- South Korea

- /

- Machinery

- /

- KOSE:A042660

3 Global Stocks Estimated To Be Undervalued In June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cooling labor markets, trade tensions, and evolving monetary policies, investors are keenly observing the opportunities that arise amidst these fluctuations. With U.S. stocks climbing for the second consecutive week and European indices buoyed by easing inflation and monetary policy shifts, identifying undervalued stocks becomes crucial in capitalizing on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.30 | CN¥76.24 | 49.8% |

| Taiwan Union Technology (TPEX:6274) | NT$213.00 | NT$423.14 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK179.38 | NOK356.89 | 49.7% |

| NHN (KOSE:A181710) | ₩25700.00 | ₩51022.19 | 49.6% |

| Kanto Denka Kogyo (TSE:4047) | ¥852.00 | ¥1689.34 | 49.6% |

| Food & Life Companies (TSE:3563) | ¥6515.00 | ¥13020.98 | 50% |

| Boreo Oyj (HLSE:BOREO) | €14.70 | €29.40 | 50% |

| Airbus (ENXTPA:AIR) | €163.62 | €326.42 | 49.9% |

| adidas (XTRA:ADS) | €209.80 | €414.98 | 49.4% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €37.10 | €73.76 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pure Health Holding PJSC (ADX:PUREHEALTH)

Overview: Pure Health Holding PJSC operates in the healthcare services sector in the United Arab Emirates and has a market cap of AED29.78 billion.

Operations: The company's revenue segments include Diagnostic Services (AED1.09 billion), Technology and Others (AED555.08 million), Health Insurance Services (AED7.13 billion), Hospital and Other Healthcare Related Services (AED19.82 billion), and Procurement and Supply of Medical Related Products (AED5.32 billion).

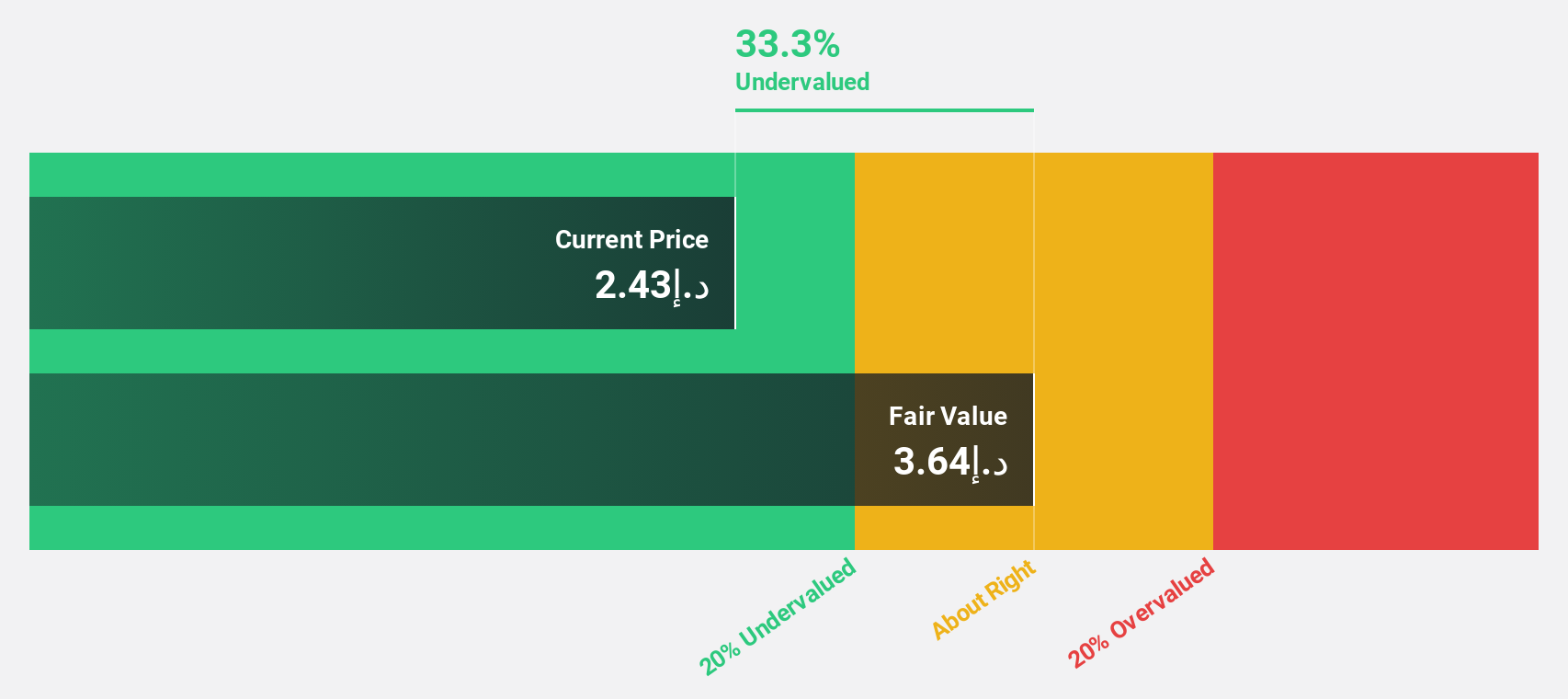

Estimated Discount To Fair Value: 26.4%

Pure Health Holding PJSC is trading at AED2.68, below its estimated fair value of AED3.64, suggesting undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 23.3% per year, outpacing the AE market's 6.1%. Recent Q1 results showed sales of AED6.58 billion and net income of AED503.85 million, reflecting steady growth despite leadership changes in board committees and a modest dividend announcement for shareholders.

- In light of our recent growth report, it seems possible that Pure Health Holding PJSC's financial performance will exceed current levels.

- Navigate through the intricacies of Pure Health Holding PJSC with our comprehensive financial health report here.

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.94 trillion.

Operations: CLASSYS Inc.'s revenue primarily comes from its Surgical & Medical Equipment segment, which generated ₩269.67 billion.

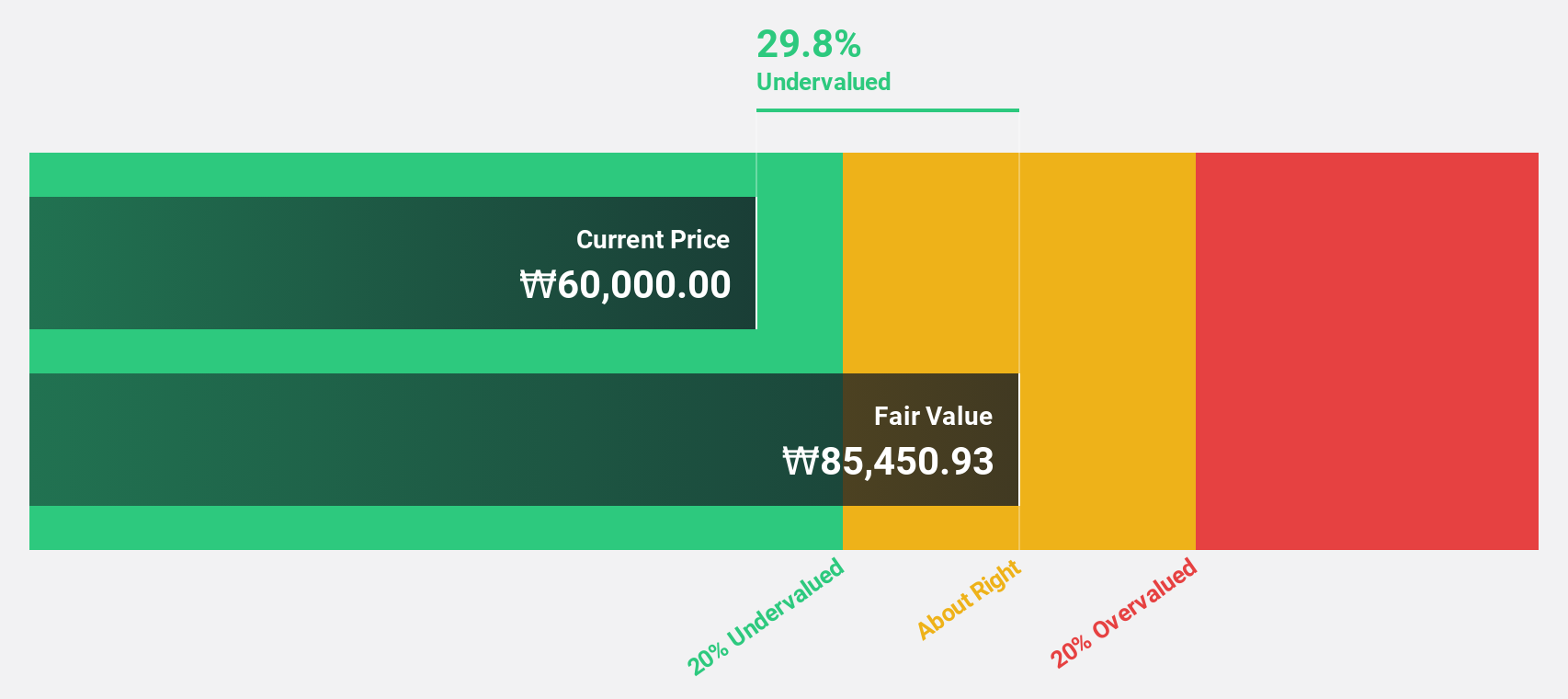

Estimated Discount To Fair Value: 28.0%

CLASSYS is trading at ₩61,400, 28% below its estimated fair value of ₩85,258.77, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 26.6% annually over the next three years, surpassing the KR market average of 20.8%. Recent Q1 results show sales increased to ₩77.1 billion from ₩50.4 billion year-on-year, with net income rising to ₩29.7 billion from ₩26.1 billion, indicating robust financial performance amidst ongoing buyback activities and conference presentations.

- The growth report we've compiled suggests that CLASSYS' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in CLASSYS' balance sheet health report.

Hanwha Ocean (KOSE:A042660)

Overview: Hanwha Ocean Co., Ltd. is a shipbuilding and offshore contractor with operations in South Korea and internationally, holding a market cap of approximately ₩24.33 trillion.

Operations: The company's revenue is primarily derived from its Merchant Ship segment at ₩9.30 trillion and Marine and Special Ship segment at ₩2.26 trillion.

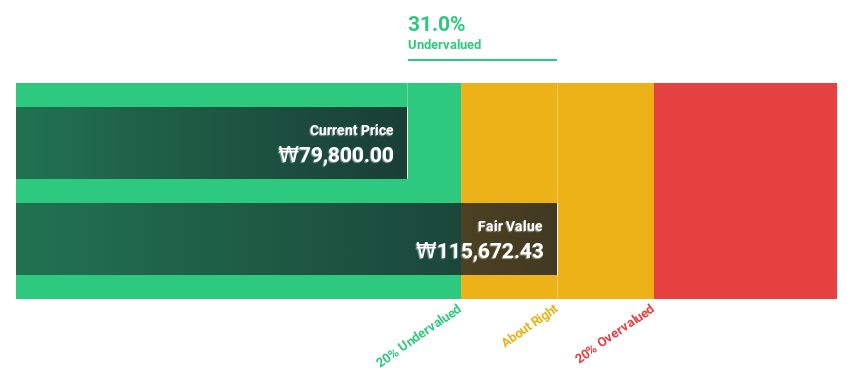

Estimated Discount To Fair Value: 12.1%

Hanwha Ocean, trading at ₩83,000, is 12.1% below its estimated fair value of ₩94,405.98, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly by 22.9% annually over the next three years, outpacing the KR market average of 20.8%. Recent Q1 results showed sales increased to ₩3.14 trillion from ₩2.28 trillion year-on-year with net income rising substantially to ₩215.69 billion from ₩51.03 billion a year ago.

- According our earnings growth report, there's an indication that Hanwha Ocean might be ready to expand.

- Take a closer look at Hanwha Ocean's balance sheet health here in our report.

Seize The Opportunity

- Click here to access our complete index of 503 Undervalued Global Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Ocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A042660

Hanwha Ocean

Operates as a shipbuilding and offshore contractor in South Korea and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives