- South Korea

- /

- Luxury

- /

- KOSE:A093240

With A 40% Price Drop For hyungji Elite Co., Ltd. (KRX:093240) You'll Still Get What You Pay For

hyungji Elite Co., Ltd. (KRX:093240) shares have had a horrible month, losing 40% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 49% in the last year.

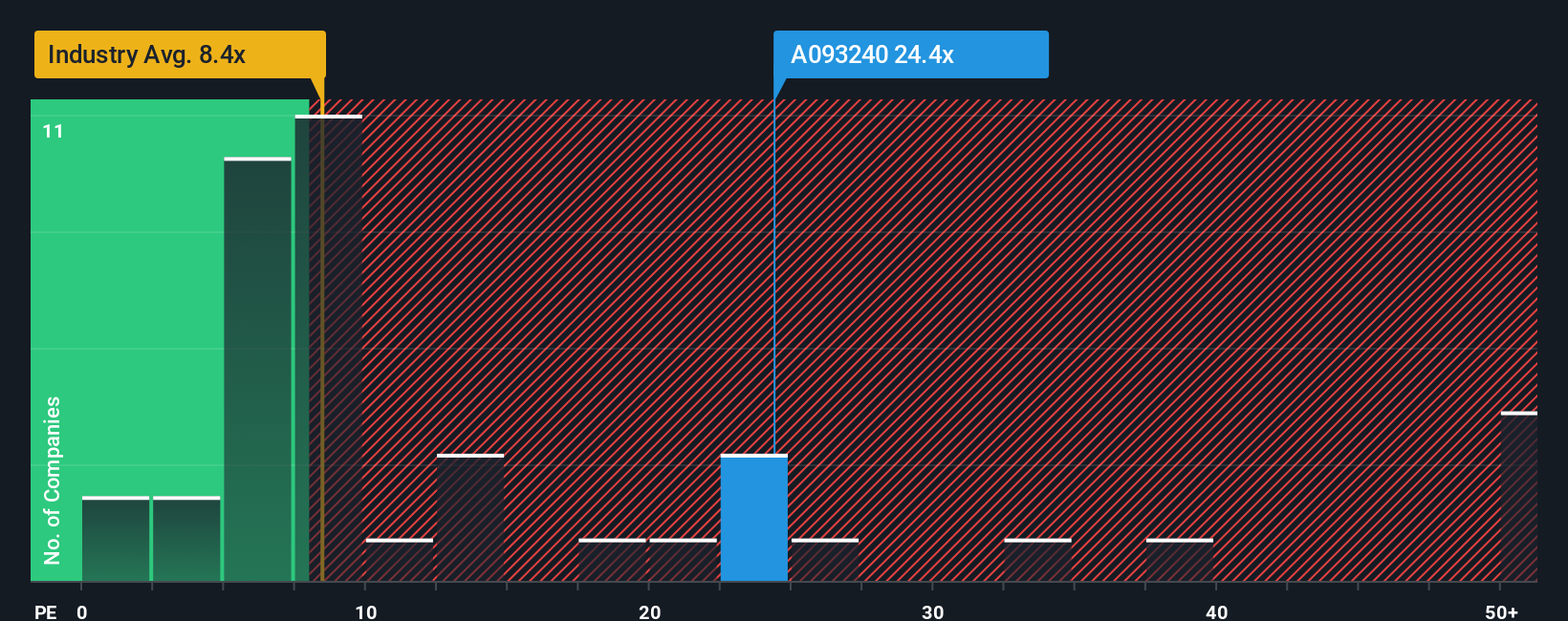

In spite of the heavy fall in price, hyungji Elite may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 24.4x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for hyungji Elite, which is generally not a bad outcome. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for hyungji Elite

How Is hyungji Elite's Growth Trending?

In order to justify its P/E ratio, hyungji Elite would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a decent 3.1% gain to the company's bottom line. The latest three year period has also seen an excellent 1,752% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 32% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that hyungji Elite's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, hyungji Elite's P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of hyungji Elite revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for hyungji Elite you should be aware of, and 3 of them don't sit too well with us.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A093240

hyungji Elite

Engages in the provides school uniforms primarily under the Elite brand in South Korea.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives