- South Korea

- /

- Luxury

- /

- KOSE:A008500

Iljeong Industrial Co.,Ltd (KRX:008500) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

Iljeong Industrial Co.,Ltd (KRX:008500) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

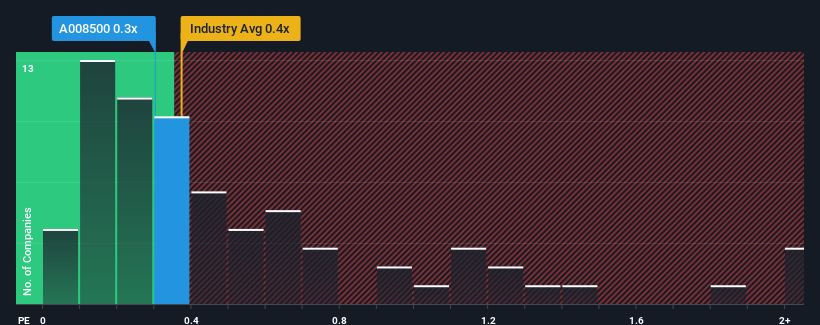

In spite of the heavy fall in price, there still wouldn't be many who think Iljeong IndustrialLtd's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Korea's Luxury industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Iljeong IndustrialLtd

What Does Iljeong IndustrialLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Iljeong IndustrialLtd has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Iljeong IndustrialLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Iljeong IndustrialLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Iljeong IndustrialLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Iljeong IndustrialLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 6.2% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why Iljeong IndustrialLtd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

With its share price dropping off a cliff, the P/S for Iljeong IndustrialLtd looks to be in line with the rest of the Luxury industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we've seen, Iljeong IndustrialLtd's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Iljeong IndustrialLtd is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008500

Iljeong IndustrialLtd

Iljeong Industrial Co.Ltd. provides car seat fabrics to automobile makers in Korea.

Low risk with questionable track record.

Market Insights

Community Narratives