Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that BAIKSAN Co,. Ltd (KRX:035150) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for BAIKSAN Co

What Is BAIKSAN Co's Debt?

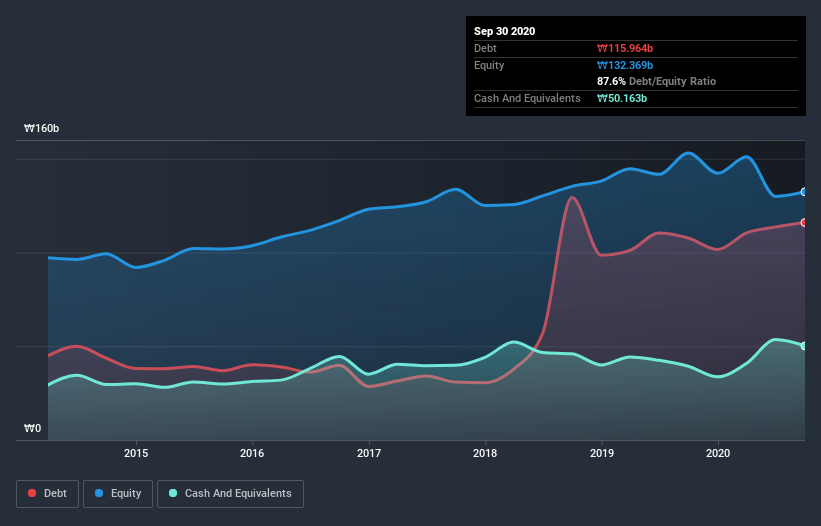

As you can see below, at the end of September 2020, BAIKSAN Co had ₩116.0b of debt, up from ₩107.7b a year ago. Click the image for more detail. However, because it has a cash reserve of ₩50.2b, its net debt is less, at about ₩65.8b.

How Strong Is BAIKSAN Co's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that BAIKSAN Co had liabilities of ₩150.1b due within 12 months and liabilities of ₩36.0b due beyond that. Offsetting these obligations, it had cash of ₩50.2b as well as receivables valued at ₩91.5b due within 12 months. So its liabilities total ₩44.5b more than the combination of its cash and short-term receivables.

BAIKSAN Co has a market capitalization of ₩160.9b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

BAIKSAN Co shareholders face the double whammy of a high net debt to EBITDA ratio (6.2), and fairly weak interest coverage, since EBIT is just 0.51 times the interest expense. This means we'd consider it to have a heavy debt load. Even worse, BAIKSAN Co saw its EBIT tank 95% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since BAIKSAN Co will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Considering the last three years, BAIKSAN Co actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both BAIKSAN Co's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its level of total liabilities is not so bad. Overall, it seems to us that BAIKSAN Co's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example BAIKSAN Co has 4 warning signs (and 2 which are potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade BAIKSAN Co, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BAIKSAN Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A035150

BAIKSAN Co

Engages in the production, manufacture, and sale of synthetic leather, resin, and non-woven fabric in South Korea.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives