It hasn't been the best quarter for DoubleUGames Co., Ltd. (KRX:192080) shareholders, since the share price has fallen 15% in that time. Looking on the brighter side, the stock is actually up over twelve months. But to be blunt its return of 24% fall short of what you could have got from an index fund (around 44%).

Check out our latest analysis for DoubleUGames

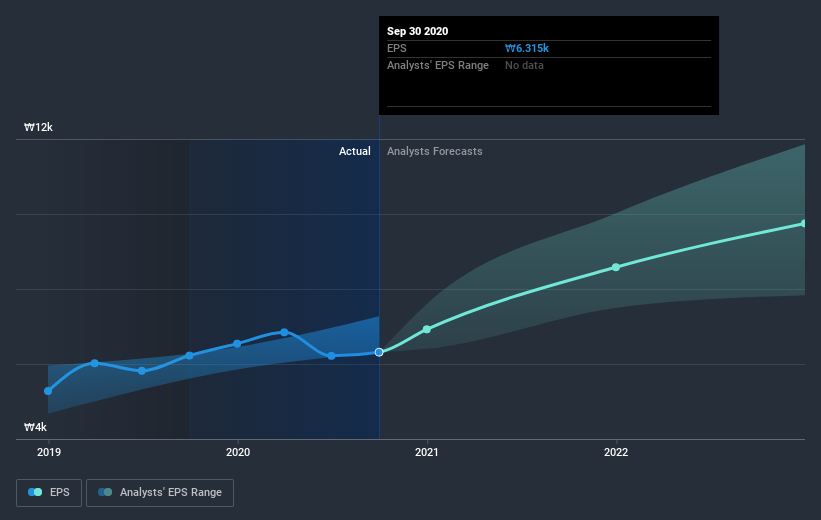

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year DoubleUGames grew its earnings per share (EPS) by 1.4%. This EPS growth is significantly lower than the 24% increase in the share price. This indicates that the market is now more optimistic about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on DoubleUGames' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

DoubleUGames shareholders gained a total return of 25% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 4% per year over five year. This suggests the company might be improving over time. Before forming an opinion on DoubleUGames you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade DoubleUGames, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A192080

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success