- South Korea

- /

- Luxury

- /

- KOSDAQ:A159580

Investors Who Bought Zero to Seven (KOSDAQ:159580) Shares Three Years Ago Are Now Up 54%

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Zero to Seven Inc. (KOSDAQ:159580) share price is up 54% in the last three years, clearly besting the market return of around 20% (not including dividends).

View our latest analysis for Zero to Seven

While Zero to Seven made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Zero to Seven's revenue trended up 3.5% each year over three years. That's not a very high growth rate considering it doesn't make profits. In that time the share price is up 15% per year, which is not unreasonable given the revenue gorwth. The real question is when the business will generate profits, and how quickly they will grow. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

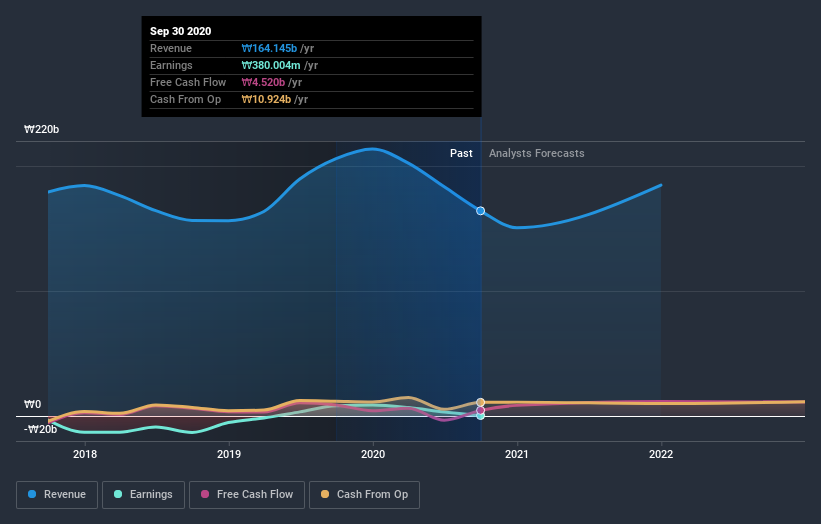

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Zero to Seven has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Zero to Seven's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Zero to Seven had a tough year, with a total loss of 30%, against a market gain of about 38%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Zero to Seven that you should be aware of.

We will like Zero to Seven better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Zero to Seven, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zero to Seven might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A159580

Zero to Seven

Operates as a childcare company in South Korea and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives