anticipated to expand at a rate of 41.3% per year, outpacing the South Korean market's average of 10.5%. However, financial challenges persist as interest payments are not well covered by earnings and the company has experienced high share price volatility recently.

- Navigate through the intricacies of Techwing with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Techwing is priced higher than what may be justified by its financials.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

Overview: Park Systems Corp., a company that develops, manufactures, and sells atomic force microscopy (AFM) systems globally, has a market capitalization of approximately ₩1.33 trillion.

Operations: The firm's primary revenue is generated from the global sales of atomic force microscopy systems.

Insider Ownership: 33.1%

Earnings Growth Forecast: 35.8% p.a.

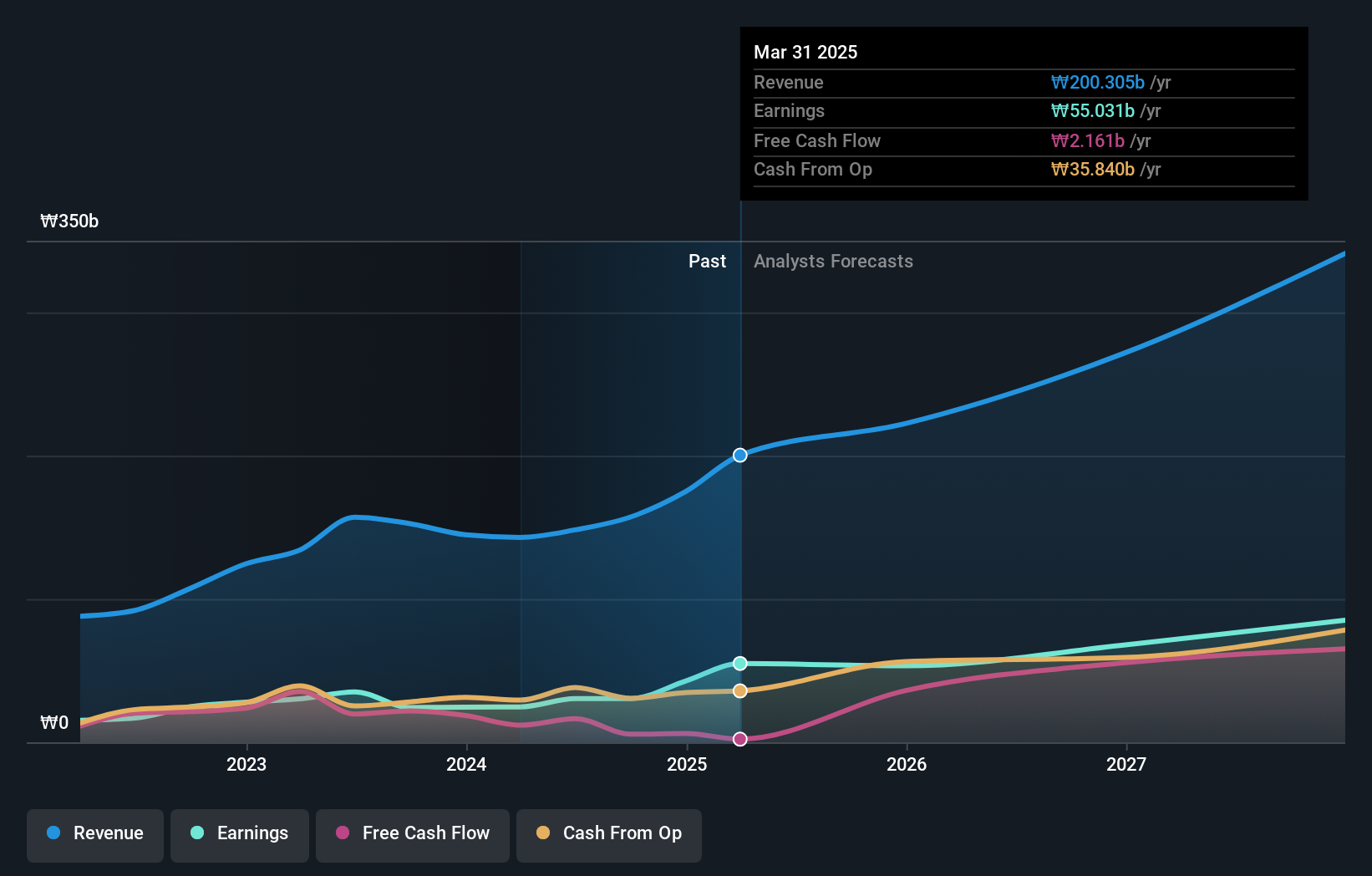

Park Systems is set to outperform the South Korean market with its earnings and revenue growth projected at 35.8% and 22.2% per year respectively, significantly above market averages of 28.9% and 10.5%. Despite no substantial insider buying or selling in the past three months, the company's high forecasted Return on Equity of 25.7% signals strong internal confidence in its financial health moving forward.

- Dive into the specifics of Park Systems here with our thorough growth forecast report.

- The analysis detailed in our Park Systems valuation report hints at an inflated share price compared to its estimated value.

Hana Materials (KOSDAQ:A166090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hana Materials Inc., a company based in South Korea, specializes in manufacturing and selling silicon electrodes and rings, with a market capitalization of approximately ₩1.20 billion.

Operations: The firm specializes in the production and sales of silicon electrodes and rings.

Insider Ownership: 12.5%

Earnings Growth Forecast: 43.8% p.a.

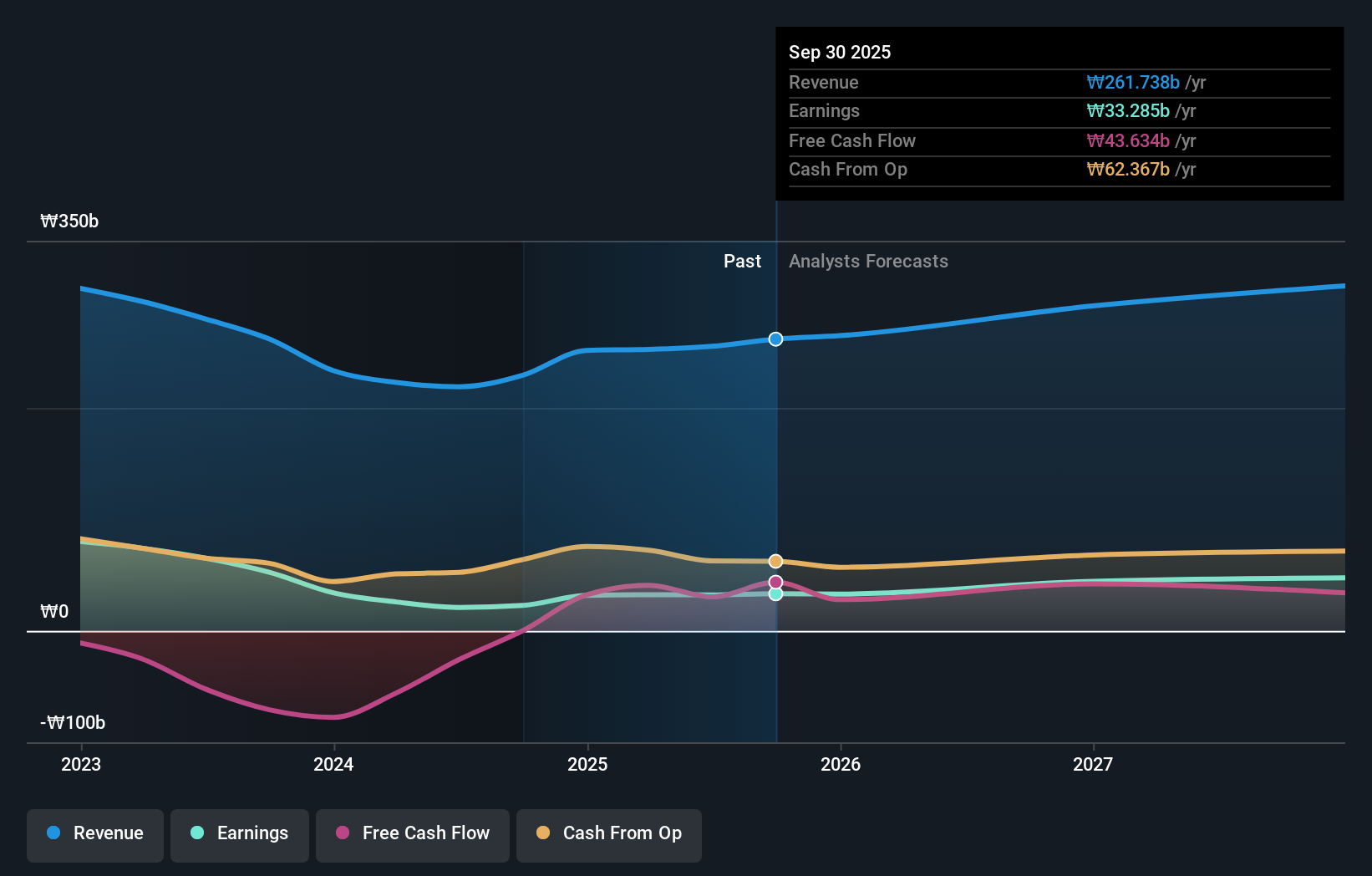

Hana Materials is poised for robust growth with projected annual revenue and earnings increases of 21.7% and 43.75%, respectively, outpacing the South Korean market averages. However, it faces challenges such as a decrease in profit margins from 25.1% to 11.6% and a high level of debt which may raise concerns about its financial health despite no recent insider trading activity to provide additional insights into internal confidence levels.

- Unlock comprehensive insights into our analysis of Hana Materials stock in this growth report.

- According our valuation report, there's an indication that Hana Materials' share price might be on the expensive side.

Where To Now?

- Click here to access our complete index of 82 Fast Growing KRX Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Hana Materials is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

High growth potential with mediocre balance sheet.