- South Korea

- /

- Luxury

- /

- KOSE:A008500

These 4 Measures Indicate That Iljeong IndustrialLtd (KRX:008500) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Iljeong Industrial Co.,Ltd (KRX:008500) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Iljeong IndustrialLtd

How Much Debt Does Iljeong IndustrialLtd Carry?

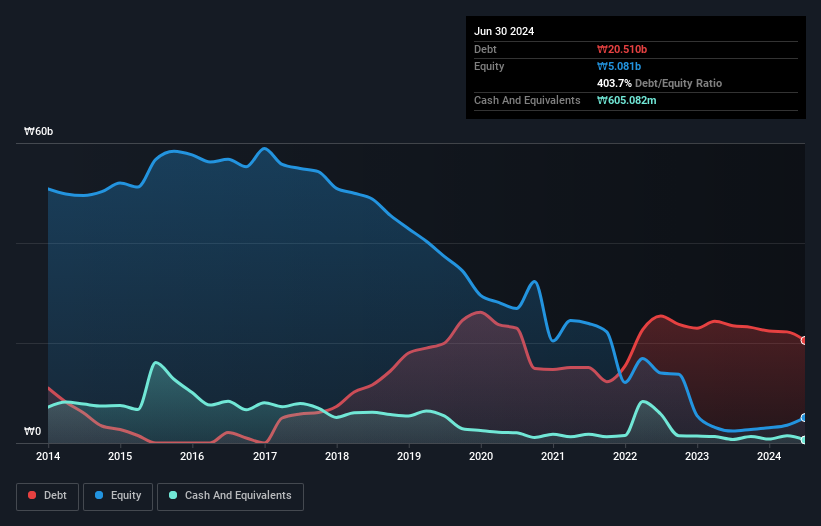

You can click the graphic below for the historical numbers, but it shows that Iljeong IndustrialLtd had ₩20.5b of debt in June 2024, down from ₩23.5b, one year before. However, it does have ₩605.1m in cash offsetting this, leading to net debt of about ₩19.9b.

How Healthy Is Iljeong IndustrialLtd's Balance Sheet?

We can see from the most recent balance sheet that Iljeong IndustrialLtd had liabilities of ₩17.9b falling due within a year, and liabilities of ₩10.9b due beyond that. On the other hand, it had cash of ₩605.1m and ₩8.23b worth of receivables due within a year. So its liabilities total ₩20.0b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of ₩15.8b, we think shareholders really should watch Iljeong IndustrialLtd's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 6.7, it's fair to say Iljeong IndustrialLtd does have a significant amount of debt. However, its interest coverage of 3.1 is reasonably strong, which is a good sign. However, the silver lining was that Iljeong IndustrialLtd achieved a positive EBIT of ₩2.1b in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Iljeong IndustrialLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Iljeong IndustrialLtd actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We'd go so far as to say Iljeong IndustrialLtd's net debt to EBITDA was disappointing. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that Iljeong IndustrialLtd's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Iljeong IndustrialLtd (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008500

Iljeong IndustrialLtd

Iljeong Industrial Co.Ltd. provides car seat fabrics to automobile makers in Korea.

Low risk with questionable track record.

Market Insights

Community Narratives