- South Korea

- /

- Capital Markets

- /

- KOSE:A001200

Investors Don't See Light At End Of Eugene Investment & Securities Co.,Ltd.'s (KRX:001200) Tunnel And Push Stock Down 26%

Unfortunately for some shareholders, the Eugene Investment & Securities Co.,Ltd. (KRX:001200) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

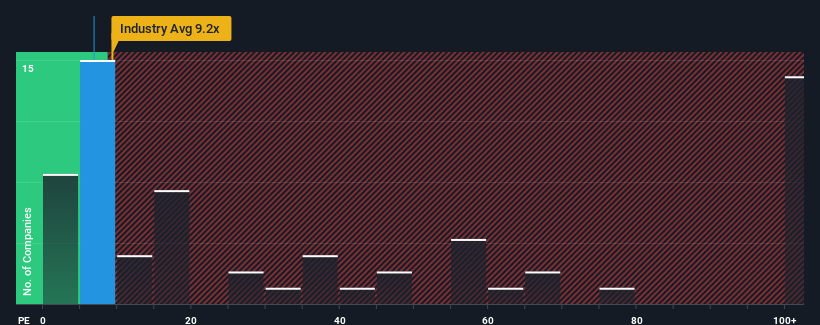

Although its price has dipped substantially, Eugene Investment & SecuritiesLtd's price-to-earnings (or "P/E") ratio of 6.8x might still make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 12x and even P/E's above 23x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Eugene Investment & SecuritiesLtd as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Eugene Investment & SecuritiesLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Eugene Investment & SecuritiesLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 254% last year. Still, incredibly EPS has fallen 54% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 35% shows it's an unpleasant look.

With this information, we are not surprised that Eugene Investment & SecuritiesLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Eugene Investment & SecuritiesLtd's P/E?

The softening of Eugene Investment & SecuritiesLtd's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Eugene Investment & SecuritiesLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Eugene Investment & SecuritiesLtd (including 1 which is significant).

You might be able to find a better investment than Eugene Investment & SecuritiesLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eugene Investment & SecuritiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001200

Eugene Investment & SecuritiesLtd

Provides various financial products and services to individuals, corporates, and institutional investors.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives