- South Korea

- /

- Luxury

- /

- KOSE:A069640

The Price Is Right For Hansaemk Co.,Ltd. (KRX:069640) Even After Diving 32%

Hansaemk Co.,Ltd. (KRX:069640) shares have had a horrible month, losing 32% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

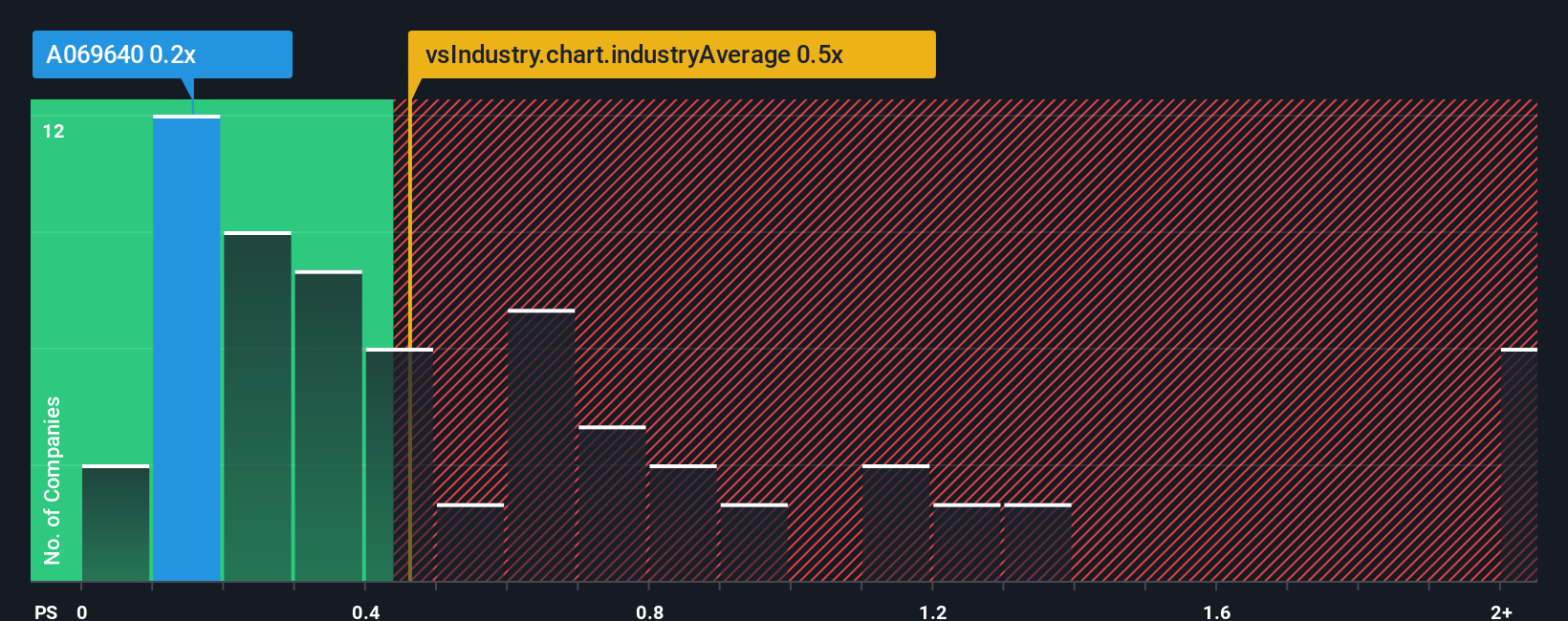

Even after such a large drop in price, it's still not a stretch to say that HansaemkLtd's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Luxury industry in Korea, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for HansaemkLtd

How HansaemkLtd Has Been Performing

As an illustration, revenue has deteriorated at HansaemkLtd over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on HansaemkLtd will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For HansaemkLtd?

In order to justify its P/S ratio, HansaemkLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the industry is similarly expected to grow by 5.2% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why HansaemkLtd's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From HansaemkLtd's P/S?

Following HansaemkLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that HansaemkLtd maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for HansaemkLtd (of which 2 shouldn't be ignored!) you should know about.

If these risks are making you reconsider your opinion on HansaemkLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HansaemkLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A069640

HansaemkLtd

Manufactures and sells women’s, men’s, and kid's casual clothes and golf wear in South Korea and internationally.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion