- South Korea

- /

- Oil and Gas

- /

- KOSE:A017940

We Think You Should Be Aware Of Some Concerning Factors In E1's (KRX:017940) Earnings

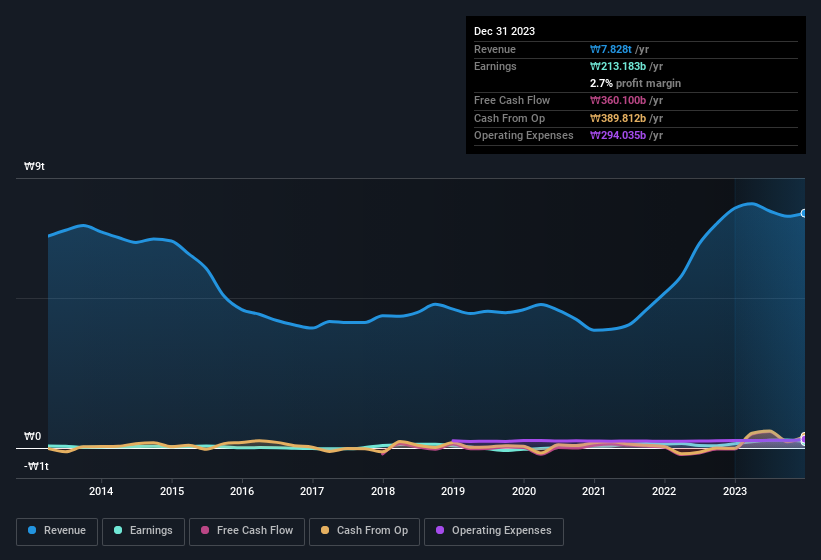

The recent earnings posted by E1 Corporation (KRX:017940) were solid, but the stock didn't move as much as we expected. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

View our latest analysis for E1

The Impact Of Unusual Items On Profit

Importantly, our data indicates that E1's profit received a boost of ₩25b in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that E1's positive unusual items were quite significant relative to its profit in the year to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On E1's Profit Performance

As we discussed above, we think the significant positive unusual item makes E1's earnings a poor guide to its underlying profitability. For this reason, we think that E1's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into E1, you'd also look into what risks it is currently facing. For example, E1 has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

This note has only looked at a single factor that sheds light on the nature of E1's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if E1 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A017940

E1

Imports, stores, trades, and sells liquefied petroleum gas (LPG) in South Korea.

Good value with slight risk.

Market Insights

Community Narratives