- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A043100

Investors Don't See Light At End Of Alphanox Co.,Ltd.'s (KOSDAQ:043100) Tunnel And Push Stock Down 27%

Alphanox Co.,Ltd. (KOSDAQ:043100) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

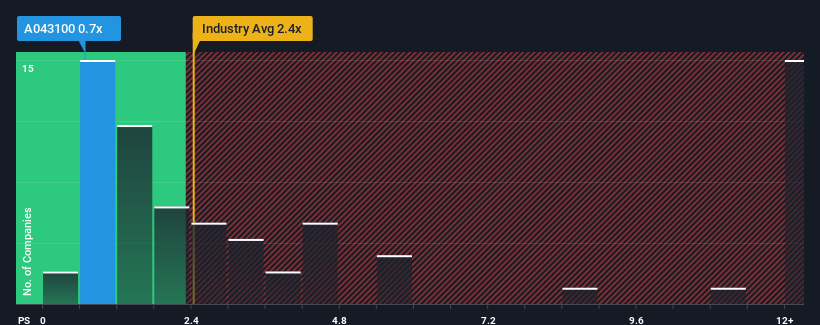

Since its price has dipped substantially, AlphanoxLtd may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Medical Equipment industry in Korea have P/S ratios greater than 2.4x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AlphanoxLtd

What Does AlphanoxLtd's Recent Performance Look Like?

The revenue growth achieved at AlphanoxLtd over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on AlphanoxLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AlphanoxLtd's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For AlphanoxLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AlphanoxLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.8% last year. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that AlphanoxLtd's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From AlphanoxLtd's P/S?

AlphanoxLtd's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of AlphanoxLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Having said that, be aware AlphanoxLtd is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A043100

AlphanoxLtd

Manufactures and sells medical devices and healthcare products in South Korea.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives