Stock Analysis

- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A003570

Top KRX Dividend Stocks To Consider In June 2024

Reviewed by Simply Wall St

The South Korean market has shown promising growth, with a 1.3% increase over the last week and an overall rise of 3.7% in the past year, accompanied by forecasts of annual earnings growth of 29%. In this context, dividend stocks that demonstrate consistent payouts and potential for stable returns are particularly appealing for those looking to invest under current market conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.27% | ★★★★★★ |

| NH Investment & Securities (KOSE:A005940) | 6.49% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 4.58% | ★★★★★☆ |

| Hyundai Steel (KOSE:A004020) | 3.49% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.39% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.51% | ★★★★★☆ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.42% | ★★★★★☆ |

| KB Financial Group (KOSE:A105560) | 3.94% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.84% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.07% | ★★★★☆☆ |

Click here to see the full list of 67 stocks from our Top KRX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

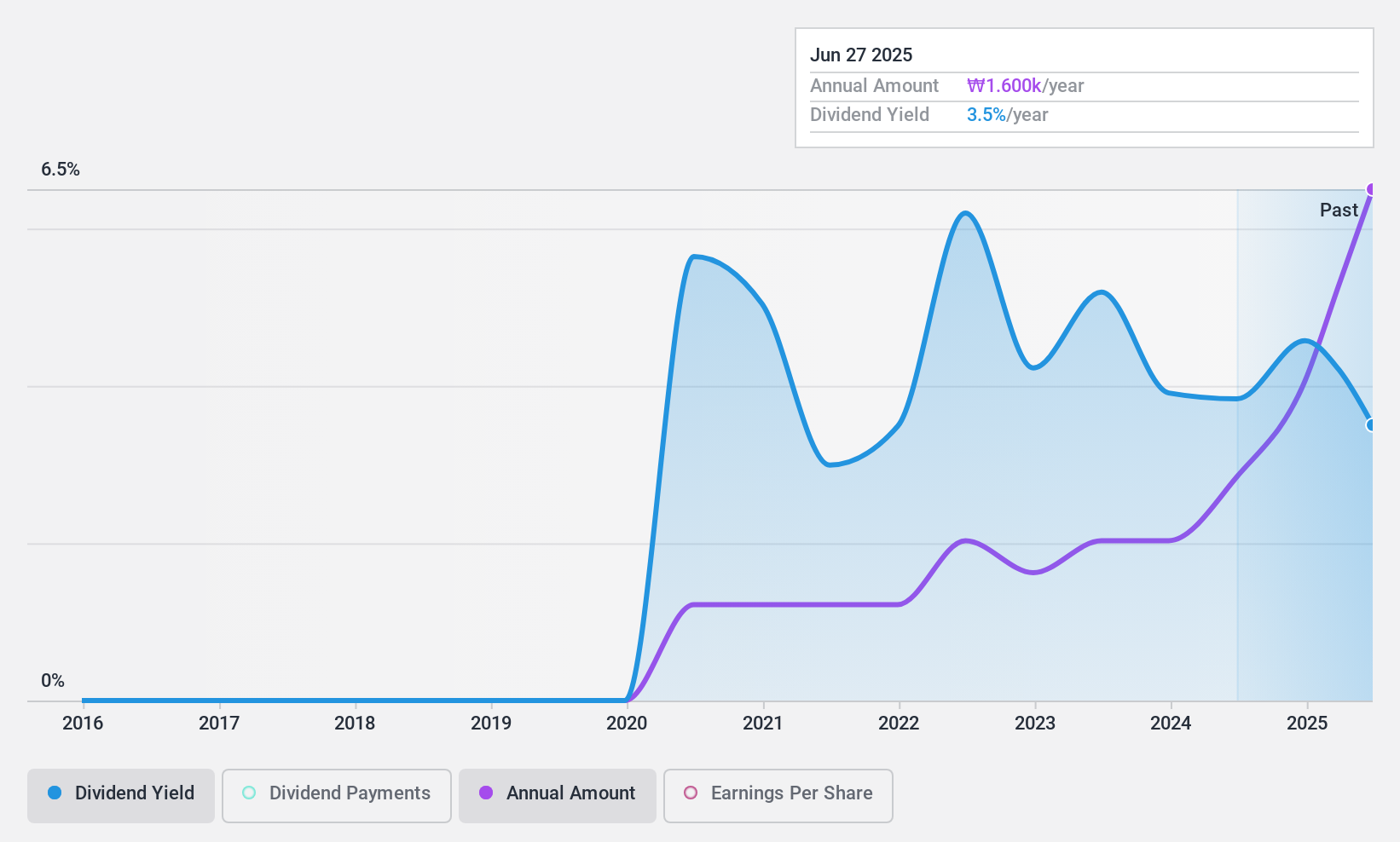

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Snt Dynamics Co., Ltd. specializes in the manufacturing and sale of precision machinery, with a market capitalization of approximately ₩429.96 billion.

Operations: Snt Dynamics Co., Ltd. generates its revenue primarily through the production and sale of precision machinery.

Dividend Yield: 3.6%

Snt DynamicsLtd, despite a volatile dividend history and less than a decade of payments, offers a promising 3.65% yield, ranking in the top 25% in the South Korean market. The dividends are well-supported with a low payout ratio of 30.4% and an even lower cash payout ratio of 12.5%. Recent financials show robust growth with net income up to KRW 12.88 billion from KRW 10.87 billion year-over-year, underpinning potential stability in future dividend payouts despite past inconsistencies.

- Unlock comprehensive insights into our analysis of Snt DynamicsLtd stock in this dividend report.

- Upon reviewing our latest valuation report, Snt DynamicsLtd's share price might be too pessimistic.

KPX ChemicalLtd (KOSE:A025000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KPX Chemical Co., Ltd. operates in South Korea, focusing on the manufacturing and sales of organic chemicals and chemical products, with a market capitalization of approximately ₩237.52 billion.

Operations: KPX Chemical Co., Ltd. generates its revenue from the production and distribution of organic chemicals and chemical products within South Korea.

Dividend Yield: 6%

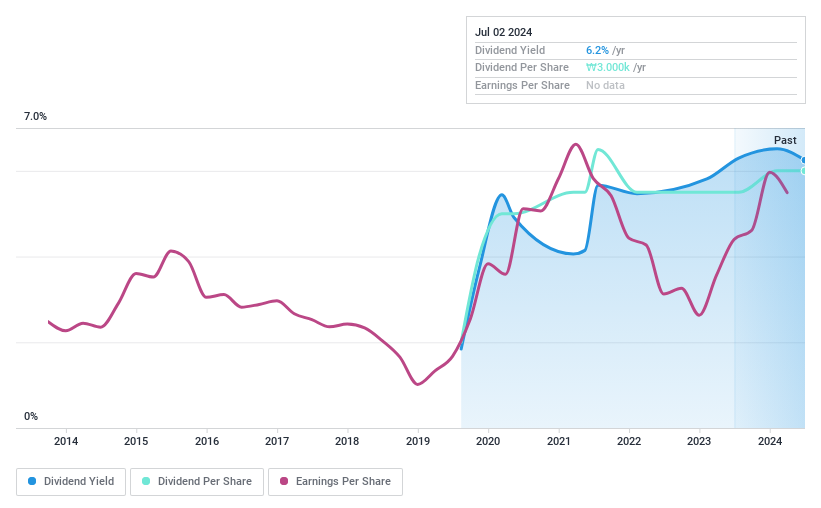

KPX Chemical Ltd, while offering a competitive 6.01% dividend yield, one of the top in South Korea, has shown inconsistent dividend reliability over the past five years. Despite this volatility, both earnings and cash flows significantly cover dividends with payout ratios of 23.9% and 15.4%, respectively. The company's recent approach to dividends is supported by a solid financial base but is tempered by its relatively short history of dividend payments and fluctuations in annual payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of KPX ChemicalLtd.

- Our valuation report unveils the possibility KPX ChemicalLtd's shares may be trading at a discount.

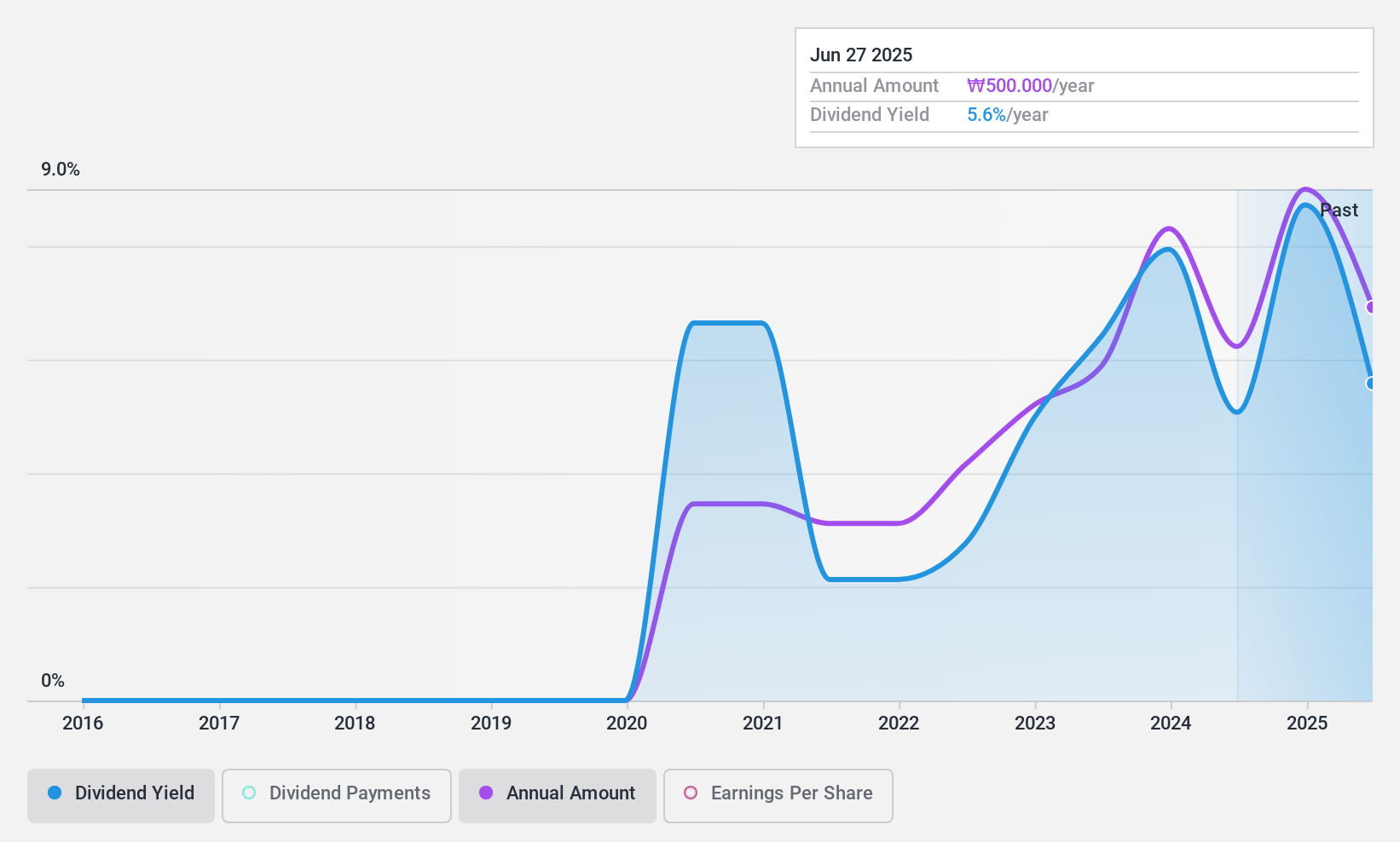

JS (KOSE:A194370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JS Corporation, with a market cap of ₩227.34 billion, operates globally in the manufacture and sale of handbags.

Operations: JS Corporation generates its revenue primarily through the global production and distribution of handbags.

Dividend Yield: 5.1%

JS Corporation, with a dividend yield of 5.07%, ranks among the top 25% in the South Korean market. Despite its appealing yield, the company's dividend history is marked by significant fluctuations, including annual drops over 20%. However, dividends appear sustainable with a low payout ratio of 23.1% and cash payout ratio of 14.9%, indicating strong coverage by both earnings and cash flows. The firm has increased dividends recently but has only been distributing them for four years amidst high debt levels.

- Navigate through the intricacies of JS with our comprehensive dividend report here.

- The analysis detailed in our JS valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 67 Top KRX Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Snt DynamicsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003570

Flawless balance sheet with solid track record.