- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A065510

Positive Sentiment Still Eludes Huvitz Co., Ltd. (KOSDAQ:065510) Following 25% Share Price Slump

Huvitz Co., Ltd. (KOSDAQ:065510) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 41%, which is great even in a bull market.

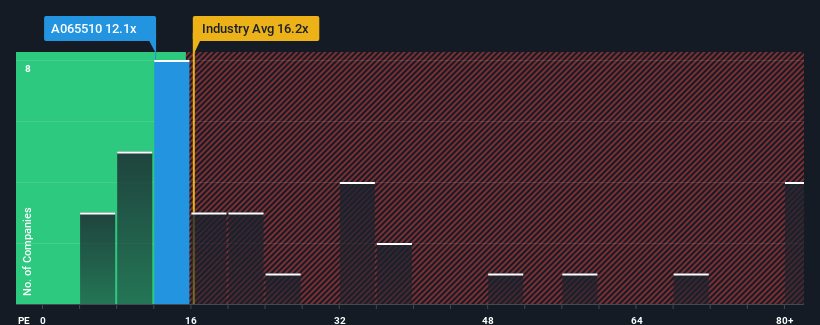

In spite of the heavy fall in price, there still wouldn't be many who think Huvitz's price-to-earnings (or "P/E") ratio of 12.1x is worth a mention when the median P/E in Korea is similar at about 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Huvitz has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Huvitz

How Is Huvitz's Growth Trending?

In order to justify its P/E ratio, Huvitz would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 46% over the next year. Meanwhile, the rest of the market is forecast to only expand by 34%, which is noticeably less attractive.

In light of this, it's curious that Huvitz's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Huvitz's plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Huvitz currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 2 warning signs for Huvitz that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Huvitz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A065510

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success