- South Korea

- /

- Capital Markets

- /

- KOSE:A016360

3 Global Dividend Stocks Offering Up To 5.3% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed economic signals, including a weakening U.S. labor market and fluctuating interest rate expectations, investors are increasingly attentive to strategies that can offer stability and income. In this context, dividend stocks present an attractive option as they provide potential income generation even amidst market volatility, making them a noteworthy consideration for those looking to balance their portfolios in uncertain times.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.67% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.33% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.67% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.86% | ★★★★★★ |

| NCD (TSE:4783) | 4.39% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.66% | ★★★★★★ |

Click here to see the full list of 1319 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

Samsung SecuritiesLtd (KOSE:A016360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Securities Co., Ltd. is a financial investment company operating in South Korea and internationally, with a market cap of ₩6.48 trillion.

Operations: Samsung Securities Co., Ltd.'s revenue segments include Above Consignment Sale at ₩1.57 trillion, Corporate Finance at ₩296.71 billion, Operating During the Gift Period at ₩161.79 billion, S&T at ₩126.84 billion, Self-Trading at ₩34.17 billion, and Overseas Sales at ₩19.41 billion.

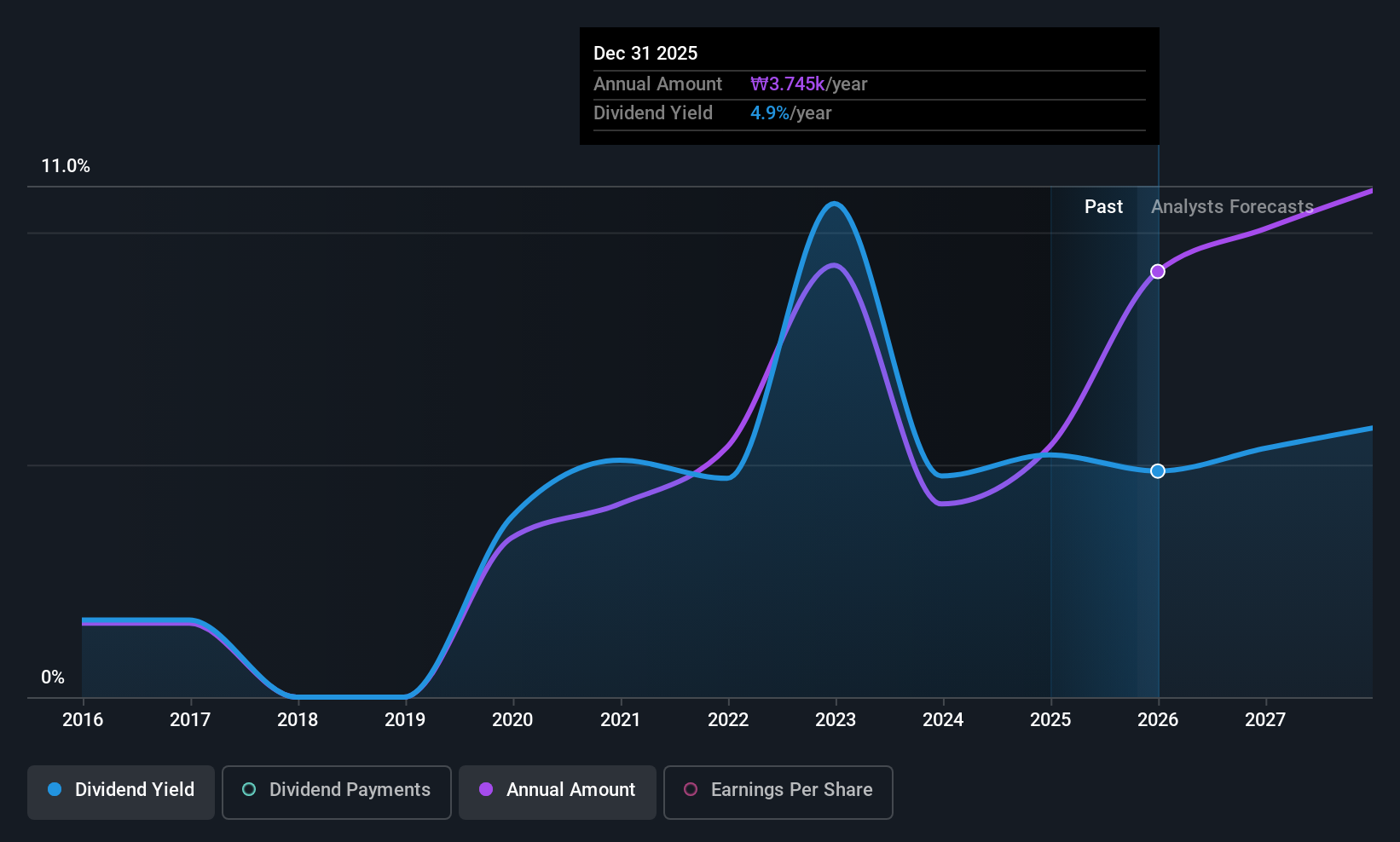

Dividend Yield: 4.7%

Samsung Securities Ltd. offers a dividend yield of 4.73%, ranking it in the top 25% of dividend payers in the KR market. However, its dividends have been volatile and unreliable over the past decade, with high cash payout ratios indicating that dividends are not well covered by free cash flows. Despite trading below estimated fair value and having a low payout ratio suggesting earnings cover dividends, sustainability concerns remain due to inconsistent payment history and insufficient cash flow coverage.

- Get an in-depth perspective on Samsung SecuritiesLtd's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Samsung SecuritiesLtd's share price might be too pessimistic.

Soken Chemical & Engineering (TSE:4972)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soken Chemical & Engineering Co., Ltd. manufactures and sells acrylic pressure-sensitive adhesives, functional polymers, organic fine particles, and adhesive tapes in Japan, China, and internationally with a market cap of ¥30.44 billion.

Operations: Soken Chemical & Engineering Co., Ltd.'s revenue is primarily derived from its Chemicals segment, which accounts for ¥44.49 billion, followed by the Equipment System segment at ¥2.97 billion.

Dividend Yield: 3.3%

Soken Chemical & Engineering's dividend yield of 3.33% is below the top tier in Japan, but its payout ratios are low, with dividends well covered by earnings and cash flows at 26.7% and 25.9%, respectively. Although dividends have grown over the past decade, their volatility raises concerns about reliability. The company trades at a significant discount to estimated fair value, indicating good relative value despite an unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Soken Chemical & Engineering.

- The valuation report we've compiled suggests that Soken Chemical & Engineering's current price could be quite moderate.

Universal Cement (TWSE:1104)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Universal Cement Corporation, with a market cap of NT$19.98 billion, operates in Taiwan where it manufactures and sells cement, ready-mixed concrete, gypsum board panels, and other building materials.

Operations: Universal Cement Corporation generates its revenue from the manufacturing and sale of cement, ready-mixed concrete, gypsum board panels, and various other building materials in Taiwan.

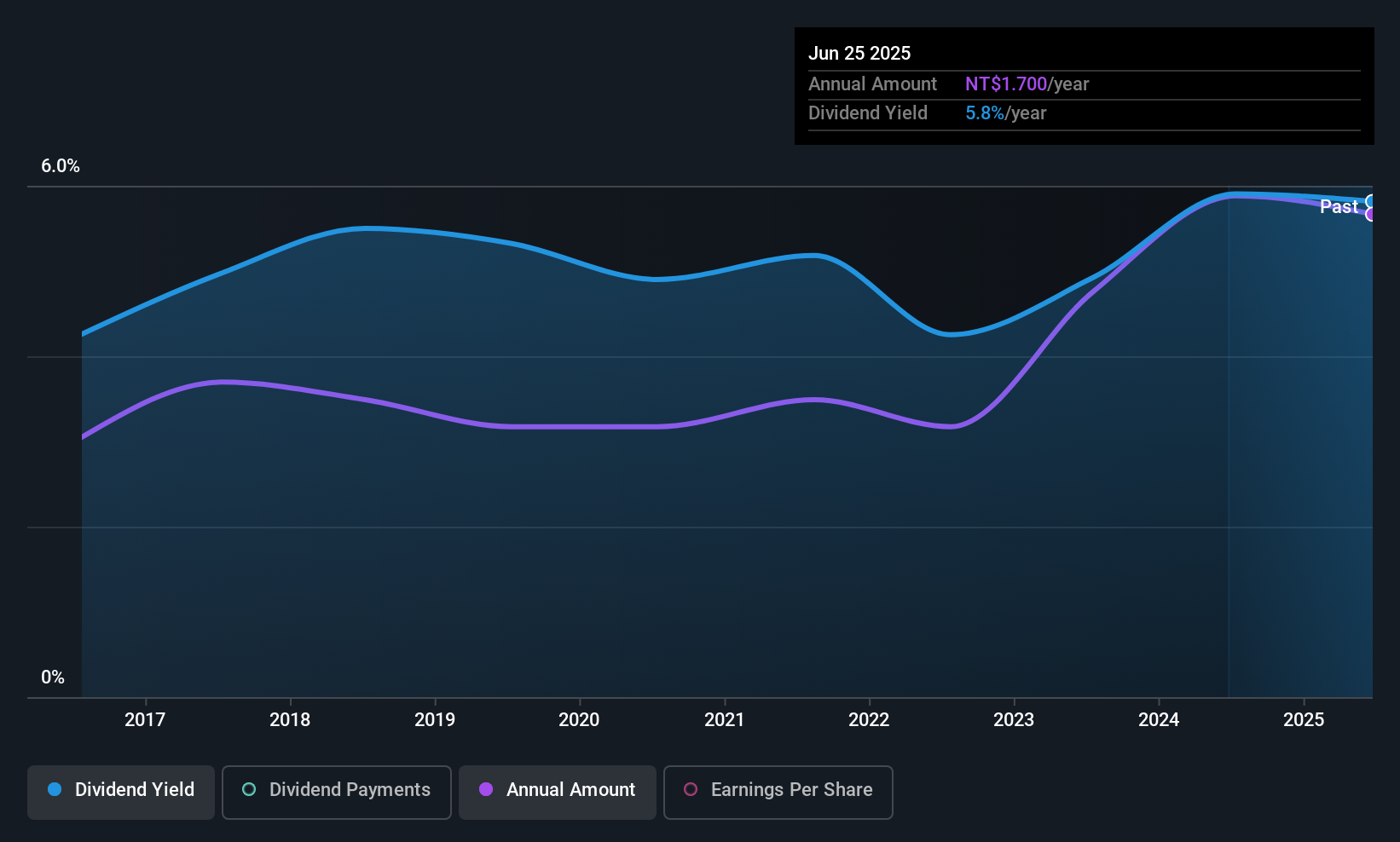

Dividend Yield: 5.3%

Universal Cement's dividend yield of 5.31% ranks in the top 25% of Taiwan's market, supported by stable and growing dividends over the past decade. With a payout ratio of 76.8%, dividends are well-covered by earnings and cash flows, maintaining sustainability with a cash payout ratio of 74.6%. Recent earnings show slight growth in net income despite lower sales, reinforcing its capacity to sustain high dividend payouts while trading below estimated fair value.

- Take a closer look at Universal Cement's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Universal Cement is trading behind its estimated value.

Where To Now?

- Navigate through the entire inventory of 1319 Top Global Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A016360

Samsung SecuritiesLtd

Samsung Securities Co., Ltd. operates as a financial investment company in South Korea and internationally.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives