- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A241520

The DSC Investment (KOSDAQ:241520) Share Price Is Up 192% And Shareholders Are Boasting About It

While DSC Investment Inc. (KOSDAQ:241520) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 192% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

View our latest analysis for DSC Investment

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

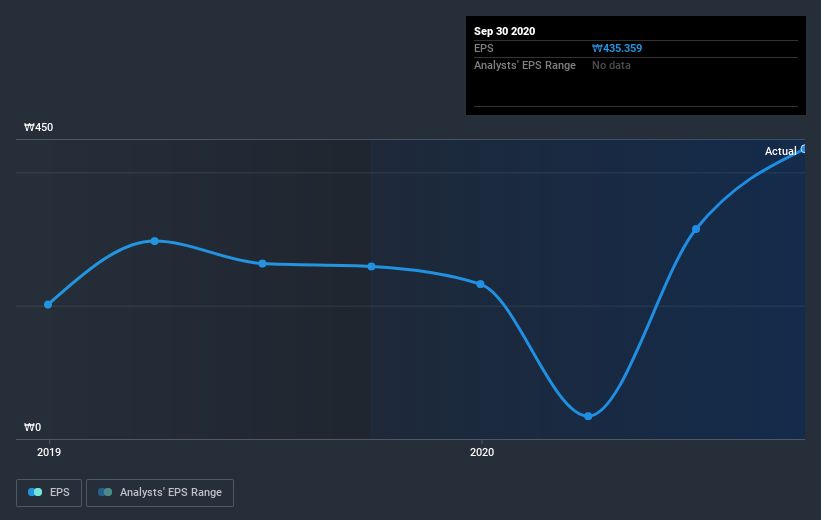

DSC Investment was able to grow EPS by 68% in the last twelve months. The share price gain of 192% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that DSC Investment rewarded shareholders with a total shareholder return of 192% over the last year. That's better than the annualized TSR of 1.5% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - DSC Investment has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading DSC Investment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A241520

DSC Investment

A venture capital firm specializing in early stage, startups, growth capital, mezzanine and secondary direct.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives