- South Korea

- /

- Capital Markets

- /

- KOSE:A001200

Does Eugene Investment & SecuritiesLtd (KRX:001200) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Eugene Investment & SecuritiesLtd (KRX:001200). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Eugene Investment & SecuritiesLtd

Eugene Investment & SecuritiesLtd's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Eugene Investment & SecuritiesLtd managed to grow EPS by 11% per year, over three years. That's a pretty good rate, if the company can sustain it.

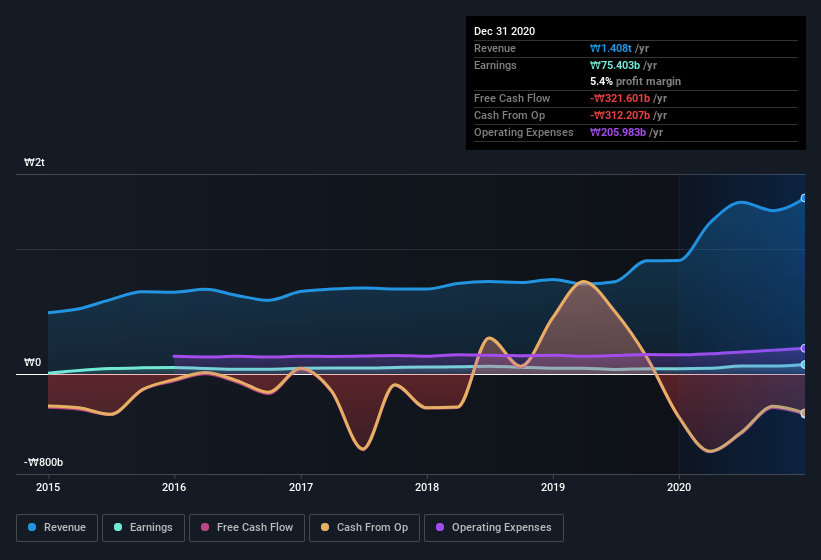

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Eugene Investment & SecuritiesLtd's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Eugene Investment & SecuritiesLtd's EBIT margins were flat over the last year, revenue grew by a solid 55% to ₩1.4t. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Eugene Investment & SecuritiesLtd's balance sheet strength, before getting too excited.

Are Eugene Investment & SecuritiesLtd Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Eugene Investment & SecuritiesLtd insiders have a significant amount of capital invested in the stock. To be specific, they have ₩31b worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 7.2% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Eugene Investment & SecuritiesLtd Worth Keeping An Eye On?

One positive for Eugene Investment & SecuritiesLtd is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. However, before you get too excited we've discovered 3 warning signs for Eugene Investment & SecuritiesLtd (1 makes us a bit uncomfortable!) that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Eugene Investment & SecuritiesLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eugene Investment & SecuritiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A001200

Eugene Investment & SecuritiesLtd

Provides various financial products and services to individuals, corporates, and institutional investors.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives