- South Korea

- /

- Luxury

- /

- KOSE:A101140

Introducing INBIOGENLtd (KRX:101140), A Stock That Climbed 95% In The Last Five Years

INBIOGEN CO.,Ltd (KRX:101140) shareholders might understandably be very concerned that the share price has dropped 46% in the last quarter. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 95% in that time.

Check out our latest analysis for INBIOGENLtd

INBIOGENLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade INBIOGENLtd's revenue has actually been trending down at about 1.9% per year. Even though revenue hasn't increased, the stock actually gained 14%, per year, during the same period. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

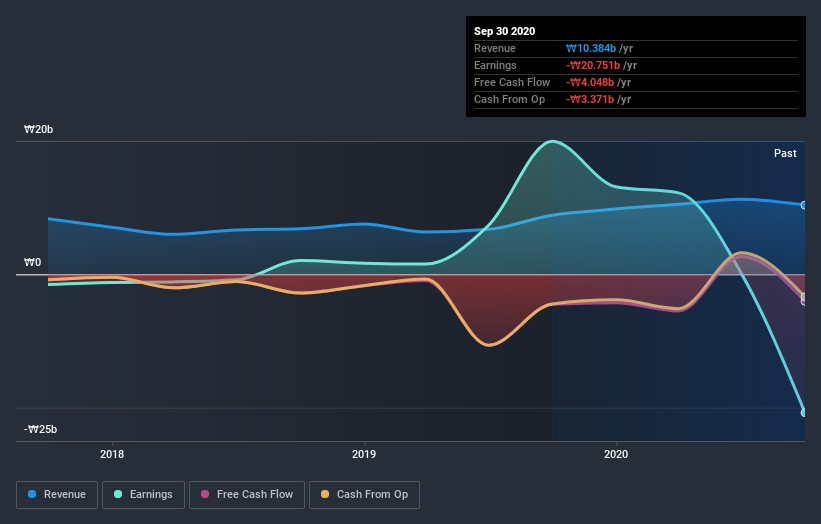

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on INBIOGENLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

INBIOGENLtd's TSR for the year was broadly in line with the market average, at 47%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 14% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for INBIOGENLtd you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade INBIOGENLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A101140

INBIOGEN

Engages in the manufacture and distribution of footwear products in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives