Di Dong Il Corporation (KRX:001530) has announced that on 3rd of April, it will be paying a dividend of₩238.1, which a reduction from last year's comparable dividend. This means that the annual payment is 1.3% of the current stock price, which is lower than what the rest of the industry is paying.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Di Dong Il's stock price has reduced by 59% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Di Dong Il's Long-term Dividend Outlook appears Promising

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Di Dong Il is unprofitable despite paying a dividend, and it is paying out 305% of its free cash flow. These payout levels would generally be quite difficult to keep up.

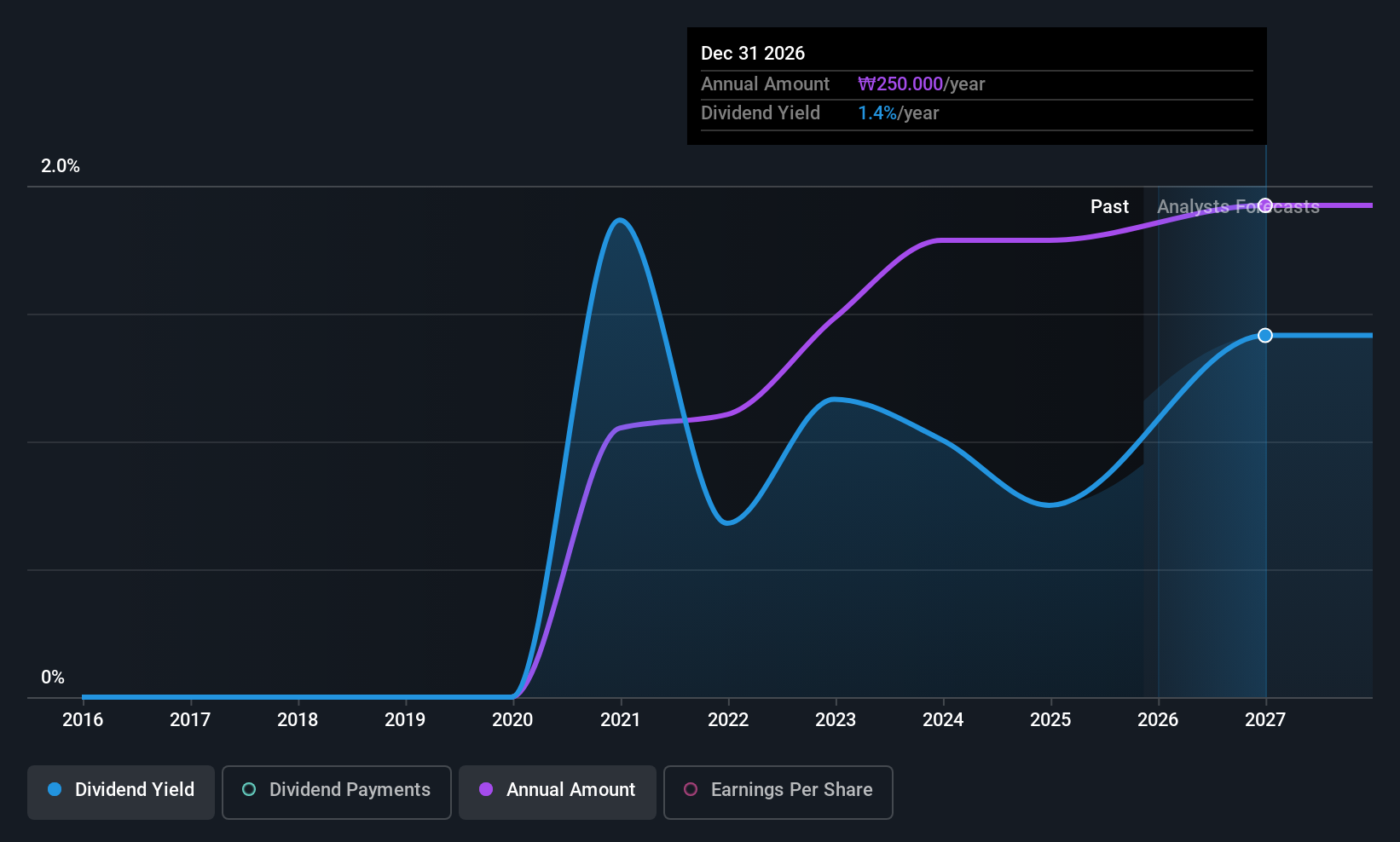

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 6.6%, which we would be comfortable to see continuing.

See our latest analysis for Di Dong Il

Di Dong Il Is Still Building Its Track Record

Di Dong Il's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2019, the annual payment back then was ₩136.79, compared to the most recent full-year payment of ₩238.1. This implies that the company grew its distributions at a yearly rate of about 9.7% over that duration. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider Di Dong Il to be a consistent dividend paying stock.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Di Dong Il's EPS has fallen by approximately 28% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

We're Not Big Fans Of Di Dong Il's Dividend

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Di Dong Il that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001530

Di Dong Il

Operates in the textile and clothing industries in South Korea and internationally.

Reasonable growth potential with low risk.

Market Insights

Community Narratives