- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A036120

SCI Information Service Inc.'s (KOSDAQ:036120) P/S Is Still On The Mark Following 29% Share Price Bounce

Those holding SCI Information Service Inc. (KOSDAQ:036120) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

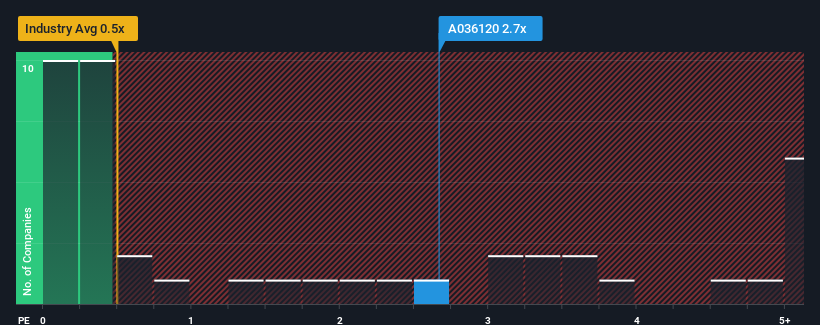

After such a large jump in price, given around half the companies in Korea's Capital Markets industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider SCI Information Service as a stock to avoid entirely with its 2.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for SCI Information Service

What Does SCI Information Service's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at SCI Information Service over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SCI Information Service will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

SCI Information Service's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.4%. As a result, revenue from three years ago have also fallen 30% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 78% over the next year, even worse than the company's recent medium-term annualised revenue decline.

In light of this, it's understandable that SCI Information Service's P/S sits above the majority of other companies. However, even if the company's recent growth rates were to continue outperforming the industry, shrinking revenues are unlikely to make the P/S premium sustainable over the longer term. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does SCI Information Service's P/S Mean For Investors?

SCI Information Service's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of SCI Information Service confirms that the company's less severe contraction in revenue over the past three-year years is a major contributor to its higher than industry P/S, given the industry is set to decline even more. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. At least if the company's outlook remains more positive than its peers, it is unlikely that the share price will experience a significant decline in the near future.

You should always think about risks. Case in point, we've spotted 4 warning signs for SCI Information Service you should be aware of, and 2 of them are a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036120

Seoul Information Service

Provides credit information services in South Korea.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives