- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140860

3 KRX Growth Companies With Up To 33% Insider Ownership

Reviewed by Simply Wall St

The South Korea stock market has moved higher in two straight sessions, advancing more than 125 points or 5 percent in that span. The KOSPI now sits just beneath the 2,570-point plateau although it may be stuck in neutral on Thursday due to mixed global forecasts and lingering concerns about the health of the U.S. economy. In this environment, identifying growth companies with high insider ownership can be a prudent strategy for investors looking for stability and potential upside. Here are three KRX-listed growth companies where insiders hold up to 33% ownership, signaling strong confidence from those closest to the business operations.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 36.4% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 89.7% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.6% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 36.6% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 17.4% | 97.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Park Systems (KOSDAQ:A140860)

Simply Wall St Growth Rating: ★★★★★★

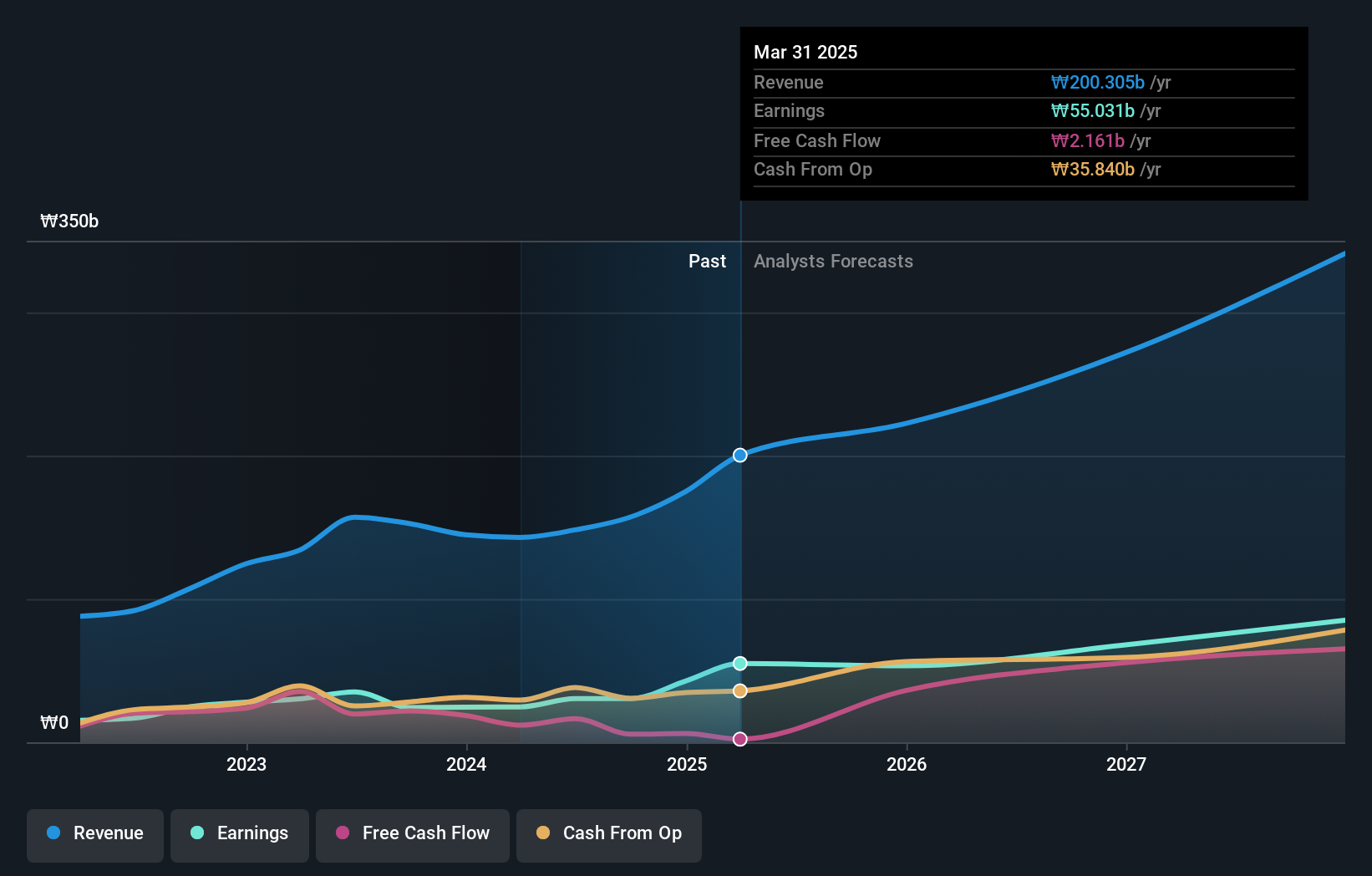

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide with a market cap of ₩1.24 trillion.

Operations: Park Systems Corp.'s revenue from Scientific & Technical Instruments is ₩142.98 billion.

Insider Ownership: 33%

Park Systems, a growth company with high insider ownership in South Korea, is expected to see significant earnings growth of 36.63% annually over the next three years. Analysts forecast its revenue will grow at 22.7% per year, outpacing the broader KR market's 9.9%. Trading at 8.8% below fair value estimates, Park Systems recently launched the FX200 AFM innovation for large samples, enhancing precision and efficiency in research and industrial applications.

- Take a closer look at Park Systems' potential here in our earnings growth report.

- According our valuation report, there's an indication that Park Systems' share price might be on the expensive side.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

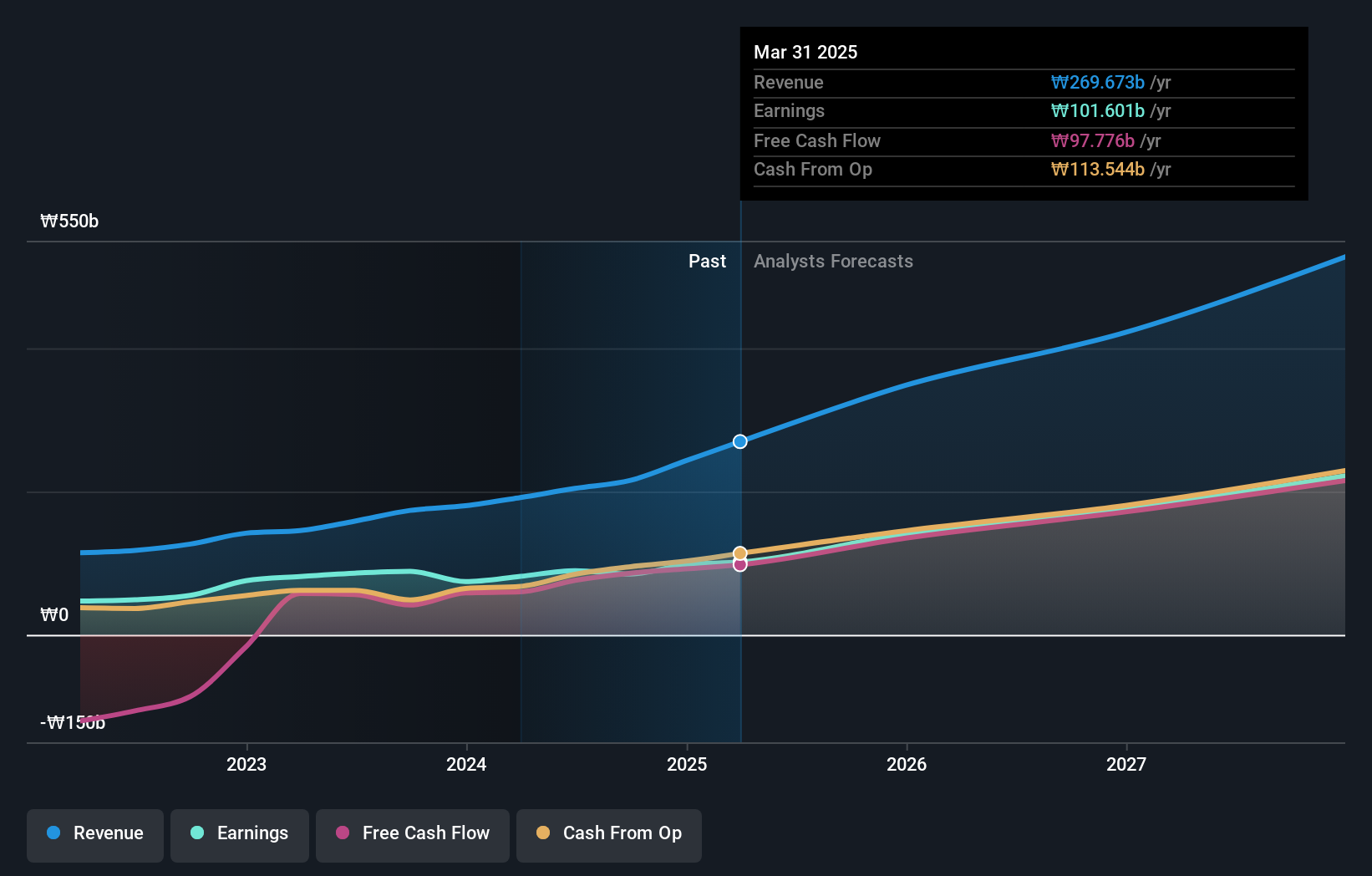

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.28 billion.

Operations: CLASSYS generates revenue primarily from its Surgical & Medical Equipment segment, which amounted to ₩191.53 million.

Insider Ownership: 10.1%

CLASSYS, with substantial insider ownership, is expected to see annual earnings growth of 22.5% over the next three years, slightly below the KR market's 28.1%. Its revenue is forecasted to grow at 21.5% per year, significantly outpacing the broader market's 9.9%. Despite a highly volatile share price recently, CLASSYS has consistently grown its earnings by 25.9% annually over the past five years and boasts a projected return on equity of 28.2%.

- Click to explore a detailed breakdown of our findings in CLASSYS' earnings growth report.

- Upon reviewing our latest valuation report, CLASSYS' share price might be too optimistic.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

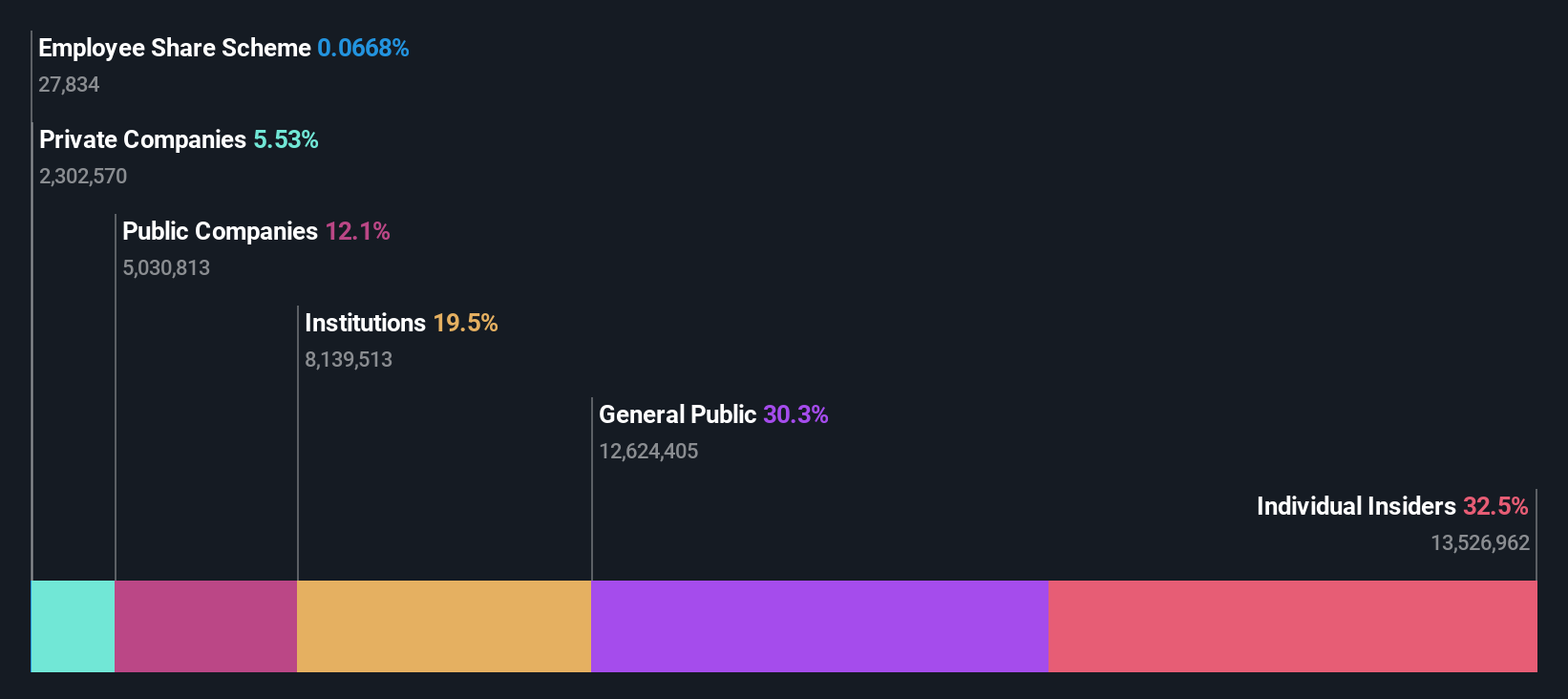

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩7.56 trillion.

Operations: HYBE's revenue segments include music production at ₩1.25 billion, publishing at ₩850 million, and artist development and management at ₩2.75 billion.

Insider Ownership: 32.5%

HYBE, with significant insider ownership, is forecasted to grow earnings by 29.6% annually, outpacing the KR market's 28.1%. Despite a Q1 revenue drop to KRW 86.49 million from KRW 172.75 million and net income decline to KRW 17.23 billion from KRW 24.29 billion year-over-year, its stock trades at nearly 30% below fair value estimates. Analysts agree on a potential price rise of around 47%, indicating strong growth prospects despite recent revenue challenges.

- Click here and access our complete growth analysis report to understand the dynamics of HYBE.

- Insights from our recent valuation report point to the potential undervaluation of HYBE shares in the market.

Where To Now?

- Embark on your investment journey to our 85 Fast Growing KRX Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A140860

Park Systems

Develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide.

Exceptional growth potential with excellent balance sheet.