- South Korea

- /

- Luxury

- /

- KOSE:A093240

hyungji Elite Co., Ltd. (KRX:093240) Stocks Pounded By 31% But Not Lagging Market On Growth Or Pricing

hyungji Elite Co., Ltd. (KRX:093240) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 54%, which is great even in a bull market.

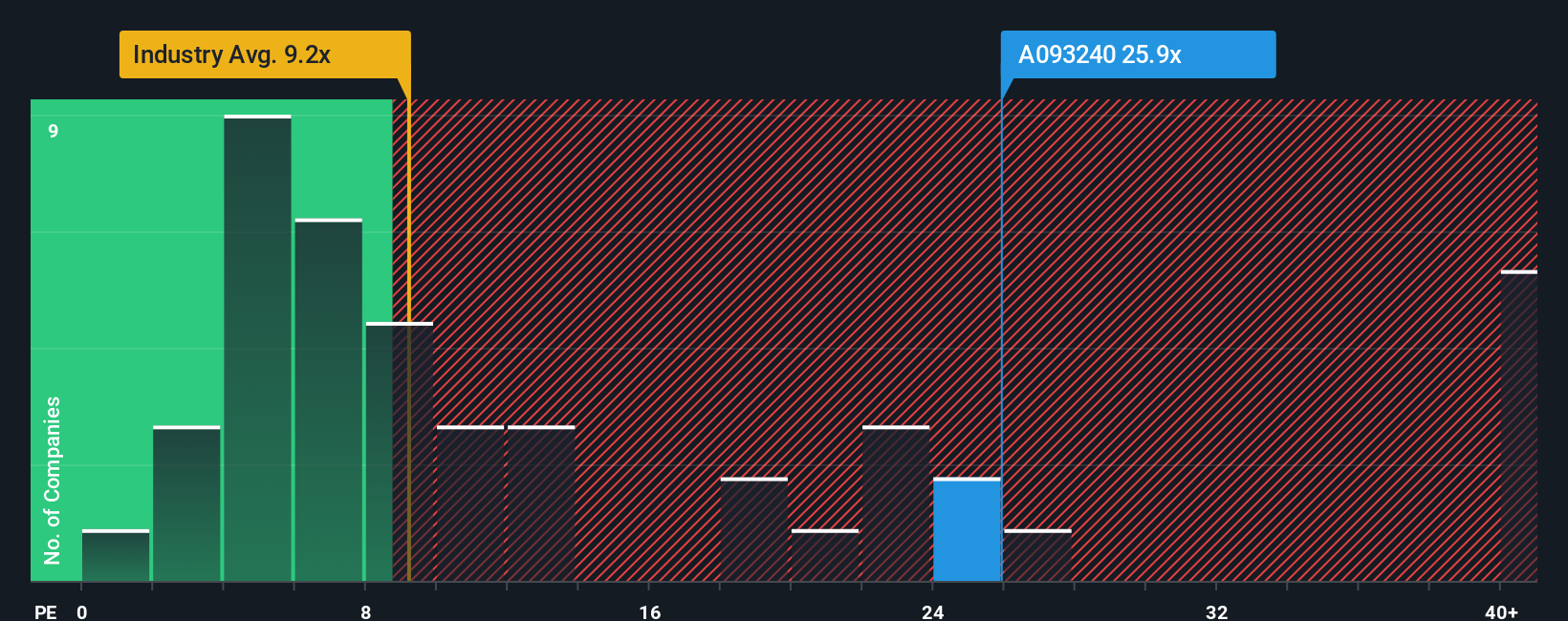

Although its price has dipped substantially, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may still consider hyungji Elite as a stock to avoid entirely with its 25.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen at a steady rate over the last year for hyungji Elite, which is generally not a bad outcome. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for hyungji Elite

How Is hyungji Elite's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like hyungji Elite's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.6% last year. Pleasingly, EPS has also lifted 1,752% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why hyungji Elite is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate hyungji Elite's very lofty P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that hyungji Elite maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 5 warning signs for hyungji Elite (of which 3 are significant!) you should know about.

If you're unsure about the strength of hyungji Elite's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A093240

hyungji Elite

Engages in the provides school uniforms primarily under the Elite brand in South Korea.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives