- South Korea

- /

- Luxury

- /

- KOSE:A011300

There's Reason For Concern Over Seong An Materials Co.,Ltd's (KRX:011300) Massive 28% Price Jump

Seong An Materials Co.,Ltd (KRX:011300) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

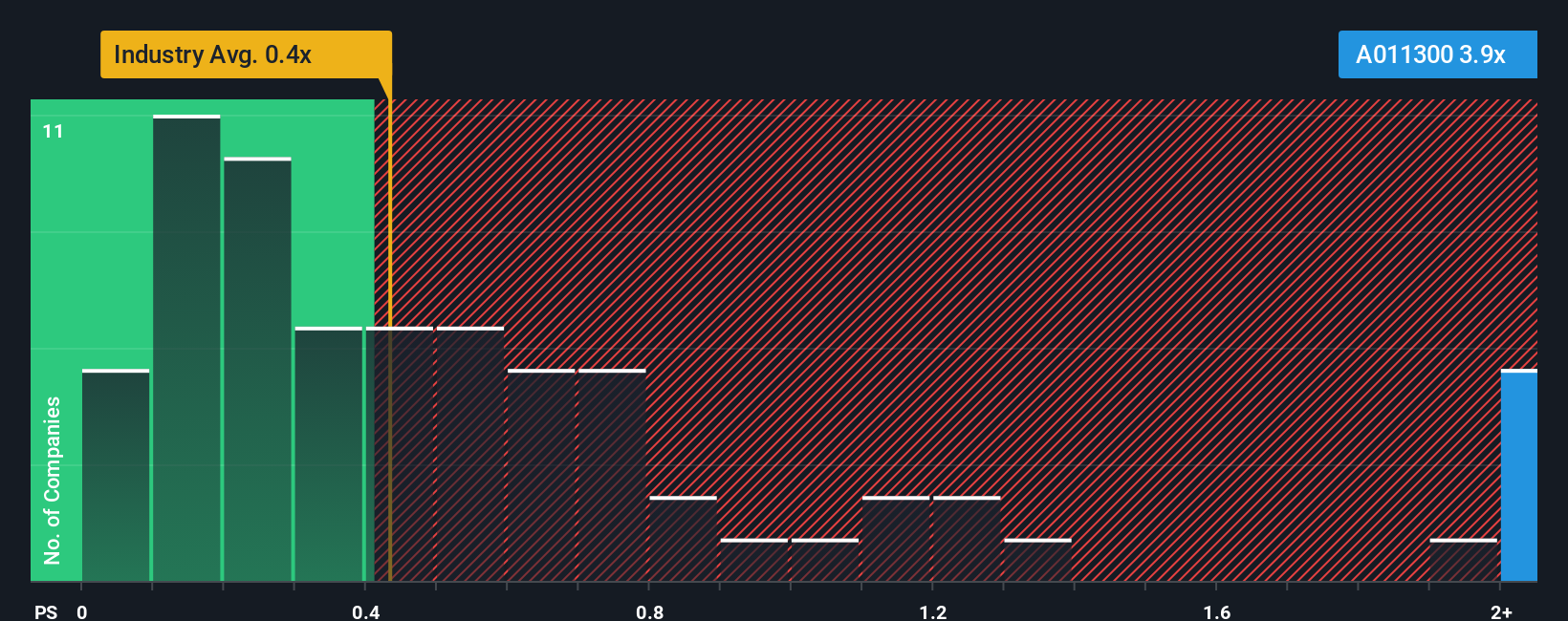

After such a large jump in price, you could be forgiven for thinking Seong An MaterialsLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in Korea's Luxury industry have P/S ratios below 0.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Seong An MaterialsLtd

What Does Seong An MaterialsLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Seong An MaterialsLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Seong An MaterialsLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Seong An MaterialsLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Seong An MaterialsLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 69% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 1.9% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this in mind, we find it intriguing that Seong An MaterialsLtd's P/S exceeds that of its industry peers. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Seong An MaterialsLtd's P/S

The strong share price surge has lead to Seong An MaterialsLtd's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Seong An MaterialsLtd currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 5 warning signs for Seong An MaterialsLtd you should be aware of, and 4 of them don't sit too well with us.

If you're unsure about the strength of Seong An MaterialsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011300

Seong An MaterialsLtd

A textile company, manufactures, exports, and sells fabric related products in Korea and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026