- South Korea

- /

- Capital Markets

- /

- KOSE:A023590

Undiscovered Gems in Asia to Explore This June 2025

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East and trade-related concerns weigh on global markets, Asian stocks present a unique landscape of opportunities. With small-cap indices experiencing volatility, discerning investors may find potential in lesser-known companies that demonstrate resilience and innovation amidst changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 72.03% | 6.01% | 64.19% | ★★★★★★ |

| Yashima Denki | 2.40% | 0.14% | 21.00% | ★★★★★★ |

| FALCO HOLDINGS | 4.93% | -0.16% | 1.44% | ★★★★★★ |

| Hefei Gocom Information TechnologyLtd | NA | 9.11% | -12.23% | ★★★★★★ |

| Center International GroupLtd | 18.20% | 0.69% | -31.63% | ★★★★★★ |

| ISE Chemicals | 1.40% | 15.34% | 32.61% | ★★★★★★ |

| Shanghai SK Automation TechnologyLtd | 37.27% | 33.22% | 12.18% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| Daoming Optics&ChemicalLtd | 33.83% | 1.38% | 5.82% | ★★★★★☆ |

| ITCENGLOBAL | 66.11% | 16.65% | 1.99% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

Overview: Snt Dynamics Ltd. engages in the manufacturing and sale of precision machinery, with a market capitalization of ₩1.25 trillion.

Operations: Snt Dynamics Ltd. generates revenue primarily from its Machinery Business and Transportation Equipment Business, with the latter contributing significantly more at ₩672.52 billion compared to the former's ₩2.88 billion.

Snt Dynamics Ltd. stands out in the aerospace and defense sector with a robust 96% earnings growth over the past year, surpassing industry averages. Despite its small size, this debt-free company boasts a favorable price-to-earnings ratio of 12.4x, slightly undercutting the KR market's 12.6x benchmark. Recent financials reveal net income at KRW 17,769 million for Q1 2025, up from KRW 12,880 million last year. The firm announced a private placement to issue bonds worth KRW 110 billion which are fully exchangeable into shares starting July 2025; such strategic moves may bolster future growth prospects significantly.

- Get an in-depth perspective on Snt DynamicsLtd's performance by reading our health report here.

Evaluate Snt DynamicsLtd's historical performance by accessing our past performance report.

Daou Technology (KOSE:A023590)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daou Technology Inc., along with its subsidiaries, offers IT and finance services and has a market capitalization of approximately ₩1.42 trillion.

Operations: Daou Technology Inc. generates revenue primarily from its finance segment, with significant contributions from the Finance - Wholesale General Manager (₩8.22 billion) and Finance - Retail General Manager (₩2.52 billion) divisions. The non-financial segment includes System Construction, which adds ₩452.49 million to the revenue stream.

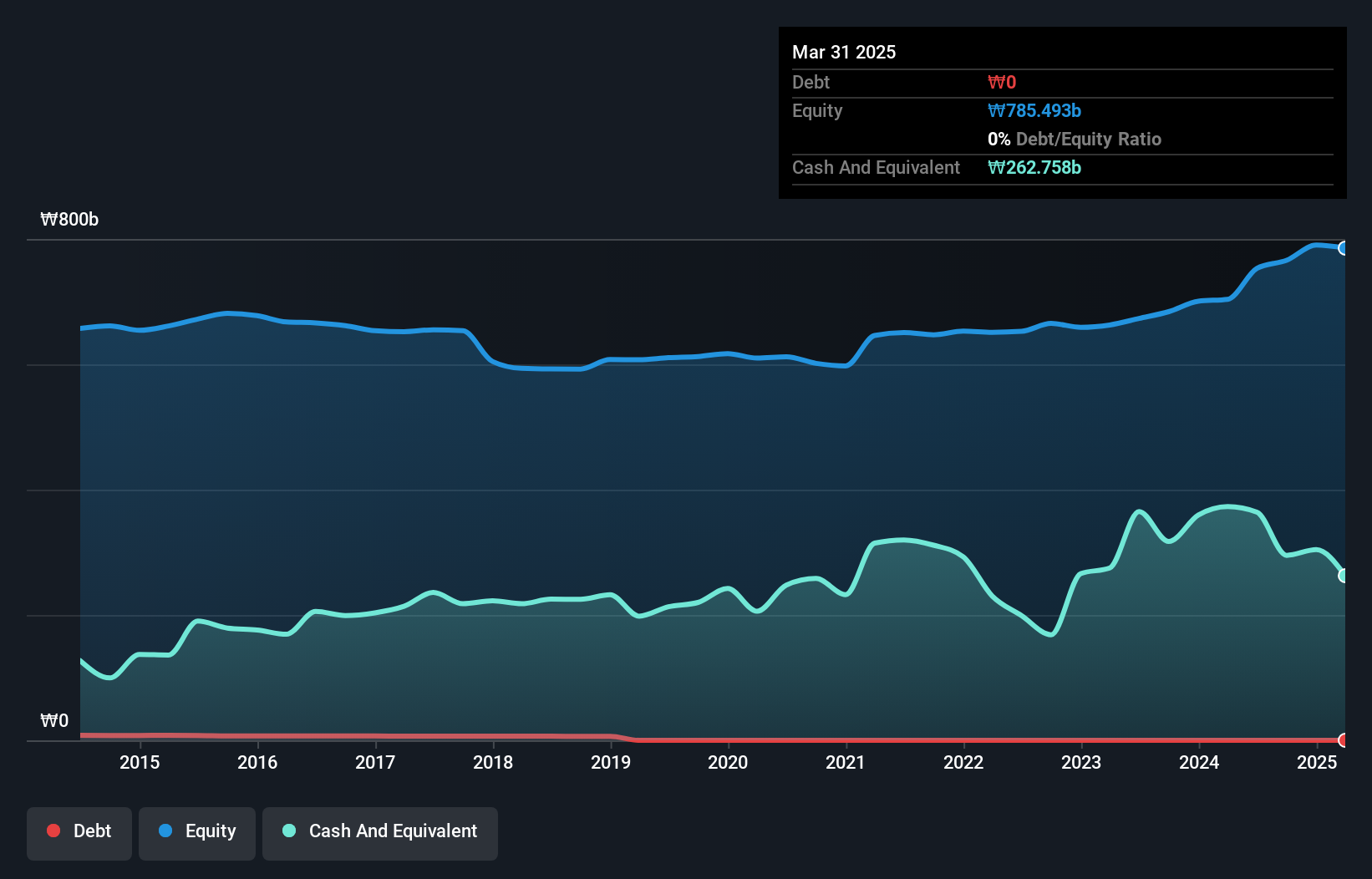

Daou Technology, a noteworthy player in the tech sector, has shown impressive financial strides. With earnings growth of 76.1% over the past year, it outpaced its industry peers significantly. The company reported sales of KRW 21.28 billion for Q1 2025, up from KRW 12.50 billion last year, though net income slightly dipped to KRW 102.11 million from KRW 103.12 million previously. Despite not being free cash flow positive, Daou's interest payments are well-covered by EBIT at a robust rate of 97 times coverage and its debt-to-equity ratio improved from over five years to stand at a healthier level today.

- Dive into the specifics of Daou Technology here with our thorough health report.

Assess Daou Technology's past performance with our detailed historical performance reports.

Gallant Micro. Machining (TPEX:6640)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gallant Micro. Machining Co., Ltd. specializes in the production and sale of machinery, equipment, precision molds, and various components across Taiwan, China, and international markets with a market cap of NT$16.65 billion.

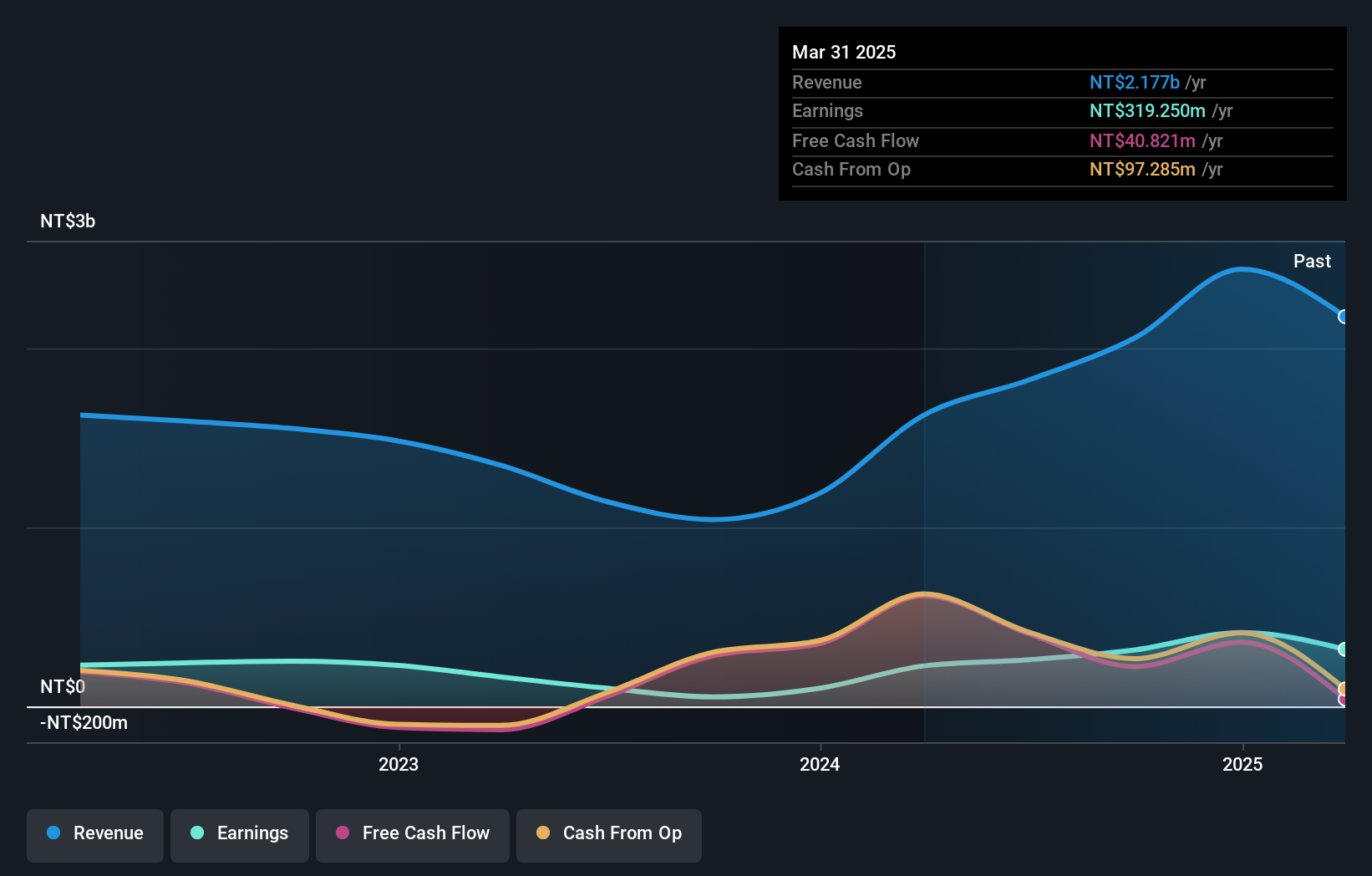

Operations: Gallant Micro. Machining Co., Ltd. generates revenue primarily from its machinery and equipment segment, with NT$1.81 billion attributed to this area, supplemented by contributions from KMC Corporation at NT$755.95 million.

Gallant Micro. Machining, a small player in the semiconductor space, has shown impressive earnings growth of 40.9% over the past year, outpacing the industry's 10.8%. Despite this growth, their recent Q1 2025 results reported a drop in sales to TWD 430.22 million from TWD 695.32 million and net income to TWD 45.84 million from TWD 139.36 million year-over-year, reflecting challenges amid volatility in share prices over three months. The debt-to-equity ratio has increased significantly from 44% to 91%, though with a satisfactory net debt level at just over 13%, interest coverage remains solid and non-cash earnings are high.

Taking Advantage

- Investigate our full lineup of 2614 Asian Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A023590

Solid track record with excellent balance sheet.

Market Insights

Community Narratives