- South Korea

- /

- Luxury

- /

- KOSDAQ:A472850

These 4 Measures Indicate That Pond Group (KOSDAQ:472850) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Pond Group Co., Ltd. (KOSDAQ:472850) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does Pond Group Carry?

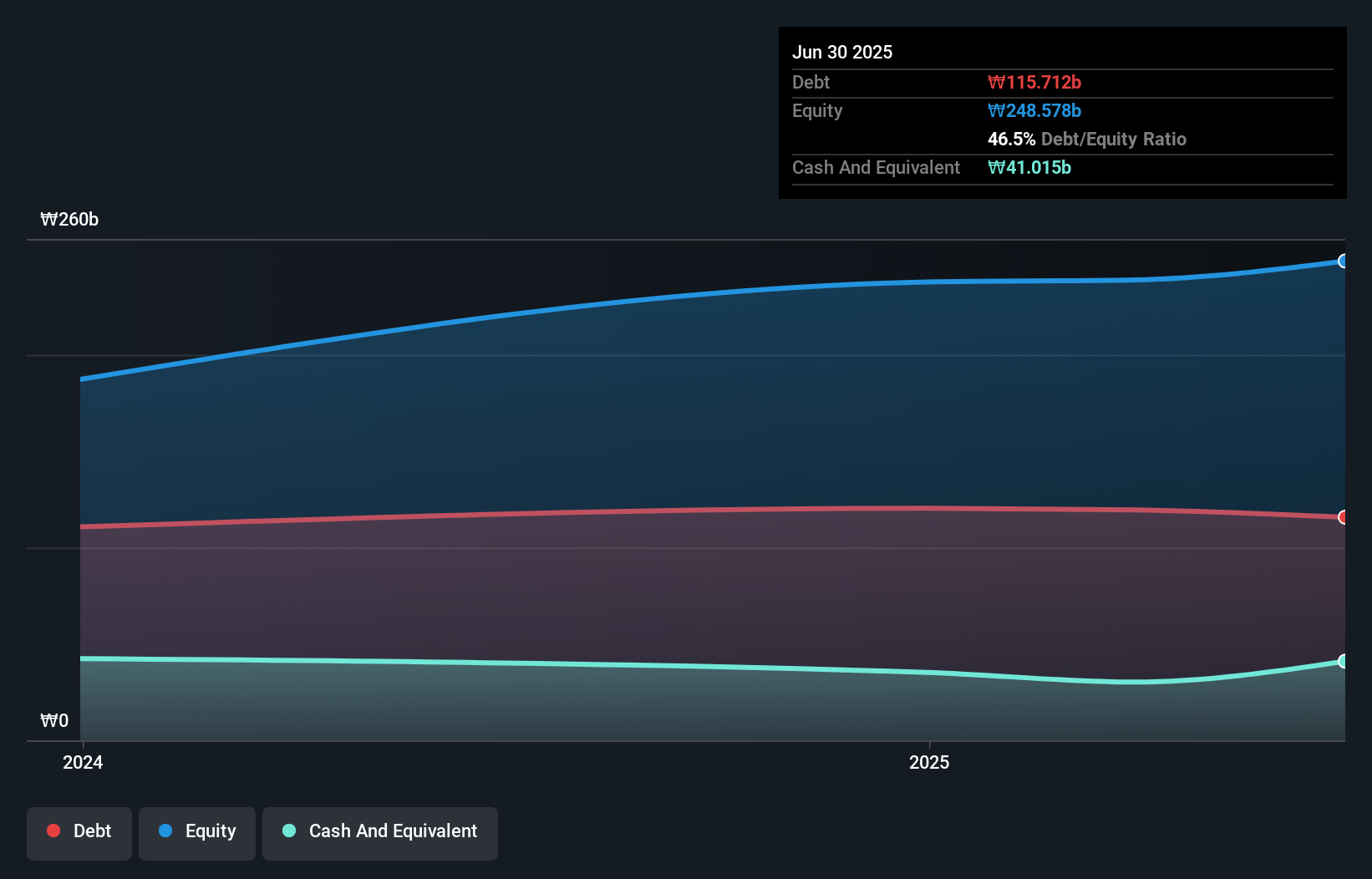

You can click the graphic below for the historical numbers, but it shows that as of June 2025 Pond Group had ₩115.7b of debt, an increase on ₩110.7b, over one year. On the flip side, it has ₩41.0b in cash leading to net debt of about ₩74.7b.

How Healthy Is Pond Group's Balance Sheet?

We can see from the most recent balance sheet that Pond Group had liabilities of ₩107.4b falling due within a year, and liabilities of ₩72.2b due beyond that. On the other hand, it had cash of ₩41.0b and ₩29.2b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩109.5b.

While this might seem like a lot, it is not so bad since Pond Group has a market capitalization of ₩339.9b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

See our latest analysis for Pond Group

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Pond Group has net debt of just 1.2 times EBITDA, indicating that it is certainly not a reckless borrower. And it boasts interest cover of 9.9 times, which is more than adequate. Better yet, Pond Group grew its EBIT by 104% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Pond Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last two years, Pond Group's free cash flow amounted to 30% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Pond Group's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. All these things considered, it appears that Pond Group can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Pond Group has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A472850

Pond Group

POND GROUP CO.,LTD. engages in the manufacture of sewn wearing apparels.

Excellent balance sheet and good value.

Market Insights

Community Narratives