- South Korea

- /

- Healthcare Services

- /

- KOSDAQ:A085660

If You Had Bought CHA Biotech's (KOSDAQ:085660) Shares Three Years Ago You Would Be Down 52%

CHA Biotech Co., Ltd. (KOSDAQ:085660) shareholders should be happy to see the share price up 19% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 52%. So it is really good to see an improvement. After all, could be that the fall was overdone.

View our latest analysis for CHA Biotech

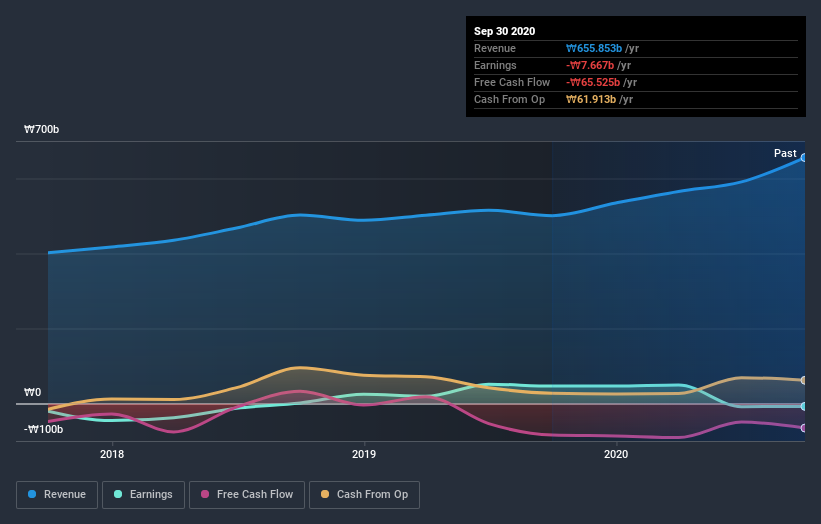

Because CHA Biotech made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, CHA Biotech grew revenue at 14% per year. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 15% per year. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

CHA Biotech shareholders gained a total return of 36% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 5% per year over five year. It is possible that returns will improve along with the business fundamentals. You could get a better understanding of CHA Biotech's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade CHA Biotech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A085660

ChabiotechLtd

A bio company, develops cell and gene therapy related to stem and immune cells in South Korea and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives