- South Korea

- /

- Consumer Services

- /

- KOSDAQ:A067280

Three Dividend Stocks To Enhance Your Income

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and competitive pressures in the technology sector, investors are increasingly seeking stability and income in their portfolios. Amidst this backdrop, dividend stocks can offer a reliable source of income, as they tend to provide regular payouts even during volatile market periods.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

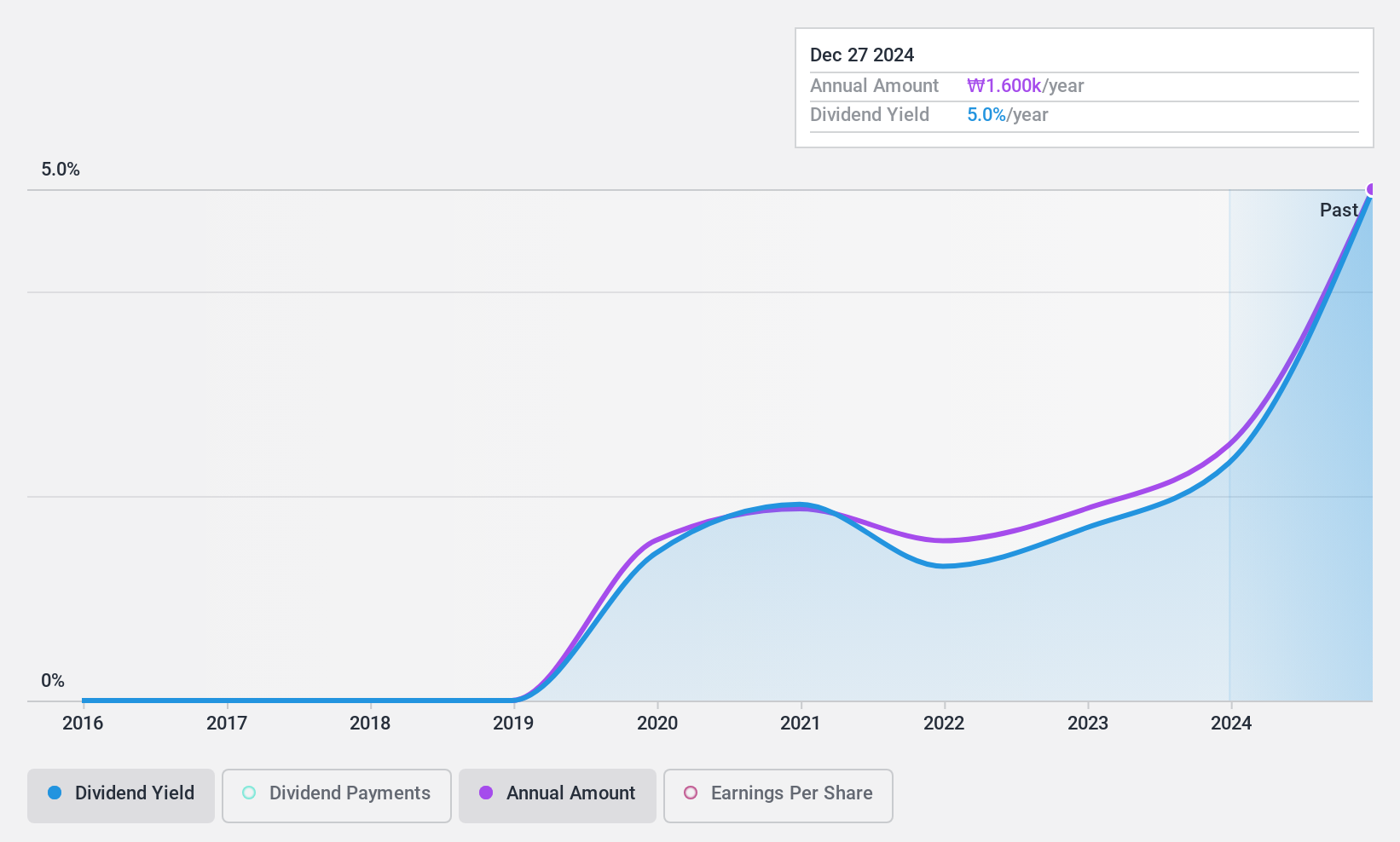

Multicampus (KOSDAQ:A067280)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multicampus Corporation is involved in education activities for the HRD system primarily in South Korea, with a market cap of approximately ₩176.91 billion.

Operations: Multicampus Corporation generates revenue from its Educational Business segment, amounting to approximately ₩354.04 billion.

Dividend Yield: 7.0%

Multicampus offers a compelling dividend profile, with a payout ratio of 30.1% and cash payout ratio of 26.8%, indicating dividends are well-covered by earnings and cash flows. The company has been paying dividends for five years, showing growth and stability despite its short history. Its dividend yield is in the top quartile of the Korean market, enhancing its attractiveness to income-focused investors. Recent earnings show stable profitability, supporting continued dividend payments.

- Dive into the specifics of Multicampus here with our thorough dividend report.

- The valuation report we've compiled suggests that Multicampus' current price could be quite moderate.

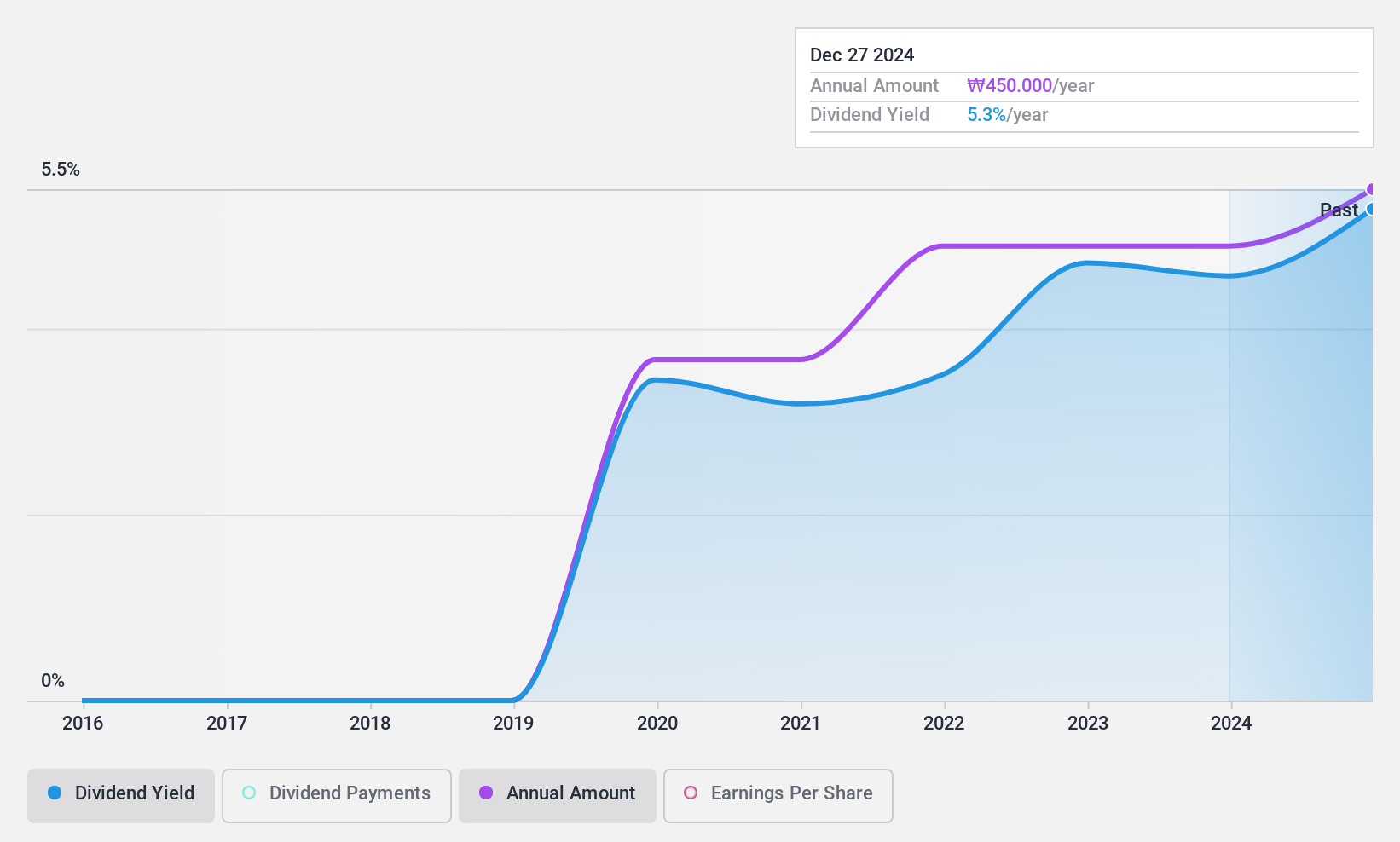

Motonic (KOSE:A009680)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide with a market cap of ₩191.40 billion.

Operations: Motonic Corporation generates its revenue from the automobile parts manufacturing segment, amounting to ₩277.03 billion.

Dividend Yield: 5.1%

Motonic's dividend profile is supported by a payout ratio of 32.7% and a cash payout ratio of 40.1%, indicating strong coverage by earnings and cash flows. Despite being paid for only five years, dividends have shown growth and reliability with minimal volatility. The yield is among the top 25% in Korea, appealing to income investors. Recent earnings growth of 25.5% enhances its ability to sustain dividends, while an extended buyback plan suggests confidence in future performance.

- Unlock comprehensive insights into our analysis of Motonic stock in this dividend report.

- Our valuation report unveils the possibility Motonic's shares may be trading at a discount.

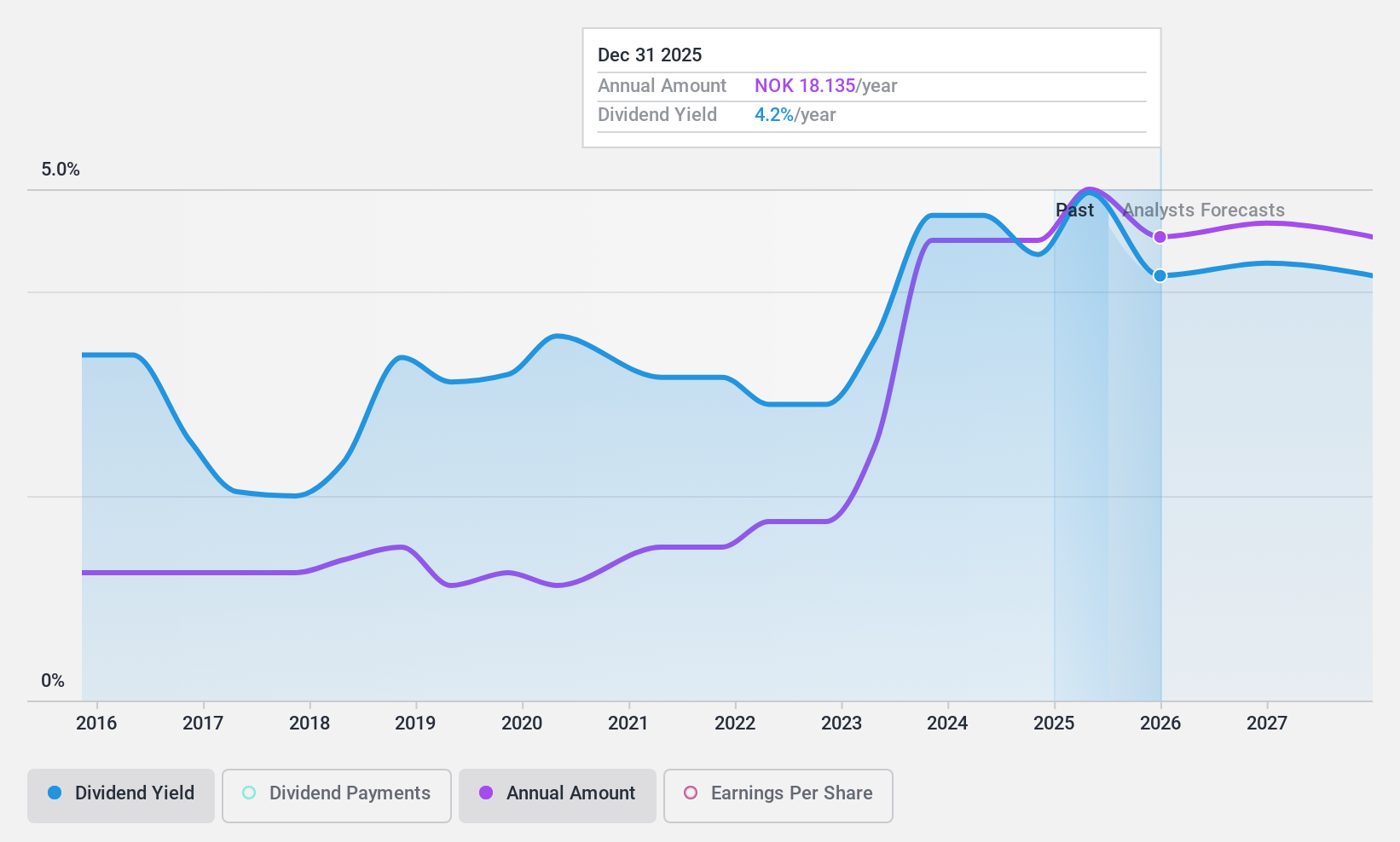

Wilh. Wilhelmsen Holding (OB:WWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wilh. Wilhelmsen Holding ASA is a global provider of maritime products and services, with a market cap of NOK17.16 billion.

Operations: Wilh. Wilhelmsen Holding ASA's revenue is primarily derived from its Maritime Services segment at $815 million, followed by New Energy at $293 million, and Strategic Holdings & Investments at $16 million.

Dividend Yield: 4.2%

Wilh. Wilhelmsen Holding's dividend yield of 4.25% is below Norway's top quartile of payers, yet its payout ratios—16% from earnings and 59% from cash flows—indicate solid coverage. Despite a history of volatility over the past decade, dividends have grown overall. The stock trades significantly below estimated fair value, suggesting potential for capital appreciation alongside income generation, though investors should be cautious about its unstable dividend track record.

- Delve into the full analysis dividend report here for a deeper understanding of Wilh. Wilhelmsen Holding.

- In light of our recent valuation report, it seems possible that Wilh. Wilhelmsen Holding is trading behind its estimated value.

Next Steps

- Investigate our full lineup of 1980 Top Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A067280

Multicampus

Operates in the education activities for the HRD system primarily in South Korea.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives